Is It The Right Time To Buy Oil And Gas Stocks?

The price of oil has plunged more than 70% from its peak price of US$110/barrel in June 2014 to the recent US$30/barrel. The drastic drop in oil price is mainly due to the oversupply of oil from the Organisation of the Petroleum Exporting Countries (OPEC) in the attempt to drive out competitors from the US Oil Shale industry. Although the decrease in oil price may seem beneficial to consumers and some industries such as airlines and manufacturing, other industries that are supporting the oil producing companies are feeling the pinch.

Hence, in order to decide if oil and gas companies are good stocks in invest now, one has to know the different subsectors within the industry.

Upstream Sector

Upstream companies are involved in oil exploration and extraction. This also includes companies that support the oil exploration and production activities.

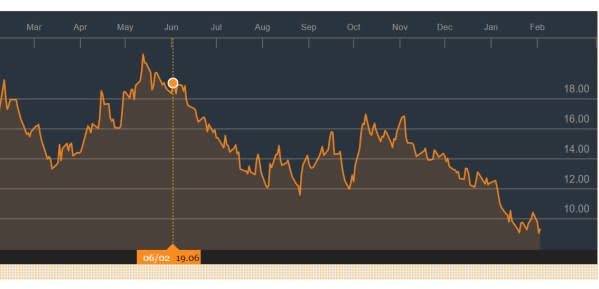

Any fluctuation in oil prices will directly affect their revenue. Since their cost of production (oil rigs and heavy machinery etc.) is largely fixed, companies from the upstream sector will be badly hit by the low oil prices. For instance, the share price of Transocean Ltd, one of the world largest oil drilling contractors, has fallen approximately 50% from US$18.37 to US$9.35 since June 2014 till now.

From the current outlook, we believe that the oil price is unlikely to rebound in near future (explained below). Hence, it is not advisable to invest in upstream companies now.

Downstream Sector

Downstream companies are involved in refining, distributing and the sale of the refined products such as gasoline and diesel fuel.

Since crude oil is their raw material for the refinery process, the fall in oil prices is good news for the downstream companies. This implies that their cost of production will decrease significantly while they are able to keep their price of gasoline and diesel fuel fairly stable.

Continuing with our belief that oil price is unlikely to rebound in the near future, companies involved in downstream processes are likely to enjoy a great deal of profit during the period of low oil prices.

Midstream Sector

As the name suggests, midstream companies serve as a bridge between the upstream and downstream sectors. They are involved in storage and transporting oil through pipelines, rails, trucks or barges.

Midstream companies are not as badly affected by the price of oil as compared to their upstream peers. This is because the distribution of pipelines and production rates play a bigger role in determining the earnings of the company. Hence, as long as the production of oil continues to grow, there is still growth opportunities for the midstream companies.

Integrated Companies

These days, most of the big oil companies would combine upstream and downstream activities thus they are known as integrated companies. Exxon Mobile and British Petroleum (BP) are the examples of such integrated companies.

In this case, the stock price of the integrated companies will depend on the proportion of exposure they have in both upstream and downstream subsectors.

Factors Affecting Oil Prices

Besides knowing the various subsectors of oil and gas industry, one has to keep a constant look out on oil prices. These are main factors which affect the direction of oil prices.

1. Oil Supply

It is estimated that more than 80% of the world’s proven oil reserves are located in OPEC Members’ countries. OPEC’s oil exports represent 60% of the oil traded internationally. Given this fact, OPEC has the ability to influence the oil prices by controlling the production of crude oil.

The OPEC has no intention of restricting their production at the current state. Hence, it is of low probability that oil price will rebound.

The weekly release on US Crude Oil Inventories by the US Energy Information Administration (EIA) would also affect short-term oil prices. The increase in inventory would trigger a decrease in oil price as well.

2. Oil Demand

With China being the world’s largest oil importer, the health of China’s economy plays an important in determining the demand for oil. The recent lacklustre China’s economic data and the devaluation of its currency are suggesting a slowdown in demand for oil.

As such, it is unlikely that the oversupply of oil can be absorbed by the demand for oil. Thus, it creates a downward pressure on the oil prices.

3. Lifting of Iran Sanction

Economic sanctions on Iran have been lifted after Iran has agreed to cut back on their nuclear activities. This means that Iran is ready to ramp up the production of oil for export thus, flooding the market with oil further.

4. Strength of US Dollar

Since prices of both WTI and Brent Crude Oil are US dollar denominated, the appreciation of US dollar will also affect the quantity demanded for oil.

This means that with the appreciation of US dollar, the price of oil (in USD) become more expensive for foreign countries (rest of the world). Therefore, quantity demanded for oil will decrease, resulting in a further decrease in oil prices.

Conclusion

Unlike investing in blue chip stocks where you can adopt the “buy and hold” strategy, investing in oil and gas industry requires a lot more time and effort to understand the different subsectors and the factors affecting oil prices. One has to be constantly updated with the oil and gas industry news in order to make wise investment decisions. Moreover, not all the companies in the subsectors are performing equally. Therefore, investors are to conduct their due diligence for the selected companies before investing as well.

Generally, prices of oil will affect the operating cost across most of the industries. Thus, it is also worth looking at stocks of other industries which largely dependent on oil.

Subscribe to our free e-newsletter to receive exclusive content not available on our website. Follow us as well on Instagram @DNSsingapore to get your daily dose of finance knowledge through photos.

The post Is It The Right Time To Buy Oil And Gas Stocks? appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance