Top fund manager: 'Switch to electric vehicles won't hurt BP or other oil giants'

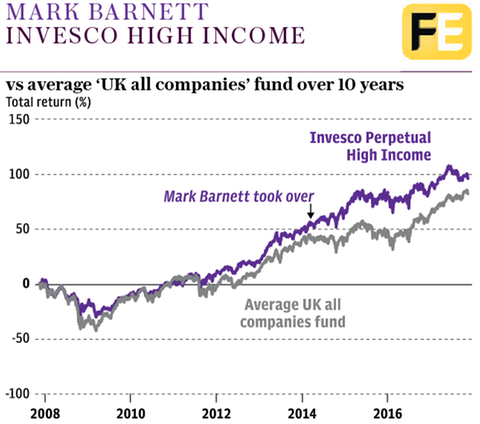

You could say Mark Barnett had the hardest job in fund management when, three years ago, he took over Invesco Perpetual’s giant Income and High Income funds from Neil Woodford.

Since then both managers have suffered, as several big stock selections have not paid off. Telegraph Money spoke to Mr Barnett about his mistakes, the future of oil and the stock that went from £1.50 to £12 a share.

How would you describe your strategy?

We look to invest in businesses that offer the opportunity over the long term to benefit from growth in cash flows and ultimately dividends. I start off by making an assessment of the economic outlook and then apply that to the market.

I see myself as an “unconstrained” manager – I’m not interested in the benchmark, it doesn’t shape how I construct the portfolio.

The problem with so many managers is that they are worried about how they are positioned against the index. But that doesn’t make any judgment about whether the index itself is risky.

How many stocks do you hold?

Between 60 and 80. Our holding period is about seven years on average.

The fund has underperformed recently. What happened?

I’ve had a couple of blow-ups in the past few years. This year in particular, Provident Financial has created a big hole in the performance.

There were also stock-specific issues with Capita in 2016 [when shares dived to a 10-year low] and at the beginning of this year with BT [whose Italian business was caught up in an accounting scandal].

Not owning HSBC, which has performed very well, has been a relative drag on the fund, as has not owning things like mining stocks, which have also done very well.

In 2015 you were confident in BP’s ability to maintain its dividend. Are you still as optimistic?

Even more so. The story was being pieced together in my own mind and it can take longer than you first believe.

The business has not performed as well as I hoped, but in the past six months there is greater evidence that it is transforming. It is buying back shares yet the market is still sceptical about its ability to maintain the dividend – which I think is misplaced. It will start growing payouts again and a lot of people will be surprised.

The market has become very negative on the prospects for big oil companies, partly because of the oil price and because electric vehicles are taking off.

There is no doubt that the trend is towards more electric vehicles, but that does not mean the world is going to switch over in the next five years. I think hybrid will prevail actually. Oil demand is roughly 100 million barrels a day; 20pc of that is consumed in private vehicles. Even if 10pc of cars switched to electric globally, and that would be a big shift, that’s only two million barrels fewer a day.

Are there other sectors you have your eye on?

The market is very pessimistic about London commercial property. I like Derwent London, the Reit [real estate investment trust], which is trading at a big discount.

What is your biggest bet at the moment?

Having BT in the portfolio feels very contrarian. It ticks all the boxes – it’s got political risk, regulatory risk, pension risk and UK risk. But I’ve been buying more of it: it feels like a crescendo of bearishness but there’s a new chairman coming in who is very experienced. There are grounds for optimism.

What has been your most successful investment?

Burford Capital, the legal finance firm, has worked very, very well. In the past five years the share price has gone from £1.50 to £12.

Have there been times when you’ve been able to use the fund’s weight to influence management?

We bought into Thomas Cook in 2011 when it was going wrong. We had a lot of influence as a large shareholder talking to management as they rebuilt the balance sheet. And we’ve been in constant contact with BP over the past two years. It sometimes needs help with conveying messages to the market.

Do you have your own money in the fund?

About half my wealth is spread across our funds, with most in the investment trusts.

In focus: Next

Next is an interesting story, says Mark Barnett.

It’s priced for an outlook that I think is a lot more pessimistic than what we’re going to get. The UK is in a much better position, particularly in terms of consumer spending, than people realise.

Next has a number of qualities that the market is choosing to overlook. It has a margin structure that is highly flexible, it has a strong balance sheet, it generates a lot of cash and has a long history of creating shareholder value by buying shares back.

It also has a property portfolio of 500 shops, which is very flexible. If it sees the profitability of the stores declining, it can reshape the portfolio quite quickly. There are layers of resilience in the business. Yes, in the short term there are fears because the firm’s earnings progression is under pressure, but I think it has stabilised.

The most recent update had disappointing sales but it was interesting the company didn’t change its profit guidance. The stock price falling 10pc after that was an overreaction.

You’ve got a share sitting on a valuation of only 11 times earnings, yielding nearly 8pc. The market is nervous about retail, in part because of the economy and in part because of the Amazon effect, the feeling that these new online businesses are all-powerful and all-conquering. Undoubtedly that exists but I think the effect is overdone.

The “Fangs” [Facebook, Amazon, Netflix and Google] are extremely powerful businesses but the market is only seeing the upside; I worry about that.

Yahoo Finance

Yahoo Finance