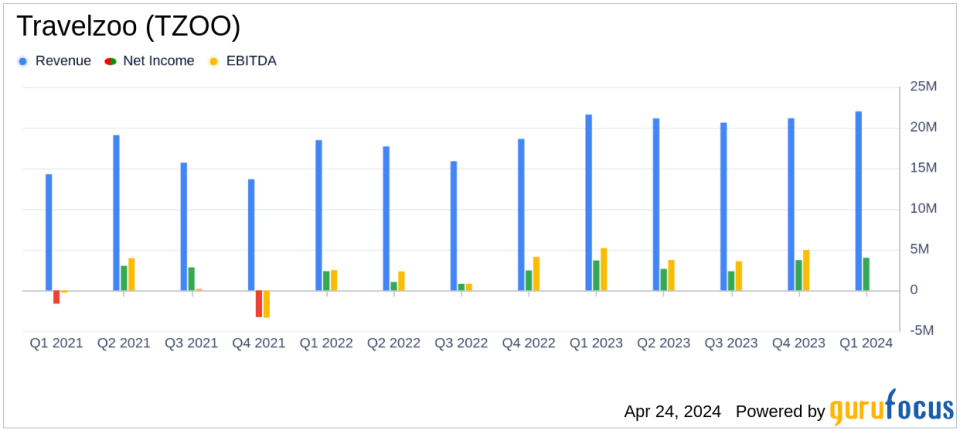

Travelzoo (TZOO) Q1 2024 Earnings: Slight Revenue Miss, EPS Beats Estimates

Revenue: $22.0 million, up 2% year-over-year, fell short of estimates of $23.70 million.

Net Income: $4.2 million, exceeded estimates of $4.11 million.

Earnings Per Share (EPS): $0.31, slightly above the estimated $0.30.

Cash Flow from Operations: Reported at $4.6 million for the quarter.

Operating Profit: Consolidated operating profit reached $5.6 million, with non-GAAP operating profit at $6.0 million.

Segment Performance: Europe segment revenue rose by 13% year-over-year to $6.7 million; North America segment revenue decreased by 4% to $14.2 million.

Membership Growth: Global members increased to 31.0 million from 30.5 million year-over-year.

On April 24, 2024, Travelzoo (NASDAQ:TZOO) released its 8-K filing, reporting its financial results for the first quarter ended March 31, 2024. The company, a global publisher of travel and entertainment offers, reported a revenue of $22.0 million, marking a 2% increase year-over-year but slightly below the analyst estimate of $23.70 million. Earnings per share (EPS) stood at $0.31, surpassing the expected $0.30.

Company Overview

Travelzoo operates primarily in North America and Europe, with additional licensing activities in the Asia Pacific region. The company's revenue streams include advertising fees and commissions from travel and entertainment deals, as well as membership fees from services like Jack's Flight Club. Despite a slight decline in North America, Travelzoo's European segment and Jack's Flight Club both reported growth.

Financial Highlights and Challenges

Travelzoo's consolidated net income for Q1 2024 was $4.2 million, a notable increase from $3.67 million in the prior-year period. This improvement reflects a robust control over costs and an enhanced operational efficiency. Operating profit increased to $5.6 million from $4.7 million year-over-year. However, the North America segment experienced a revenue decline of 4%, which could signal market saturation or competitive pressures in this mature market.

Strategic Initiatives and Forward Outlook

CEO Holger Bartel emphasized the company's focus on leveraging its global reach to negotiate exclusive travel deals, which is particularly significant amid rising travel costs. The company expects continued revenue growth in Q2 2024, although at a slower pace compared to 2023. The introduction of a membership fee in January 2024 is anticipated to contribute to future revenue streams, starting from 2025 for legacy members.

Detailed Financial Analysis

The company's cash position remains strong with $16.9 million in cash, cash equivalents, and restricted cash as of March 31, 2024. Travelzoo's ability to generate cash from operations was impressive, with $4.6 million recorded in the quarter, which supports its strategic investments and operational needs.

Segment Performance

Travelzoo's Europe segment outperformed with a 13% revenue increase in constant currencies, and operating profit in this segment more than tripled to $1.4 million. Conversely, Jacks Flight Club faced a slight operating loss due to increased marketing expenses aimed at growing its member base.

Conclusion

While Travelzoo faces challenges in its North American segment, its strategic initiatives and strong performance in other segments highlight its potential for sustained growth. The company's ability to exceed EPS estimates while slightly missing on revenue forecasts presents a mixed yet optimistic picture for investors focusing on long-term growth.

For a deeper dive into Travelzoos financial details and future prospects, interested readers and investors can access the full earnings report and management commentary through the provided filing link.

Explore the complete 8-K earnings release (here) from Travelzoo for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance