Three signs that a bank (and a big European one in particular) is in trouble

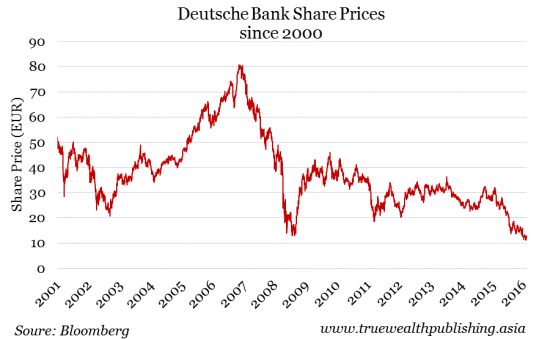

There’s a simple rule when it comes to trouble: The louder someone – your toddler in the kitchen, your spouse in a fender bender, your government minister on TV – insists that everything is just fine, the bigger the problem. By that measure, Deutsche Bank, Europe’s second-largest bank, and one of the world’s ten largest banks by assets, is in big and serious trouble. And this matters: It’s been singled out by the International Monetary Fund as “the most important net contributor to systemic risks” to the global financial system. If Deutsche Bank wobbles, the rest of the global financial system will shake. If they say it’s OK – it’s not For example, if a government minister says that everything is fine with a bank, you know it’s not. (We wrote about this, with respect to currencies, here.) It’s bad enough that a government minister should feel the need to say anything at all – so when he does, you know it’s a bad sign. Back in February, German Finance Minister Wolfgang Schaeuble said that he had “no concerns” about Deutsche Bank. To be fair, he did not volunteer the opinion, and he offered an opinion only when asked. And if he had said anything different, mass panic would have resulted. But that he was asked and that he felt compelled to answer says a lot. Second, when the CEO of a bank insists that everything is fine, you know it’s not. Around the same time as the German finance minister’s un-reassuring reassurance, Deutsche Bank co-Chief Executive Officer John Cryan wrote in a memo to employees that the bank was “rock solid,” and that it had a “strong” capital and risk position. If the boss feels compelled to gather the troops to tell everyone that everything is fine… you can bet that it isn’t. The third sign of a bank in trouble is a sick share price. I’ve written a lot about the art of contrarian investing, which involves seeing value, potential and opportunity in assets that other investors have left for dead. But often – usually – the market consensus (which is, by definition, the share price of an asset) is correct. Collapsing share prices reflect a company that is in trouble. The combined wisdom of millions of investors “knows” when something is seriously wrong. Since Schaeuble and Cryan’s comments, the share price of Deutsche Bank is down 22 percent. Meanwhile, the Bloomberg European 500 Index, a broad European stock market index, is up 11 percent. It’s been in trouble for a long time Deutsche Bank has been in trouble for a long time, though. Its shares are down 56 percent over the past year. They’re down 84 percent from their all-time high in 2007. Because of this, Deutsche Bank’s market capitalization (the number of shares outstanding times the price per share) is one-sixth the size of HSBC. It’s smaller than Singapore-based DBS Group. It’s just a bit bigger than American sports apparel company Under Armour.

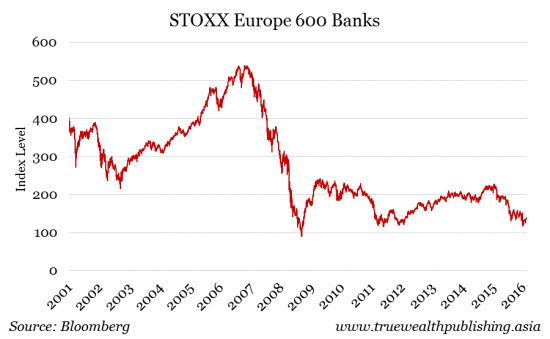

What’s wrong with Deutsche Bank? Everything. It’s struggling to adapt to a changed competitive environment where its business model and cost structure no longer make sense. Tightened regulations have made the industry a nightmare of rules – Deutsche Bank is facing an incredible 7,000 regulatory actions and lawsuits, according to the Financial Times (which last month wrote a 1,700-word article about the bank’s problems). It’s unable to sell a key asset to raise funds to improve the strength of its balance sheet. Negative interest rates have made it difficult to make a profit doing normal banking, as reflected in last year’s EUR6.8 billion loss. It’s not alone Deutsche Bank isn’t alone. Many of the same problems plaguing Deutsche Bank are also infecting other banks in Europe, which are down 37 percent over the past year (as reflected by the STOXX Europe 600 Banks Index), and have fallen 73 percent since their all-time high in 2007. Italy’s entire banking sector is at least as sick as Deutsche Bank.

Right now, Deutsche Bank shares trade at a price-to-book value (which reflects share prices divided by a company’s net asset value) of just 0.28. In accounting terms, this means that, in theory, if Deutsche Bank were to – at this very moment – sell every asset and pay off every debt, it could return shareholders nearly four times their money. Of course, that’s absurd and impossible. And what it means is that the market – the consensus of the market – believes that Deutsche Bank is worth a whole lot less than its book value suggests. That’s why the share price has fallen so far. Does it matter? The world’s banks are closely linked. A failure of or run on one bank, especially a large one, can affect institutions all around the world. Deutsche Bank’s derivatives book, said to be upwards of $70 trillion (with a “t”) is potentially an enormous risk. And maybe the biggest risk is that almost no one (likely even within Deutsche Bank) can really explain the nature of this derivatives exposure. In that sense, what happens at Deutsche Bank matters. The shadow of Lehman Brothers, the failure of which helped spark the most intense part of the 2008-2009 global economic crisis, looms. And Lehman Brothers is small potatoes compared to the systemic importance of Deutsche Bank. But it matters less than you might think for two reasons. First, if an institution as big as Deutsche Bank were to show signs of failure, the fire hose of financial firepower that would be deployed to support it would make the various rounds of quantitative easing by global central banks in recent years look like a water pistol by comparison. (That is, lots of central banks would do everything they possibly could to support Deutsche Bank, and it would work.) Secondly, the fact that we’re talking about this – and that challenges at Deutsche Bank have been the subject of speculation for many months – means that problems there won’t be a shock. Expected problems are a lot easier to deal with than unexpected problems. In the meantime, Deutsche Bank (symbol DB on the New York Stock Exchange) might be a contrarian’s dream. But just because something is cheap and is down 84 percent doesn’t mean it’s a good buy.

Kim Iskyan

Yahoo Finance

Yahoo Finance