Toronto-Dominion (TD) Down 3.8% as Q2 Earnings Decline Y/Y

Toronto-Dominion Bank’s TD shares declined 3.8% on the NYSE, in response to the release of second-quarter fiscal 2020 (ended Apr 30) results. Adjusted earnings of 85 cents per share were down 51% year over year. Also, adjusted net income declined 51% from the prior-year quarter to C$1.6 billion ($1.2 billion).

The results were adversely impacted by a significant rise in provisions. However, a rise in revenues and lower expenses were tailwinds. Growth in loan and deposit balances was also impressive.

After considering certain non-recurring items, net income was C$1.5 billion ($1.1 billion), decreasing 52% year over year.

Adjusted Revenues Rise, Expenses Fall

Total revenues amounted to C$10.5 billion ($7.6 billion), up 3% on a year-over-year basis. This upside resulted from growth in net interest income.

Net interest income rose 10% year over year to C$6.5 billion ($4.7 billion). However, non-interest income came in at C$4.1 billion ($3 billion), down 7% from the year-ago quarter.

Non-interest expenses declined 2% from the prior year to C$5.1 billion ($3.7 billion).

Adjusted efficiency ratio was 48% compared with 50.2% on Apr 30, 2019. Fall in efficiency ratio indicates a rise in profitability.

Provision for credit losses jumped substantially year over year to C$3.2 billion ($2.3 billion).

Strong Balance Sheet, Capital & Profitability Ratios Weaken

Total assets came in at C$1.67 trillion ($1.20 trillion) as of Apr 30, 2020, up 15% from the prior quarter. Net loans grew 8% on a sequential basis to C$693.2 billion ($535.4 billion) and deposits jumped 19% to C$1.08 trillion ($0.8 trillion).

As of Apr 30, 2020, common equity Tier I capital ratio was 11.0%, down from 12.0% on Apr 30, 2019. Total capital ratio was 15.3% compared with the prior year’s 15.8%.

Return on common equity — on an adjusted basis — came in at 7.3%, down from 17.0% as of Apr 30, 2019.

Our Take

While Toronto-Dominion’s efforts toward improving revenues — both organically and inorganically — are supported by its diverse geographical presence, rising operating expenses are deterring bottom-line growth to some extent. Further, rising provisions for credit losses pose a near-term concern.

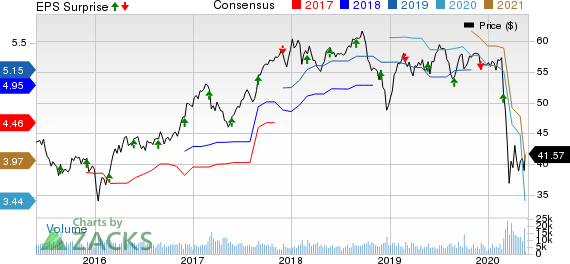

Toronto Dominion Bank The Price, Consensus and EPS Surprise

Toronto Dominion Bank The price-consensus-eps-surprise-chart | Toronto Dominion Bank The Quote

Toronto-Dominion currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

The Bank of Nova Scotia BNS, currently carrying a Zacks Rank #4 (Sell), reported second-quarter fiscal 2020 (ended Apr 30) adjusted net income of C$1.4 billion ($1 billion), down 39% year over year. The results excluded certain one-time items.

Zacks #3 (Hold) Ranked Bank of Montreal’s BMO second-quarter fiscal 2020 (ended Apr 30) adjusted net income was C$715 million ($519.9 billion), down 53% year over year.

Zacks #3 Ranked ICICI Bank’s IBN fourth-quarter fiscal 2020 (ended Mar 31) net income was INR12.21 billion ($161 million), up 26% from INR9.69 billion ($128 million) recorded in the prior-year period. Excluding coronavirus-related provisions, net income would have been INR32.60 billion ($431 million).

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of Nova Scotia The (BNS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Toronto Dominion Bank The (TD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance