TJX Companies: Own This Value Pick

TJX Companies Inc. (NYSE:TJX) is one of the largest retailers in the U.S. focused on off-price products, mainly apparel and home fashion. The company's primary operations are in the U.S., and its leading brands are TJ Maxx, Marshalls, HomeGoods, SIERRA and Homesense.

The company competes directly with Ross Stores (NASDAQ:ROST), Burlington Stores (NYSE:BURL) and Target (NYSE:TGT). TJX holds the highest market value of around $106.70 billion at the last check. Within the apparel retail segment, it reported $54 billion in revenue in 2023, more than double the amount Ross reported and five times the revenue of Burlington.

TJX Companies as a value investing pick

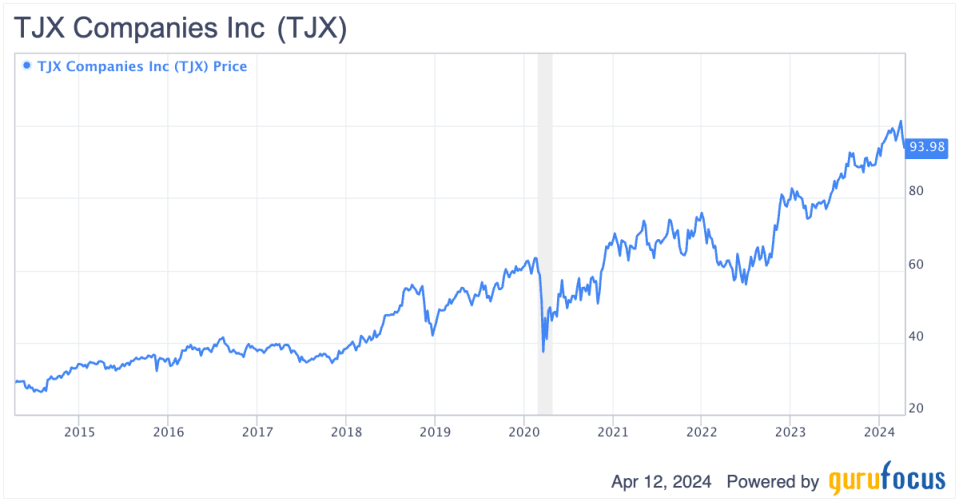

TJX's performance over the last few years has highlighted the resilience of its business, led by a highly experienced management team, with the CEO Ernie Hermann having over two decades with the company. This has positioned it as a top value investment pick that aligns with Warren Buffett (Trades, Portfolio)'s criteria for quality. Not surprisingly, the stock has appreciated by more than 200% in the last decade.

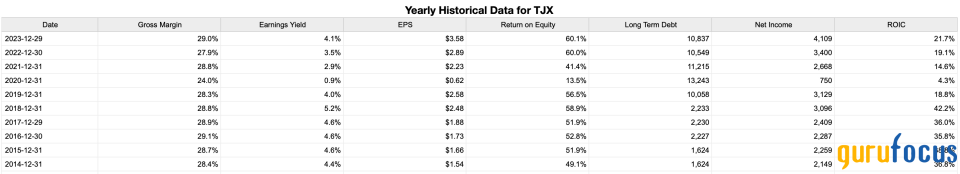

First, TJX stands out for its solid track record of 10 consecutive years of earnings per share growth, excluding the peak of the Covid-19 period, without a single negative year. This impressive achievement highlights the company's ability to sustain a solid performance even in periods of macroeconomic instability and also demonstrates the fundamental role played by its management.

Source: Stock Rover

Consequently, TJX also boasts a solid balance sheet. The company's long-term debt has been relatively low, remaining at a net debt/Ebitda ratio below 5 for the last decade. The only exception was during the pandemic, when there was a jump from 0.40 to 4.35 times net debt/Ebitda. The company returned to a normalized ratio below 1 in 2022 and trades at a net debt/Ebitda of a comfortable 0.40 times currently. In short, there are no worries about debt here.

With regard to efficiency, TJX Companies has demonstrated robust return on equity and return on invested capital figures over the last decade, except for 2020 and 2021, when it reported a ROE of 13.5% and 41% due to the impacts of the pandemic. In the other years, the company reported figures above 49%, most recently in 2023 reporting an incredible ROE of 60.10%.

The elevated ROE shows TJX has consistently delivered significant returns on shareholders' equity, a solid demonstration of the effective utilization of equity financing. ROIC, again, except in 2020, which was 4.30%, has not fallen below 14% in the last decade. In 2023, it reached a level of 21.70%. This high and healthy ROIC results from its low-cost business model, even though the company generates average annual gross margins of 29%, below the industry average of 35%.

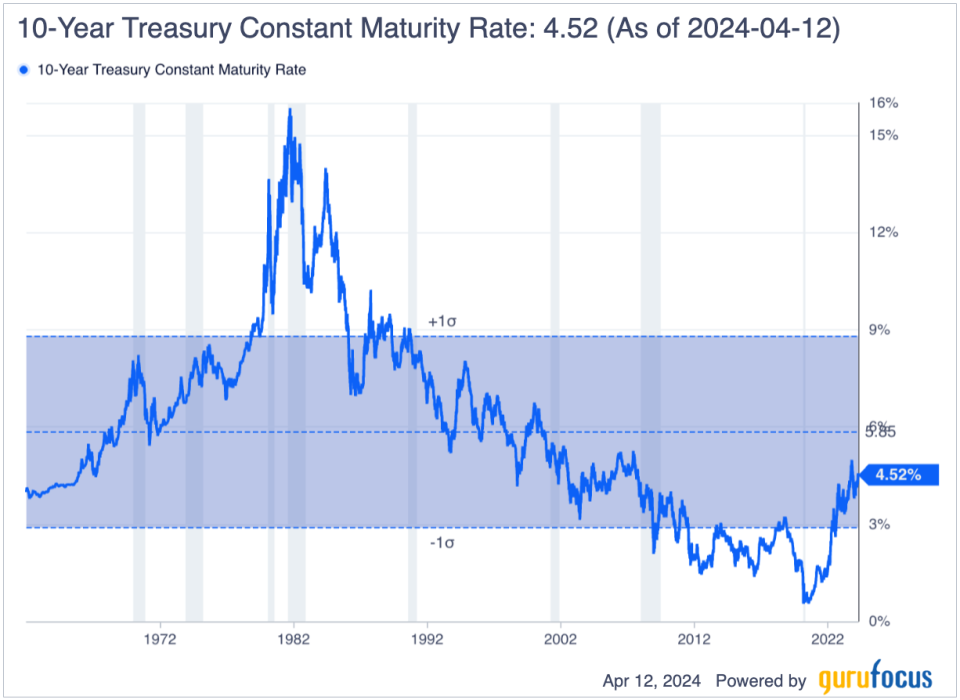

Finally, the company has an earnings yield of 4%, which is very close to the long-term Treasury yield of 4.50%, indicating the stock is undervalued compared to long-term fixed-income securities, which are a safe investment. Also, from this, it can be said that as the earnings yield is close to the long-term Treasury yield, the market may be pricing in moderate growth in the company's profits in the future, indicating stability in its highly profitable operations.

Company's latest results

Dissecting TJX's latest results for the fourth quarter of 2024, the company demonstrated solid sales figures and changing trends. Same-store sales growth of 5% year over year suggeste a return to consumers' willingness to spend again. It is important to note this performance is quite different from fiscal 2023, when same-store sales showed negative growth due to high inflation, which reduced consumers' willingness to spend.

In short, there has been a significant change in the narrative: from weak sales due to inflation to a slight increase in demand.

Another point to note is that TJX's revenue growth in the fourth quarter was due to an increase in customer transactions. This means more people are visiting and buying in stores.

The company's management also mentioned the success of the new selection of festive gifts, which suggests TJX has won over new customers, especially among young people. This is important because it shows the company is managing to stay relevant and is not falling behind with its products.

In anticipation of future market movements, I believe the quarterly results may have been a turning point in the consumer trend and could potentially yield better expectations over the current year (fiscal 2025). This opinion goes hand in hand with Herrman's statement that he is excited about what lies ahead. He said:

"Looking ahead, the first quarter is off to a good start. In 2024, we have many initiatives planned that we believe will keep driving sales and attract more shoppers to our stores. Longer term, we see many opportunities to capture additional market share across our geographies, and we are laser focused on increasing the profitability of TJX. We are convinced that our flexibility and commitment to value will continue to be a winning retail formula for many years to come."

Valuations and final remarks

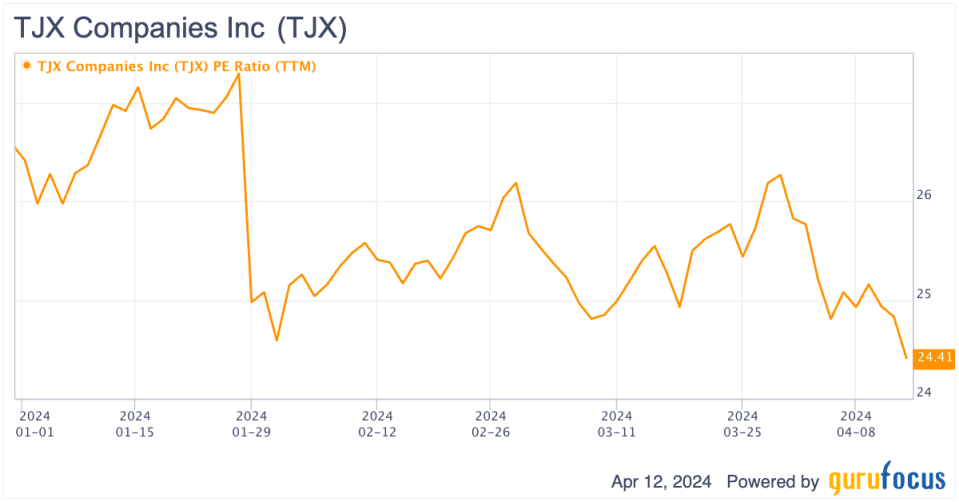

Considering the solid fundamentals that make TJX a high-class retail pick, it is no surprise shares trade at stretched valuations, especially considering the stock's 22% appreciation over the last 12 months. As the chart below shows, the company trades with a price-earnings ratio of 24.40 and a forward price-earnings ratio of 23.60 considering the consensus estimates of earnings per share growth of roughly 7% in 2024, which is far from a bargain. It is in line with TJX's historical average, but is far from the retail industry's historical average of 14.30.

TJX Data by GuruFocus

However, considering a less cyclical business model, I believe TJX's valuation can be justified by the its superior financial performance, even in adverse macroeconomic periods. It is also important to remember the high price-earnings ratio is very close to what it was five years ago when the world was experiencing the beginnings of the Covid-19 crisis when it traded at a multiple of 24.50 per share.

As a result, in the retail scenario, TJX stands out as a value thesis endowed with requirements that would pass a possible Buffett-style investment. I believe TJX is the kind of stock to hold for the long term rather than trade it for gains in the short to mid-term.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance