Thiel: I would bet on bitcoin as the 'online equivalent of gold'

Billionaire venture capitalist and entrepreneur Peter Thiel sees bitcoin (BTC) as the only cryptocurrency worth betting on.

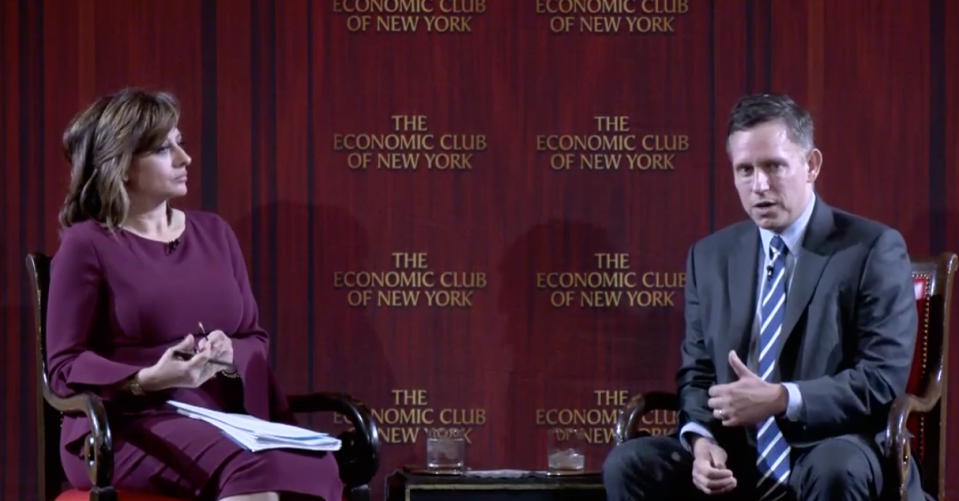

“I’m not exactly sure whether I would encourage people to run out right now and buy these cryptocurrencies,” Thiel said at a recent event hosted by the Economic Club of New York. “But, the technology that people like to talk about is the blockchain technology. I’m somewhat skeptical about how well that translates into good investments. But the one use case of cryptocurrency of a store of value may actually have quite a bit of a way to go.”

Thiel added that he’s long bitcoin and “neutral to skeptical” about most everything else with “a few possible exceptions.”

His view is that there’s going to be one cryptocurrency that will be the equivalent of gold. That will most likely be bitcoin, according to Thiel. Currently, there’s about $200 billion worth of bitcoin and $8 trillion worth of gold.

“My bet is there will be one online equivalent of gold. I would bet on the biggest.”

Bitcoin, like gold, can be used as a hedge to the “whole world falling apart,” he said.

“The question about something like bitcoin is whether it can become a new store of value. And, I think the thing it would replace is something like gold,” Thiel said. “We’re not talking about a new payments system. It’s too cumbersome to use for payments for day-to-day transactions, but the analogy is it’s like bars of gold in a vault that never moves.”

He added that bitcoin is “bubble-like,” but that doesn’t rebut the use case of bitcoin as a store of value.

“There are all these elements that remind me of 99/2000 that make me nervous. It’s people playing fast and loose with ICO rules just like the IPOs of the dot-com bubble. You have sort of the crazy promoter-type people, where the people who exaggerate beat the people with a normal plan and then they get beaten by the people who exaggerate a lot. So there are a lot of very crazy, unhealthy dynamics,” Thiel said. “At the same time, it still strikes me as deeply contrarian.”

One thing that’s different this time is that there are virtually no Wall Street analysts pushing bitcoin. Whereas during the dot-com bubble, there were a lot of analysts covering tech stocks.

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.

Yahoo Finance

Yahoo Finance