Top US Growth Companies With High Insider Ownership In June 2024

Over the past year, the United States stock market has seen a robust increase of 23%, maintaining stability in the last week. In this context, growth companies with high insider ownership can be particularly appealing, as they often indicate confidence from those most familiar with the company's prospects and align with expectations of strong earnings growth.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 85.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Let's explore several standout options from the results in the screener.

Arq

Simply Wall St Growth Rating: ★★★★☆☆

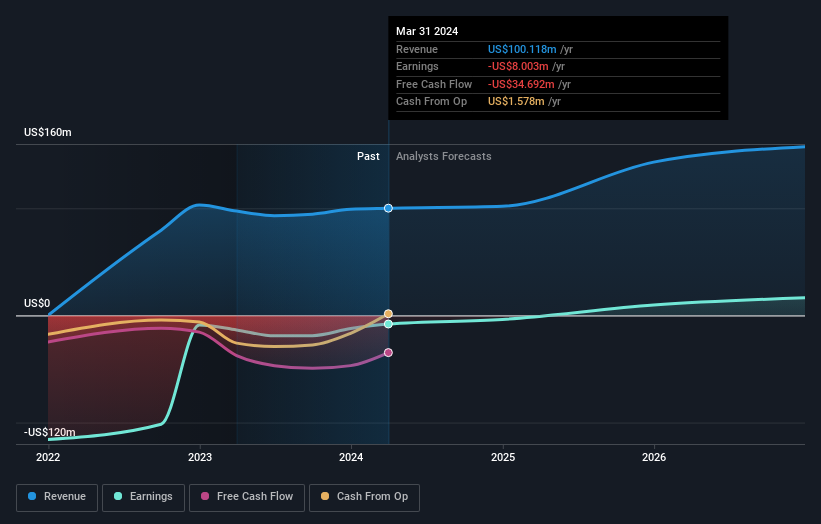

Overview: Arq, Inc. specializes in producing activated carbon products across North America with a market capitalization of approximately $250.84 million.

Operations: The company generates its revenue primarily from the specialty chemicals segment, totaling $100.12 million.

Insider Ownership: 19.8%

Revenue Growth Forecast: 18.6% p.a.

Arq, Inc. has demonstrated a robust trajectory with its revenue forecast to grow at 18.6% annually, outpacing the US market average of 8.4%. Despite recent volatility in share price and shareholder dilution over the past year, the company's earnings are projected to increase significantly, potentially becoming profitable within three years. Recent strategic moves include a $15 million private placement and securing a substantial sales contract for its GAC product from its Red River facility, indicating proactive management and potential for growth.

Get an in-depth perspective on Arq's performance by reading our analyst estimates report here.

Our expertly prepared valuation report Arq implies its share price may be too high.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinterest, Inc. is a global visual search and discovery platform with a market capitalization of approximately $28.34 billion.

Operations: The company generates its revenue primarily from internet information services, totaling approximately $3.19 billion.

Insider Ownership: 11.4%

Revenue Growth Forecast: 13.9% p.a.

Pinterest, Inc. is poised for substantial growth with earnings expected to climb 34.5% annually, significantly outpacing the US market forecast of 14.6%. Despite trading at a 24.7% discount to its estimated fair value, Pinterest shows promise as it recently turned profitable and anticipates revenue growth of 13.9% yearly, faster than the market's 8.4%. The addition of experienced executive Chip Bergh to the board underscores strategic leadership aiming to sustain this momentum.

TETRA Technologies

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TETRA Technologies, Inc. operates as an energy services and solutions company with a market capitalization of approximately $486.52 million.

Operations: The company generates revenue through two primary segments: Water & Flowback Services, which brought in $309.76 million, and Completion Fluids & Products, contributing $321.27 million.

Insider Ownership: 10.2%

Revenue Growth Forecast: 15% p.a.

TETRA Technologies, despite a recent dip in net income to US$0.915 million from US$6.04 million, is trading at 87.8% below its estimated fair value and shows potential with expected annual earnings growth of 43.26%. Revenue growth projections stand at 15% per year, surpassing the US market's 8.4%. The appointment of Angela D. John to the board adds valuable energy transition experience, positioning TETRA for strategic advancements in clean energy sectors.

Next Steps

Unlock our comprehensive list of 178 Fast Growing US Companies With High Insider Ownership by clicking here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:ARQ NYSE:PINS and NYSE:TTI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance