Top 5 Stocks to Buy in the Flourishing Building Products Industry

Increased government infrastructure spending is bolstering companies in the Zacks Building Products - Miscellaneous industry. Although potential challenges like macroeconomic uncertainties, high rates, low consumer confidence, new product investments, and rising raw material costs could squeeze margins, firms such as Owens Corning OC, Armstrong World Industries, Inc. AWI, Knife River Corporation KNF, Arcosa, Inc. ACA and Frontdoor, Inc. FTDR stand to gain from improved residential market, operational excellence, geographic and product diversification strategies, strategic acquisitions, and higher infrastructure investments.

Industry Description

The Zacks Building Products - Miscellaneous industry primarily comprises manufacturers, designers and distributors of home improvement and building products like ceiling systems, doors, windows, flooring and metal products. Some industry players provide solutions to rehabilitate the aging infrastructure, primarily pipelines in the wastewater, water, energy, mining and refining industries. The companies also manufacture expansion joints and structural bearings, ventilation products, ground-mounted solar racking and commercial greenhouses, as well as mail storage (solutions including mailboxes along with package delivery products). Companies in this industrial cohort also rent out equipment to a diverse customer base, including construction and industrial companies, manufacturers, utilities, municipalities, homeowners and government entities.

3 Trends Shaping the Future of the Building Products Industry

U.S. Administration’s Infrastructural Spending & Improving Residential Market: The industry players are expected to benefit from strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply-chain investments. The U.S. administration’s endeavor to rebuild the nation’s deteriorating roads and bridges and fund new climate-resilient and broadband initiatives is expected to aid the companies. Meanwhile, as the industry players’ business prospects are highly correlated with U.S. housing market conditions, improving residential construction markets are expected to drive growth. Builders are now cautiously optimistic for 2024 as the lack of existing inventory is shifting demand to the new home market, thereby driving the demand for companies’ products in the industry.

Operational Excellence, Product Innovation & Acquisitions: The industry participants have been undertaking strong cost-saving initiatives like business consolidation, system implementations, plant/branch closures, improvement in the global supply chain and headcount reductions to boost profitability. Industry participants have also been strategically investing in new products, sales and support services, digitally enabled solutions and advanced manufacturing capabilities to boost revenues. The companies are also following a systematic acquisition strategy to supplement organic growth and expand access to additional markets and products.

Rising Costs: Inflationary headwinds with respect to transportation costs, material costs and energy costs have been a pressing concern. Also, rising labor costs are compressing margins. These are dampening the companies’ operating performance. Although the industry participants have been working to recover higher costs through various price increases, they expect this ongoing volatility in material and transportation costs to be a concern. Apart from higher raw material costs, the companies bear expenses related to product launches. If companies are unable to offset these costs through price increases or supply-chain initiatives, their profits may be affected.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Building Products – Miscellaneous industry is a 27-stock group within the broader Zacks Construction sector. The industry currently carries a Zacks Industry Rank #40, which places it in the top 16% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates positive near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of a higher earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are gradually gaining confidence in this group’s earnings growth potential. Since March 2024, the industry’s earnings estimates for 2024 have been revised upward to $4.79 from $4.70 per share.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

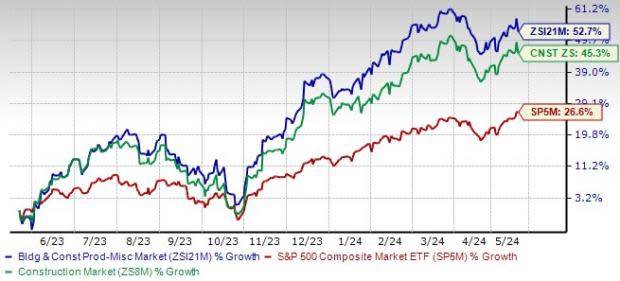

Industry Outperforms Sector, S&P 500

The Zacks Building Products – Miscellaneous industry has outperformed the broader Zacks Construction sector and the Zacks S&P 500 Composite over the past year.

Over this period, the industry has rallied 52.7% compared with the broader sector’s 45.3% rise. Meanwhile, the Zacks S&P 500 Composite has jumped 26.6% over the same period.

One-Year Price Performance

Industry's Current Valuation

On the basis of the forward 12-month price to earnings, which is a commonly used multiple for valuing building products’ stocks, the industry is trading at 17.1X versus the S&P 500’s 21.2X and the sector’s 17.6X.

Over the past five years, the industry has traded as high as 20.1X, as low as 9.9X and at a median of 15X, as the chart below shows.

Industry’s P/E Ratio (Forward 12-Month) Versus S&P 500

5 Building Product Stocks to Buy Now

We have selected five stocks from the Zacks universe of building products that currently carry a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Armstrong World Industries: Based in Lancaster, PA, Armstrong World is a leading global manufacturer of ceiling systems primarily for commercial, institutional, and residential building construction and renovation. The company has been thriving by focusing on innovative new products and pursuing strategic acquisitions to diversify its portfolio. Its recent acquisition of 3form, LLC is set to bolster the Architectural Specialties segment and strengthen connections with architects and designers.

Additionally, Armstrong World has been investing in digitalization and technological advancements. Since 2022, its digital initiative, Canopy, has shown consistent quarterly growth, generating new demand for its products. Furthermore, the company's recent investments in developing new products in metal, wood, and Tectum materials are contributing positively to its performance.

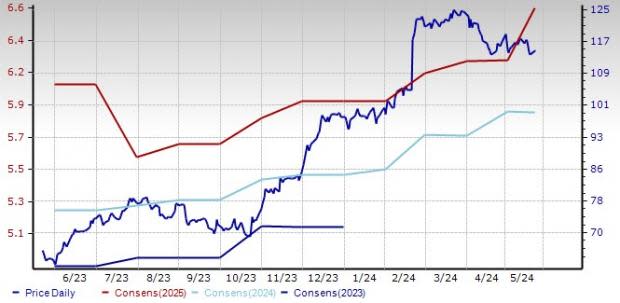

AWI, a Zacks Rank #1 stock, has gained 81.6% over the past year. AWI has seen an upward estimate revision of 2.6% for 2024 earnings over the past 30 days to $5.89 per share. The company’s earnings for 2024 are expected to increase 10.7%. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average surprise being 15.2%.

Price and Consensus: AWI

Frontdoor: Based in Memphis, TN, this company provides home warranties in the United States. The company is benefiting from its focus on new and innovative ways to boost demand for services, and the relaunch of American Home Shield brand is a significant component of this strategy. Looking ahead, the company is committed to establishing a solid foundation by investing in its brand and technology infrastructure and enhancing productivity throughout the organization.

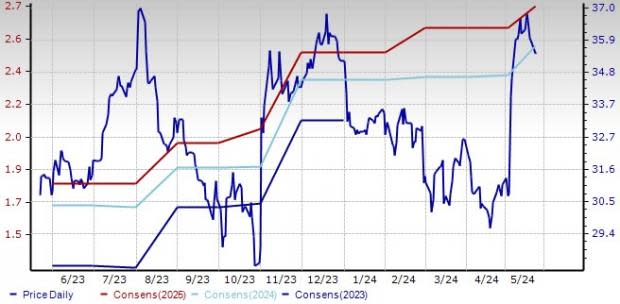

Frontdoor, a Zacks Rank #1 stock, has gained 15.4% over the past year. FTDR has seen an upward estimate revision of 7.2% for 2024 earnings over the past 30 days to $2.52 per share. The estimated figure indicates 9.6% year-over-year growth for 2024. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 286.8%. It currently holds a VGM Score of A.

Price and Consensus: FTDR

Owens Corning: Headquartered in Toledo, OH, Owens Corning is a global leader in building materials systems and composite solutions. Since its founding in 1938, the company has become a market-leading innovator in glass fiber technology. Owens Corning is leveraging strong demand in its Roofing business, ongoing product innovation, and effective pricing strategies to drive growth. Additionally, reduced input and manufacturing costs are enhancing profitability. Strategic initiatives and targeted acquisitions are further strengthening its market position and contributing to its success.

Owens Corning, a Zacks Rank #1 stock, has gained 61.2% over the past year. OC has seen an upward estimate revision of 13% for 2024 earnings over the past 30 days to $15.56 per share. The estimated figure indicates 7.9% year-over-year growth for 2024. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 17.4%. It currently holds a VGM Score of A.

Price and Consensus: OC

Knife River: Headquartered in Bismarck, ND, this firm offers construction materials and contracting services throughout the United States, specializing in aggregates-based solutions. Knife River has effectively implemented its EDGE plan to enhance adjusted EBITDA margins and achieve strategic objectives. A crucial component of this strategy involves optimizing pricing to fully capture the value of core products, including aggregates, ready-mix concrete, asphalt, and contracting services. The company has adopted a more judicious approach in selecting higher-margin projects within its contracting services division. Despite challenges, Knife River maintains a positive outlook on the long-term market strength, anticipating favorable impacts from local, state, and federal funding.

Knife River, a Zacks Rank #2 stock, has gained 109.3% since its inception on May 25, 2023, outperforming the industry’s 56.3% increase. KNF has seen an upward estimate revision of 0.6% for 2024 earnings over the past 30 days to $3.52 per share. The estimated figure indicates 9% year-over-year growth for 2024. The company’s earnings surpassed the Zacks Consensus Estimate in the last two reported quarters of the three trailing quarters, the average being 38.7%. It currently holds a VGM Score of A.

Price and Consensus: KNF

Arcosa: This Dallas, TX-based company provides infrastructure-related products and solutions. The company remains focused on its long-term vision to lessen the complexity of Arcosa’s overall portfolio and shift its business mix toward less cyclical, higher-margin growth opportunities that leverage core strengths and drive long-term shareholder value creation. The company is benefiting from significant tailwinds in infrastructure and heavy manufacturing projects, alongside improved conditions in single-family residential construction within its operational regions. Leveraging its disciplined commercial approach, the company has successfully increased unit profitability in both natural and recycled aggregates despite persistent cost challenges. Arcosa is well-positioned for a robust performance in 2024, supported by sustained momentum from infrastructure spending across its diverse range of businesses. With a favorable commercial landscape, the company maintains its focus on achieving operational excellence and enhancing profitability.

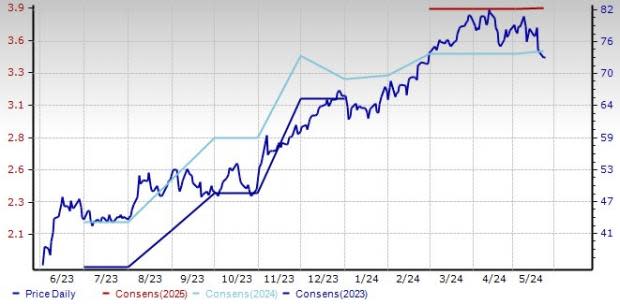

Arcosa, a Zacks Rank #2 stock, has gained 25.3% over the past year. ACA has seen an upward estimate revision of 1.5% for 2024 earnings over the past 30 days to $3.43 per share. The estimated figure indicates 6.2% year-over-year growth for 2024. The company’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average being 43.9%. It currently holds a VGM Score of B.

Price and Consensus: ACA

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Owens Corning Inc (OC) : Free Stock Analysis Report

Armstrong World Industries, Inc. (AWI) : Free Stock Analysis Report

Frontdoor Inc. (FTDR) : Free Stock Analysis Report

Arcosa, Inc. (ACA) : Free Stock Analysis Report

Knife River Corporation (KNF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance