Toast raises seed funding to help migrant workers in Singapore send money back home

Singapore’s Lucky Plaza shopping center.

Singapore-based online remittance platform Toast has raised a S$1.2 million (US$850,000) seed round, the company announced today. The oversubscribed round was led by Singapore-based investment firm Aetius Capital, and joined by international investor ACE & Company, which has previously invested in financial comparison site CompareAsia and online peer-to-peer payments startup Transferwise. New York-based investment company One Zero Capital also participated in the round.

Toast is the first out of accelerator Startupbootcamp Fintech Singapore’s inaugural cohort of startups to raise funding. Most of the investors that got in this round found out about the startup through its time in the accelerator, which founder and CEO Aaron Siwoku says he is grateful for. “[Startupbootcamp] gave us a tremendous amount of visibility,” he says. “It’s designed to plug you into a network, to do things faster than you’d be able to on your own.”

A better way

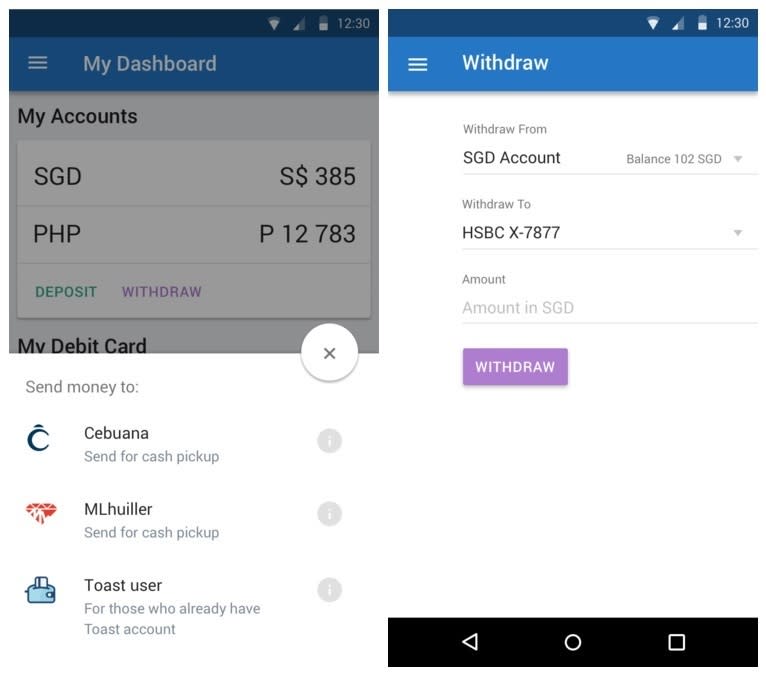

Toast has created an online money remittance platform for migrant workers in Singapore who want to send money back to their families in the Philippines (other countries such as Indonesia, Bangladesh, Myanmar, and so on are in the startup’s future plans). It has developed a mobile app where the user can create an account, verify their identity, load it with funds, and then remit the money to their chosen destination in minutes, for a fixed fee of S$6 (US$4) per transaction.

See: Startupbootcamp announces top 10 FinTech startups to join its Singapore programThe process is supposed to save time and money for workers who queue up every month in places like the Lucky Plaza shopping center, a Filipino hub in Singapore, to send money using good old money transfer operators (MTOs). The sight of people queuing in the Singapore heat was what inspired the team to come up with a better way, Aaron tells Tech in Asia.

“The reason they are queuing up is because these MTOs are still running a very old-fashioned business model,” he explains. “People queue up, they hand cash over a counter, the cash has to be counted, their ID has to be verified each time they do a transaction, and this creates queues.” So the startup looked for a way to digitize the process using a mobile app.

Toast founder and CEO, Aaaron Siwoku.

While there are companies in Singapore trying to solve the same problem, like cashless payments terminal manufacturer Numoni, Toast’s approach works almost entirely through the mobile app.

95 percent of those workers have some type of smartphone, Aaron says. And 100 percent of them have another very useful thing: an EZ link travel card or a NETS Flashpay card – contactless cards which are topped up with funds and used for various payments across Singapore, including the mass transit system and certain retailers.

Traditional money transfer facilities are inefficient compared to today’s technology. “We live in the age of instant messaging,” Aaron says. “I can have a conversation with my mother in real time via my smartphone, yet if I send money it takes three to five days. I know more about a package I send to my mom with FedEx, than I do about money I send to her. I think this is a problem.”

Do it yourself

The Toast app will be available for Android phones next month.

After creating an account, the user can register by taking a picture of their ID card. The software will enter their details into the system automatically. Every time the user needs to do a transaction, the app will prompt them to take a selfie, which it compares against the photo ID it already has for verification.

With their EZ link or NETS Flashpay card topped up with the desired amount, the user then has to visit a customer service center – which Toast plans to set up – where they can tap the card onto a terminal to load the money into their account. Then, the funds can be remitted to the user’s family, who can receive the money through Cebuana or M. Lhuillier – non-banking financial institutions in the Philippines that Toast has partnered with. Security Bank also has a partnership with the startup.

Later on, Toast plans to enable users to add funds to their accounts by just tapping their card on their NFC-enabled phone. The team’s data shows that 60 percent of their target audience owns phones with NFC capability. For the rest, it’s looking into solutions like NFC readers that plug into a smartphone via the audio jack – but that’s further down the line.

The presence of a physical location is a key factor in Toast’s first step into the world. Aaron feels it’s important to have a place where people can come in, see that this is not just a faceless business, ask questions, and be eased into the startup’s offering.

“Our retail unit is not designed to take cash [but] to be a relationship-building center and a sales center,” he says. “I’m not interested in how we get the first 100,000 customers, or the first 10,000 customers, I’m interested in how we get the first thousand customers.”

Aaron will even give his mobile phone number out to Toast’s first customers. He claims they will be able to call at any time if they have a problem using the app. “I know I can’t do that forever, but I can certainly do it for the first thousand users,” he says. He hopes it will help show that the team is dedicated and cares about its product and its customers.

Breaking the chain

Toast was born when its previous incarnation, CryptoSigma, pivoted away from trying to do money remittances using the blockchain. The team felt that the value the blockchain would bring to their business and to their users wasn’t worth the trouble of implementing it – not without the potential for a lot of pain down the road.

“The blockchain is not that liquid right now, so we would have problems trying scaling up,” Aaron says. “Then we would have had to re-engineer the whole system and that would’ve thrown a major spanner in the works.”

Instead, the team decided to go with a simpler solution, using existing infrastructure that would be easier to harness – and easier to explain to regulators – in order to obtain the necessary licensing. “The big value proposition is that we’re solving a significant problem these migrant workers have,” Aaron explains.

See: Blockchain tech can eradicate corruption in AsiaAaron remains enthusiastic about the prospects of blockchain technology, but Toast isn’t going to be the company to build this platform. “When the blockchain becomes a viable solution for net settlement, it’s going to be someone else who makes it, and it’s going to be a B2B product,” he says. And by then, if it makes sense, Toast can very well make use of that platform for its own purposes. There is no value in trying to run two businesses at once, Aaron points out. “It’s like trying to build a horse and cart to deliver fruit,” he muses.

Go for launch

Toast will use its seed funding to expand its team with some key hires, particularly in financial engineering and marketing. It already has employees and advisors with experience in finance and remittances.

It plans to grow the team slowly for now, as it wants to stay lean until the time comes to raise its series A. It’s looking at a runway of about 12 to 18 months with its current funding, which should allow it to acquire users, set up its physical store, and continue the regulatory wrangling.

“Don’t be mistaken that we don’t have any traction,” Aaron says. “We do, just not the traction you’re thinking about. We’re building something that we hope one day can become a digital bank. So the traction we’re building is not with users, it’s with regulators.” The approach has thrown a few investors off, but they’re starting to come around to what Toast is trying to do, Aaron claims.

“We’re not just here to run a startup for its own sake, or to go through funding rounds, but to solve a problem, and provide value,” he says.

This post Toast raises seed funding to help migrant workers in Singapore send money back home appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance