Travelers' (TRV) Q2 Earnings Miss Estimates But Rise Y/Y

The Travelers Companies, Inc.’s TRV second-quarter 2019 core income of $2.02 per share missed the Zacks Consensus Estimate of $2.27 by 11%. However, the bottom line improved 11.6% year over year.

The year-over-year improvement in earnings can largely be attributed to lower level of catastrophe loss and higher net investment income. However, higher non-catastrophe weather-related losses and lower net favorable prior year reserve development were partial offsets.

Behind the Q2 Headlines

Travelers’ total revenues rose 5% from the year-ago quarter to $7.8 billion.

Net written premiums grew 4% year over year to a record $7.5 billion owing to increase in each of the business segments, namely Business and International Insurance, Bond & Specialty Insurance and Personal Insurance.

Net investment income increased 8.9% year over year to $648 million.

Travelers witnessed underwriting gain of $74 million, down 17.8% from the year-earlier period. Combined ratio deteriorated 30 basis points (bps) year over year to 98.4% attributable to higher underlying combined ratio and lower net favorable prior year reserve development, partially offset by lower catastrophe losses.

At the end of the second quarter, statutory capital and surplus were $21.1 billion. Debt-to-capital ratio (excluding after-tax net unrealized investment gains) was 20.6%, within the company’s target range of 15-25%.

Adjusted book value per share was $90.05, up 3% from 2018 end.

Core return on equity was 9.2%, up 50 bps year over year.

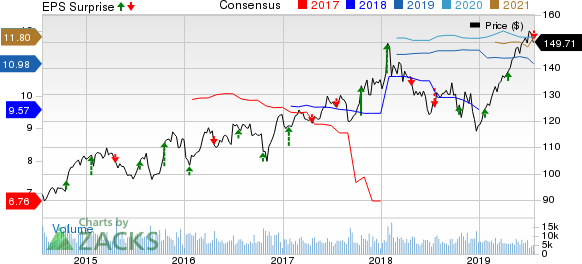

The Travelers Companies, Inc. Price, Consensus and EPS Surprise

The Travelers Companies, Inc. price-consensus-eps-surprise-chart | The Travelers Companies, Inc. Quote

Segment Update

Personal Insurance: Net written premiums of $2.9 billion increased 6% year over year driven by solid performance at Agency Automobile as well as Agency Homeowners and Other.

Combined ratio improved 470 bps year over year to 100.2% due to lower catastrophe losses, partially offset by higher underlying combined ratio.

Segment income of $88 million marked a reversal from the year-ago loss of $17 million and was driven by lower catastrophe losses and higher net investment income. However, lower underlying underwriting gain was a partial offset.

Bond & Specialty Insurance: Net written premiums rose 9% year over year to $710 million, primarily backed by continued strong retention and new business in management liability and surety.

Combined ratio deteriorated 840 bps year over year to 74.9% owing to lower net favorable prior year reserve development and higher underlying combined ratio, partially offset by lower catastrophe losses.

Segment income dropped 14.7% year over year to $174 million on lower net favorable prior year reserve development.

Business Insurance: Net written premiums increased 6% year over year to about $2.9 billion, reflecting continued strong retention and higher renewal premium change.

Combined ratio deteriorated 230 bps year over year to 101.1%, attributable to higher catastrophe, a higher underlying combined ratio and lower net favorable prior year reserve development.

Segment income of $351 million was down 8.8% year over year. The downside was due to higher catastrophe losses, lower underlying underwriting gain and lower net favorable prior year reserve development, partially offset by higher net investment income.

Dividend and Share Repurchase Update

The property & casualty insurer returned $593 million in the reported quarter. It repurchased 2.6 million shares worth $376 million. The company is now left with $2.536 billion worth of shares under its existing authorization.

The company’s board approved a quarterly dividend of 82 cents per share. The dividend is payable on Sep 30, 2019 to shareholders of record at the close of business as of Sep 10, 2019.

Zacks Rank

Travelers currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here..

Performance of Other Insurers

Of the insurance industry players, which have reported second-quarter results so far, earnings of The Progressive Corporation PGR, RLI Corp. RLI and Brown and Brown Inc. BRO beat the respective Zacks Consensus Estimate.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

RLI Corp. (RLI) : Free Stock Analysis Report

The Progressive Corporation (PGR) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance