Top Insider-Owned Growth Stocks In Australia For May 2024

As of May 2024, the Australian market presents a mixed landscape with sectors like industrials and energy experiencing growth, while materials and financials face challenges. This nuanced performance across different sectors highlights the importance of strategic investment choices. In this context, companies with high insider ownership can be particularly compelling. Insider ownership often signals confidence from those who know the company best, aligning their interests with that of shareholders especially in fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Alpha HPA (ASX:A4N) | 28.3% | 95.3% |

Liontown Resources (ASX:LTR) | 16.4% | 64.3% |

SiteMinder (ASX:SDR) | 11.4% | 69.4% |

Chrysos (ASX:C79) | 22.2% | 57.5% |

We're going to check out a few of the best picks from our screener tool.

Liontown Resources

Simply Wall St Growth Rating: ★★★★★★

Overview: Liontown Resources Limited is an Australian company focused on the exploration, evaluation, and development of mineral properties, with a market capitalization of approximately A$3.10 billion.

Operations: The company primarily generates its revenue from the exploration, evaluation, and development of mineral properties in Australia.

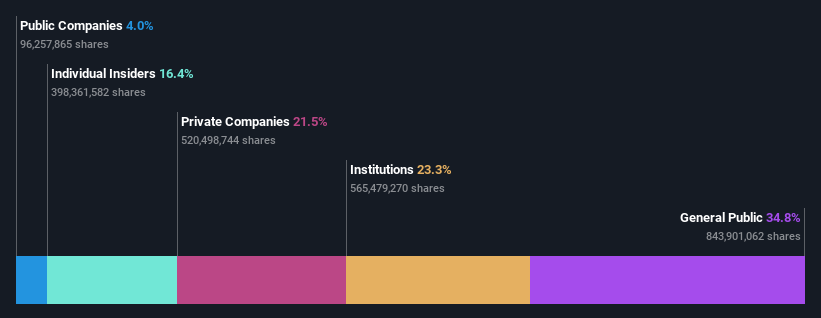

Insider Ownership: 16.4%

Earnings Growth Forecast: 64.3% p.a.

Liontown Resources, an Australian growth company with high insider ownership, is navigating a challenging financial landscape with less than A$1 million in revenue and a significant net loss of A$31.02 million as of December 2023. Despite these hurdles, the company is projected to outpace the Australian market with an expected revenue growth rate of 55.6% per year and become profitable within three years. However, shareholder dilution occurred over the past year, impacting investor holdings negatively.

Upon reviewing our latest valuation report, Liontown Resources' share price might be too optimistic.

Mineral Resources

Simply Wall St Growth Rating: ★★★★★☆

Overview: Mineral Resources Limited is a mining services company based in Australia, with operations extending to Asia and globally, boasting a market cap of approximately A$15.16 billion.

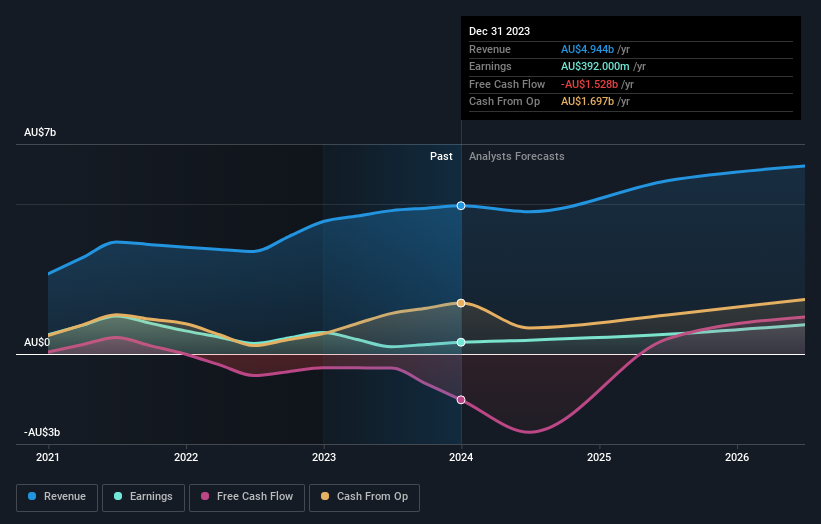

Operations: The company generates revenue from lithium (A$1.60 billion), iron ore (A$2.50 billion), and mining services (A$2.82 billion).

Insider Ownership: 11.6%

Earnings Growth Forecast: 29.2% p.a.

Mineral Resources, despite a decline in profit margins from 16.3% to 7.9%, is trading at a substantial discount of 42.3% below its estimated fair value and shows promising financial prospects with earnings expected to grow by 29.2% annually, outpacing the Australian market's forecast of 13.5%. The company recently reported a significant increase in half-year net income from A$388.6 million to A$537.3 million and declared a fully franked dividend, reflecting strong operational performance and shareholder commitment.

Temple & Webster Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Temple & Webster Group Ltd operates as an online retailer specializing in furniture, homewares, and home improvement products across Australia, with a market capitalization of approximately A$1.46 billion.

Operations: The company generates its revenue primarily from the online sales of furniture, homewares, and home improvement products, totaling approximately A$442.25 million.

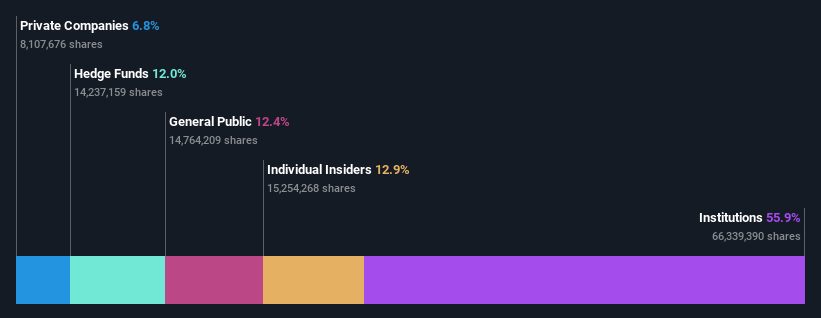

Insider Ownership: 12.9%

Earnings Growth Forecast: 35.5% p.a.

Temple & Webster Group, an e-commerce entity in home furnishings, demonstrated a robust performance with half-year sales rising from A$207.1 million to A$253.83 million and net income increasing slightly to A$4.13 million. While insider transactions were balanced over the past quarter, the company's forecasted earnings growth at 35.5% annually surpasses the broader Australian market's 13.4%. However, its Return on Equity is expected to remain low at 14.2%, indicating potential challenges in efficiency or profitability ahead.

Summing It All Up

Click through to start exploring the rest of the 87 Fast Growing Companies With High Insider Ownership now.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:LTR ASX:MIN and ASX:TPW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance