Top Ranked Income Stocks to Buy for February 7th

Here are four stocks with buy rank and strong income characteristics for investors to consider today, February 7th:

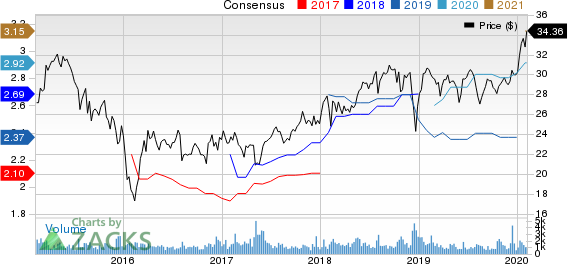

AGNC Investment Corp. (AGNC): This company invests in residential mortgage pass-through securities and collateralized mortgage obligations has witnessed the Zacks Consensus Estimate for its current year earnings 8.7% over the last 60 days.

AGNC Investment Corp. Price and Consensus

AGNC Investment Corp. price-consensus-chart | AGNC Investment Corp. Quote

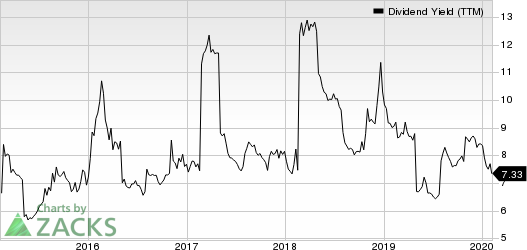

This Zacks Rank #1 (Strong Buy) company has a dividend yield of nearly 10%, compared with the industry average of 8.2%. Its five-year average dividend yield is 11.8%.

AGNC Investment Corp. Dividend Yield (TTM)

AGNC Investment Corp. dividend-yield-ttm | AGNC Investment Corp. Quote

Artisan Partners Asset Management Inc. (APAM): This investment management company provides its services to pension and profit-sharing plans, trusts, endowments, foundations, charitable organizations and others has witnessed the Zacks Consensus Estimate for its current year earnings increasing 8.3% over the last 60 days.

Artisan Partners Asset Management Inc. Price and Consensus

Artisan Partners Asset Management Inc. price-consensus-chart | Artisan Partners Asset Management Inc. Quote

This Zacks Rank #1 company has a dividend yield of 7.2%, compared with the industry average of 2.3%. Its five-year average dividend yield is 7.6%.

Artisan Partners Asset Management Inc. Dividend Yield (TTM)

Artisan Partners Asset Management Inc. dividend-yield-ttm | Artisan Partners Asset Management Inc. Quote

AllianceBernstein Holding L.P. (AB): This investment management company that provides research services to investment companies, pension and profit sharing plans, banks and thrift institutions and many more has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.3% over the last 60 days.

AllianceBernstein Holding L.P. Price and Consensus

AllianceBernstein Holding L.P. price-consensus-chart | AllianceBernstein Holding L.P. Quote

This Zacks Rank #2 (Buy) company has a dividend yield of 7.3%, compared with the industry average of 2.3%. Its five-year average dividend yield is 8.3%.

AllianceBernstein Holding L.P. Dividend Yield (TTM)

AllianceBernstein Holding L.P. dividend-yield-ttm | AllianceBernstein Holding L.P. Quote

Apollo Investment Corporation (AINV): This business development company specializing in middle market companies has witnessed the Zacks Consensus Estimate for its current year earnings increasing 6.3% over the last 60 days.

Apollo Investment Corporation Price and Consensus

Apollo Investment Corporation price-consensus-chart | Apollo Investment Corporation Quote

This Zacks Rank #2 company has a dividend yield of 10.5%, compared with the industry average of 8.5%. Its five-year average dividend yield is 11.5%.

Apollo Investment Corporation Dividend Yield (TTM)

Apollo Investment Corporation dividend-yield-ttm | Apollo Investment Corporation Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.7% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Artisan Partners Asset Management Inc. (APAM) : Free Stock Analysis Report

Apollo Investment Corporation (AINV) : Free Stock Analysis Report

AGNC Investment Corp. (AGNC) : Free Stock Analysis Report

AllianceBernstein Holding L.P. (AB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance