Three Solid Canadian Dividend Stocks With Minimum Yields Of 2.1%

Amid a buoyant Canadian market where the TSX reached its highest closing level since April 2022, investors are witnessing a resurgence in sectors such as technology and industrials. In this climate of cautious optimism, with inflation concerns still on the radar, dividend stocks offering yields of at least 2.1% stand out as potentially attractive options for those seeking steady income streams in their investment portfolios.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

First National Financial (TSX:FN) | 6.69% | ★★★★★☆ |

IGM Financial (TSX:IGM) | 6.30% | ★★★★★☆ |

Canadian Imperial Bank of Commerce (TSX:CM) | 5.38% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.76% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.07% | ★★★★★☆ |

Richards Packaging Income Fund (TSX:RPI.UN) | 3.98% | ★★★★★☆ |

National Bank of Canada (TSX:NA) | 3.85% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.32% | ★★★★★☆ |

Primo Water (TSX:PRMW) | 2.10% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.50% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

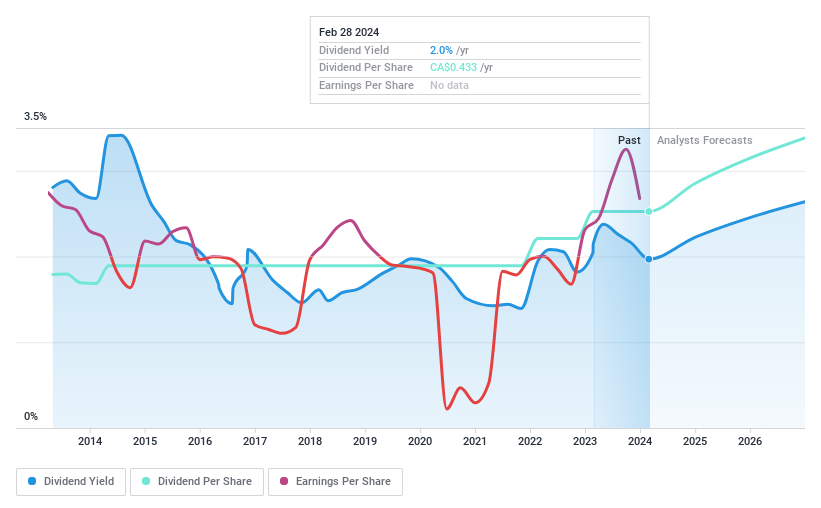

Primo Water (PRMW.TO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Primo Water Corporation is a provider of water solutions catering to both residential and commercial clientele, with a market capitalization of approximately CA$3.56 billion.

Operations: Primo Water Corporation generates its revenue primarily through its North American operations, which brought in $1.77 billion.

Dividend Yield: 2.1%

Primo Water Corporation's dividend of US$0.09 per share is underpinned by a cash payout ratio of 28.3%, indicating sustainability from cash flows, despite a modest yield of 2.1% relative to the Canadian market's higher average. The company has maintained stable dividends over the past decade and recently reported significant earnings growth, with full-year sales reaching US$1.77 billion and net income at US$238.1 million, marking substantial year-over-year increases. However, interest payments are not as comfortably covered by earnings, suggesting potential caution for dividend security in adverse conditions.

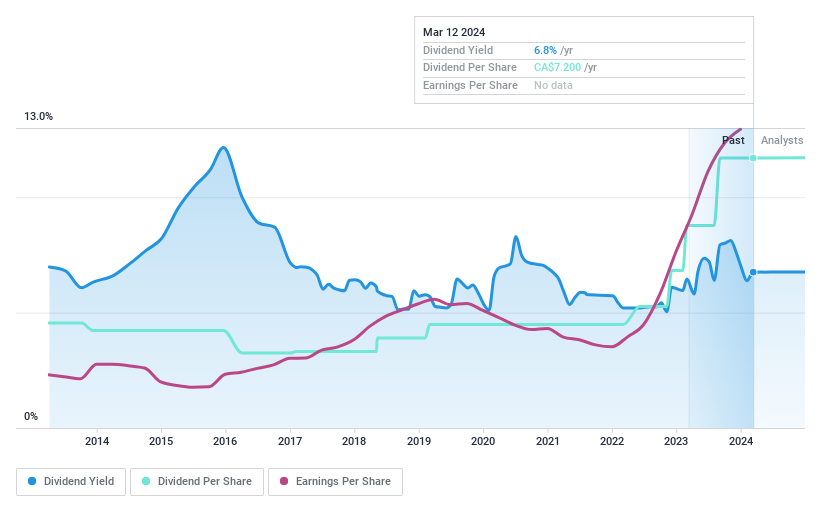

Olympia Financial Group (OLY.TO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olympia Financial Group Inc. is a Canadian firm that, via its subsidiary Olympia Trust Company, functions as a non-deposit taking trust company with a market capitalization of approximately CA$257.48 million.

Operations: Olympia Financial Group Inc. generates its revenue from various segments, including Health (CA$10.03 million), Corporate (CA$0.19 million), Exempt Edge (CA$1.31 million), Investment Account Services (CA$75.70 million), Currency and Global Payments (CA$8.44 million), and Corporate and Shareholder Services (CA$4.13 million).

Dividend Yield: 6.8%

Olympia Financial Group's recent declaration of a CA$0.60 monthly dividend reflects its commitment to regular shareholder returns, supported by a substantial increase in annual revenue to CA$99.82 million and net income to CA$23.96 million. However, the dividends appear vulnerable with a high cash payout ratio of 94.5% and earnings forecasted to decline annually by 6.1% over the next three years, coupled with historical volatility in dividend payments and concerns over coverage by cash flows despite an attractive yield above the Canadian market average.

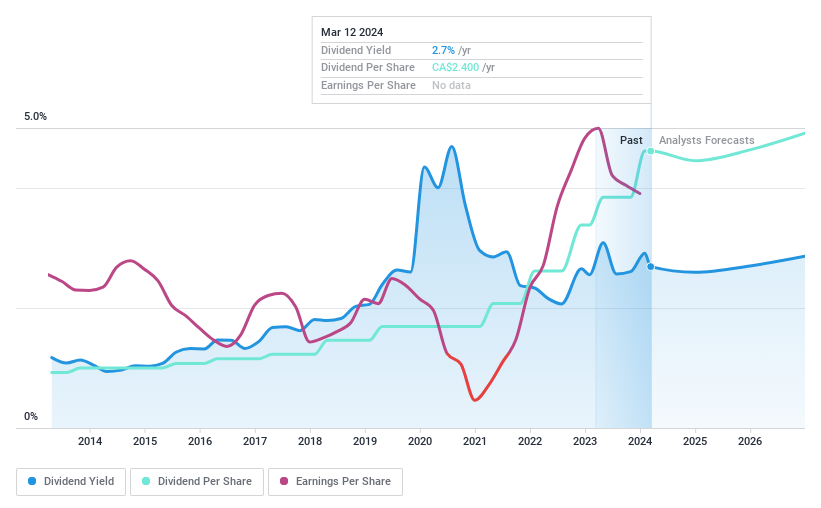

Imperial Oil (IMO.TO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Imperial Oil Limited is a Canadian company specializing in the exploration, production, and sale of crude oil and natural gas, with a market capitalization of approximately CA$47.34 billion.

Operations: Imperial Oil Limited's revenue is primarily derived from its Downstream segment, which generated CA$55.75 billion, followed by the Upstream segment at CA$16.50 billion, and the Chemical segment contributing CA$1.58 billion.

Dividend Yield: 2.7%

Imperial Oil's recent dividend hike to CA$0.60 per share signals a positive trend, despite a year-over-year dip in net income from CA$7.34 billion to CA$4.89 billion and sales decreasing from CA$59.67 billion to CA$50.97 billion in 2023. The company maintains a conservative payout ratio of 22.8% and cash flows comfortably cover the dividend with a 66% cash payout ratio, although earnings are expected to contract by an average of 5.7% annually over the next three years, suggesting caution for future growth prospects amidst stable decade-long dividend payments and boardroom reshuffles indicating strategic realignments ahead of the April annual meeting.

Where To Now?

Delve into our full catalog of 21 Top Dividend Stocks here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance