Top Ranked Value Stocks to Buy for April 13th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, April 13th:

Atlas Air Worldwide Holdings, Inc. (AAWW): This provider of outsourced aircraft and aviation operating services has a Zacks Rank #2 (Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 54.7% over the last 60 days.

Atlas Air Worldwide Holdings Price and Consensus

Atlas Air Worldwide Holdings price-consensus-chart | Atlas Air Worldwide Holdings Quote

Atlas Air Worldwide has a price-to-earnings ratio (P/E) of 3.81, compared with 19.60 for the industry. The company possesses a Value Score of A.

Atlas Air Worldwide Holdings PE Ratio (TTM)

Atlas Air Worldwide Holdings pe-ratio-ttm | Atlas Air Worldwide Holdings Quote

Encore Capital Group, Inc. (ECPG): This specialty finance company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 3.8% over the last 60 days.

Encore Capital Group Inc Price and Consensus

Encore Capital Group Inc price-consensus-chart | Encore Capital Group Inc Quote

Encore Capital has a price-to-earnings ratio (P/E) of 4.35, compared with 6.00 for the industry. The company possesses a Value Score of B.

Encore Capital Group Inc PE Ratio (TTM)

Encore Capital Group Inc pe-ratio-ttm | Encore Capital Group Inc Quote

Diamond S Shipping Inc. (DSSI): This shipping company has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 17% over the last 60 days.

Diamond S Shipping Inc. Price and Consensus

Diamond S Shipping Inc. price-consensus-chart | Diamond S Shipping Inc. Quote

Diamond S Shipping has a price-to-earnings ratio (P/E) of 2.91, compared with 4.10 for the industry. The company possesses a Value Score of B.

Diamond S Shipping Inc. PE Ratio (TTM)

Diamond S Shipping Inc. pe-ratio-ttm | Diamond S Shipping Inc. Quote

Global Net Lease, Inc. (GNL): This real estate investment trust has a Zacks Rank #2, and seen the Zacks Consensus Estimate for its current year earnings rising 4.7% over the last 60 days.

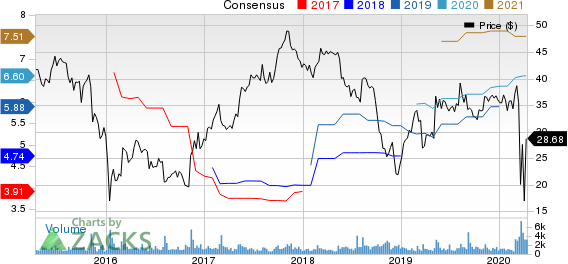

Global Net Lease, Inc. Price and Consensus

Global Net Lease, Inc. price-consensus-chart | Global Net Lease, Inc. Quote

Global Net Lease has a price-to-earnings ratio (P/E) of 6.88, compared with 13.80 for the industry. The company possesses a Value Score of B.

Global Net Lease, Inc. PE Ratio (TTM)

Global Net Lease, Inc. pe-ratio-ttm | Global Net Lease, Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Global Net Lease, Inc. (GNL) : Free Stock Analysis Report

Encore Capital Group Inc (ECPG) : Free Stock Analysis Report

Diamond S Shipping Inc. (DSSI) : Free Stock Analysis Report

Atlas Air Worldwide Holdings (AAWW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance