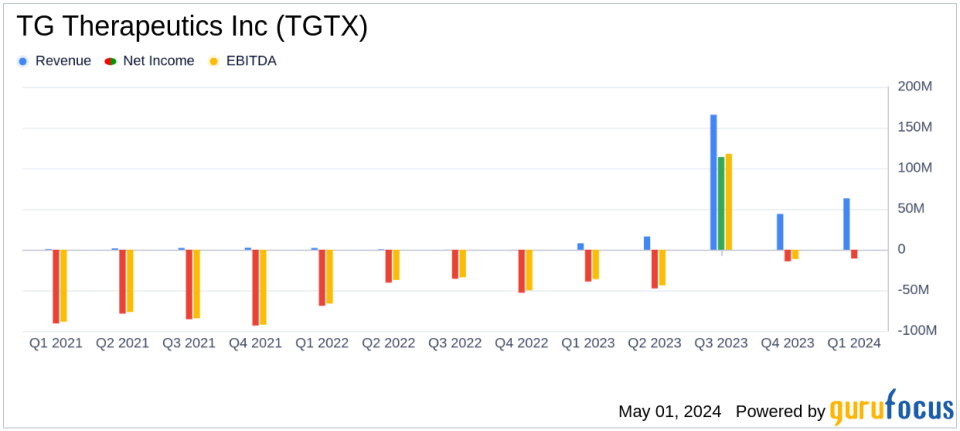

TG Therapeutics Inc (TGTX) Surpasses Revenue Estimates in Q1 2024, Despite Widening Net Loss

Total Revenue: Reported $63.5 million in Q1 2024, surpassing estimates of $54.58 million.

Net Loss: Recorded at $10.7 million for Q1 2024, significantly below the estimated net loss of $4.13 million.

Earnings Per Share: Actual EPS of -$0.07, fell short of the estimated -$0.04.

Product Revenue Growth: BRIUMVI U.S. net product revenue reached $50.5 million, indicating over 25% growth quarter over quarter.

R&D Expenses: Increased to $32.7 million in Q1 2024 from $15.9 million in the same period last year, driven by development costs and licensing expenses.

SG&A Expenses: Rose to $34.6 million due to scale-up activities for BRIUMVI's commercial launch.

Cash Position: Ended the quarter with $209.8 million in cash, cash equivalents, and investment securities.

TG Therapeutics Inc (NASDAQ:TGTX) released its 8-K filing on May 1, 2024, detailing a significant revenue increase in Q1 2024, primarily driven by robust sales of its flagship product, BRIUMVI. Despite surpassing revenue forecasts, the company reported a widened net loss compared to the previous year.

Company Overview

TG Therapeutics is a fully integrated, commercial-stage biopharmaceutical company focused on the acquisition, development, and commercialization of novel treatments for B-cell diseases. The U.S. Food and Drug Administration (FDA) has approved BRIUMVI (ublituximab-xiiy) for treating adult patients with relapsing forms of multiple sclerosis (RMS). The company is also advancing its pipeline with other potential treatments, including TG-1701 (BTK inhibitor) and TG-1801 (anti-CD47/CD19 bispecific mAb), currently in Phase 1 trials.

Financial Performance Highlights

The first quarter of 2024 saw TG Therapeutics achieve a total revenue of $63.5 million, significantly higher than the analyst estimate of $54.58 million. This includes $50.5 million from BRIUMVI U.S. net product sales, marking over 25% growth quarter over quarter, and a $12.5 million milestone payment related to BRIUMVI's launch in the first EU country. Despite these gains, the company recorded a net loss of $10.7 million for the quarter, a notable improvement from the $39.2 million loss in Q1 2023 but still higher than the estimated net loss of $4.13 million.

Operational and Development Milestones

During Q1 2024, TG Therapeutics continued to expand its commercial and clinical footprint. The company secured a national contract with the Department of Veterans Affairs, making BRIUMVI the preferred anti-CD20 antibody for RMS. On the development front, efforts are underway to enhance BRIUMVI's dosing convenience and to expand its indications beyond MS.

Financial Health and Future Outlook

As of March 31, 2024, TG Therapeutics reported having $209.8 million in cash, cash equivalents, and investment securities. This robust financial position is expected to support ongoing operations and fund further development activities. The company has updated its 2024 revenue guidance for BRIUMVI in the U.S. to range between $270 million and $290 million.

Analysis and Industry Impact

The strong revenue performance, particularly from BRIUMVI, highlights TG Therapeutics' growing influence in the biopharmaceutical sector, especially in treatments for B-cell diseases. The company's ability to exceed revenue expectations reflects well on its commercial strategies and the market's acceptance of BRIUMVI. However, the widened net loss underscores ongoing challenges in managing operational and development costs, which investors and stakeholders will closely monitor.

In conclusion, TG Therapeutics' first quarter of 2024 demonstrates a potent mix of robust revenue growth tempered by financial losses, as the company continues to navigate the complexities of commercial expansion and clinical advancements in the competitive biopharmaceutical landscape.

Explore the complete 8-K earnings release (here) from TG Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance