Top Ranked Growth Stocks to Buy for October 14th

Here are four stocks with buy ranks and strong growth characteristics for investors to consider today, October 14th:

Career Education Corporation (CECO): This higher educationcompany which carries a Zacks Rank #1 (Strong Buy), has witnessed the Zacks Consensus Estimate for its current year earnings increasing 9.7% over the last 60 days.

Career Education Corporation Price and Consensus

Career Education Corporation price-consensus-chart | Career Education Corporation Quote

Career Education has a PEG ratio of 0.81 compared with 1.48 for the industry. The company possesses a Growth Scoreof A.

Career Education Corporation PEG Ratio (TTM)

Career Education Corporation peg-ratio-ttm | Career Education Corporation Quote

NRG Energy, Inc. (NRG): This energy company, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 1.6% over the last 60 days.

NRG Energy, Inc. Price and Consensus

NRG Energy, Inc. price-consensus-chart | NRG Energy, Inc. Quote

NRG Energy has a PEG ratio of 0.28, compared with 2.91 for the industry. The company possesses a Growth Score of A.

NRG Energy, Inc. PEG Ratio (TTM)

NRG Energy, Inc. peg-ratio-ttm | NRG Energy, Inc. Quote

BrightView Holdings, Inc. (BV): This landscaping service company, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 0.9% over the last 60 days.

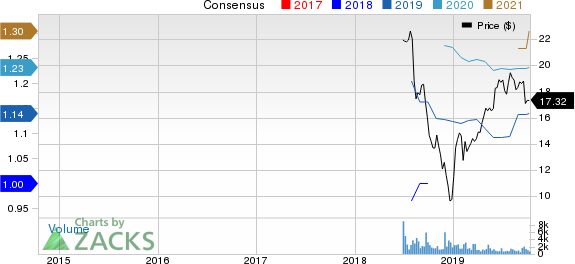

BrightView Holdings, Inc. Price and Consensus

BrightView Holdings, Inc. price-consensus-chart | BrightView Holdings, Inc. Quote

BrightView Holdings has a PEG ratio of 0.74, compared with 13.87 for the industry. The company possesses a Growth Score of A.

BrightView Holdings, Inc. PEG Ratio (TTM)

BrightView Holdings, Inc. peg-ratio-ttm | BrightView Holdings, Inc. Quote

Dell Technologies Inc. (DELL): This computer software company, which carries a Zacks Rank #1, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 13.6% over the last 60 days.

Dell Technologies Inc. Price and Consensus

Dell Technologies Inc. price-consensus-chart | Dell Technologies Inc. Quote

Dell has a PEG ratio of 0.58, compared with 2.44 for the industry. The company possesses a Growth Score of A.

Dell Technologies Inc. PEG Ratio (TTM)

Dell Technologies Inc. peg-ratio-ttm | Dell Technologies Inc. Quote

See the full list of top ranked stocks here.

Learn more about the Growth score and how it is calculated here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Career Education Corporation (CECO) : Free Stock Analysis Report

BrightView Holdings, Inc. (BV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance