Will Top-Line Improvement Aid Paychex (PAYX) in Q3 Earnings?

Paychex, Inc. PAYX will release its third-quarter fiscal 2024 results on Apr 2, before market open.

We expect growing demand for services and higher revenues to have positively impacted the company’s performance in the to-be-reported quarter.

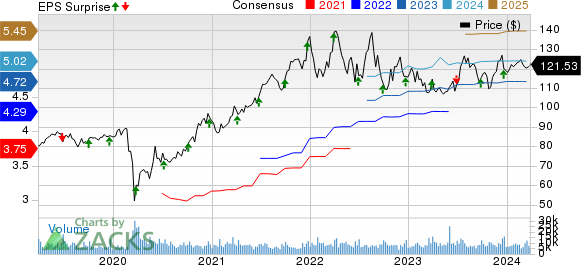

Paychex, Inc. Price, Consensus and EPS Surprise

Paychex, Inc. price-consensus-eps-surprise-chart | Paychex, Inc. Quote

Factors to Note

Management Solutions is likely to have benefited from growth in the number of clients served across the suite of HCM solutions , price realization, a rise in product penetration and growing ancillary services. Our estimate for revenues from Management Solutions is pegged at $1.1 billion, suggesting a 4.8% rise from the year-ago quarter’s actual.

Growth in PEO and insurance solution revenues is likely to have resulted from higher revenues per client, including increased insurance revenues and average worksite employees. Our estimate for PEO and insurance solution revenues is pegged at $349.6 million, which indicates an 8.8% increase from the year-ago quarter’s reported figure.

We expect interest on funds held for clients to increase marginally year over year to $35.6 million . The increase is likely to have resulted from higher average interest rates.

The Zacks Consensus Estimate for total revenues is pegged at $1.5 billion, up 5.7% from the year-ago quarter’s actual.

PAYX currently has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings Snapshot

Equifax EFX reported better-than-expected fourth-quarter 2023 results.

EFX’s earnings (excluding 75 cents from non-recurring items) were $1.81 per share, beating the Zacks Consensus Estimate by 4% and increasing 19.1% from the year-ago figure. Revenues of $1.33 billion beat the consensus estimate by 1.1% and increased 10.7% from the year-ago figure on a reported basis and 14% on a local-currency basis.

S&P Global Inc. SPGI reported mixed fourth-quarter 2023 results.

SPGI’s adjusted earnings per share of $3.13 missed the Zacks Consensus Estimate by 0.6% but increased 23.2% year over year. Revenues of $3.2 billion surpassed the consensus estimate by 0.5% and improved 7.3% year over year, backed by strong performances in all divisions.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Equifax, Inc. (EFX) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance