Tesco told to change Clubcard logo after losing legal battle with Lidl

Tesco has lost a bid at the Court of Appeal against a ruling that its Clubcard logo infringed on the trademark of rival supermarket Lidl.

Lidl sued Tesco in 2020 shortly after Tesco adopted a yellow circle against a blue background to promote its “Clubcard Prices” discount scheme.

The two retailers traded allegations of copying brands and deceiving customers at a trial last year.

A judge at London’s High Court ruled Tesco took “unfair advantage” of the reputation for low prices held by Lidl’s trademarks.

The Court of Appeal today dismissed Tesco’s appeal against the ruling that it infringed Lidl’s trademark.

Tesco is not expected to attempt to appeal against today’s ruling and is understood to be updating its Clubcard prices logo in the coming weeks, while a Lidl spokesperson said the grocer was “delighted” by the judgment.

Lord Justice Arnold, sitting with Lord Justice Birss and Lord Justice Lewison, said the High Court judge found the yellow circle with a red outline on a blue background “had become distinctive of Lidl” and that the Clubcard prices signs would bring the Lidl logo “to mind”.

He continued: “Tesco could easily have used a different sign to promote Clubcard prices. There is no error of law or principle in that reasoning, and the conclusion is one that the judge was fully entitled to reach.”

Read the latest updates below.

05:56 PM GMT

That’s all for today...

Thanks for joining us today. We’ll be back in the morning but do check out some of the latest business and economics stories elsewhere on The Telegraph website, including these:

Rachel Reeves prepares to clip the wings of the almighty OBR

Jeremy Warner: Britain is about to suffer a massive collision with reality

05:43 PM GMT

BBC’s plan to run radio adverts is catastrophic for UK media, warn publishers

The BBC is facing a backlash over its “catastrophic” plans to introduce adverts on its radio and podcast output. James Warrington reports:

The public service broadcaster is exploring proposals to place ads around some of its programmes when they are streamed via platforms such as Spotify and Apple in the UK.

The Archers, Desert Island Discs and In Our Time are among the shows that could be selected for adverts in the future as the BBC looks for ways to plug a £500m black hole in its finances.

However, the plans have drawn criticism from rivals, who warned that the publicly funded broadcaster was attempting to muscle in on the commercial advertising market.

Owen Meredith, chief executive of the News Media Association, which represents local and national publishers, branded the move “very alarming”.

05:33 PM GMT

Ben & Jerry’s could be floated in Amsterdam

Unilever’s ice cream unit could be floated in Amsterdam and not London, the company has revealed in a call with journalists.

The unit sells brands such as Wall’s, Magnum, Cornetto and Ben & Jerry’s.

Bloomberg reported that while no decision had been made over the location, Unilever boss Hein Schumacher pointed out that the unit is currently run from Rotterdam and is moving to a new head office in Amsterdam.

A Dutch listing would be a setback to the London Stock Exchange after a number of losses abroad.

Mr Schumacher said:

Where eventually the listing will take place as well as its head office, that’s something that we’re going to have to determine in the next 18 months. We are open to options.

04:55 PM GMT

FTSE 100 closes up

The FTSE 100 closed up 0.20pc today. Unilever was the biggest riser, up 3.08pc, followed by Rolls-Royce, up 2.74pc. The biggest faller was consumer goods producer Reckitt Benckiser, down 4.52pc, followed by the world’s silver and gold producer Fresnillo, down 4.29pc.

Meanwhile, the FTSE 250 closed down 0.28pc. PureTech Health rose the most, up 9.31pc, followed by City firm Close Brothers, up 3.95pc. The biggest faller was housebuilder Crest Nicholson, down 9.11pc, followed by plastic and metal components manufacturer Essentra, down 4.72pc.

04:27 PM GMT

George Lucas backs Disney boss in row with billionaire Nelson Peltz

The Hollywood tycoon behind the Star Wars franchise has thrown his weight behind Disney’s chief executive amid a bitter clash with activist investor Nelson Peltz. James Warrington reports:

George Lucas, who sold his company Lucasfilm to Disney for $4bn in 2012 and remains a major shareholder, said he had “full faith and confidence” in both the media giant and its boss Bob Iger.

In a statement, he said: “Creating magic is not for amateurs. When I sold Lucasfilm just over a decade ago, I was delighted to become a Disney shareholder because of my long-time admiration for its iconic brand and Bob Iger’s leadership.

“When Bob recently returned to the company during a difficult time, I was relieved. No one knows Disney better.”

The comments will be a major boost to Disney and Mr Iger in their battle against Mr Peltz, who holds a stake of around $3.5bn in the company.

Mr Peltz’s Trian Fund Management is pushing for changes in strategy and management. It has nominated the activist to the board, alongside former Disney finance chief Jay Rasulo.

04:24 PM GMT

Robinhood finance app forced to ditch high-risk trading hours before launch

The investing app Robinhood has been forced to launch in the UK without a key feature allowing riskier trades. James Titcomb has the detail:

The British version comes without Robinhood’s “margin investing” option that allows American users to borrow money from the app to make bigger trades.

The company, which was at the centre of the Gamestop meme stocks craze in 2021, has been criticised in the past for encouraging risky investments.

It had previously said it planned to offer margin investing at interest rates of 12pc due to a “regulatory exemption”.

A spokesman for the app said: “Margin investing is paused as we continue to discuss with the regulator.”

The Financial Conduct Authority did not comment.

Robinhood had planned to launch in the UK in 2020 but suspended the launch amid growing scrutiny in the US. It revived the plans last year.

04:12 PM GMT

SpaceX plays down Starlink IPO

SpaceX isn’t currently working on a floatation of its Starlink unit, according to Gwynne Shotwell, the company’s chief operating officer.

Ms Shotwell told a conference today: “We are not focused on an IPO for Starlink right now”.

Rather, the company is improving the product, including transmission speeds, she said, according to a Bloomberg report.

04:09 PM GMT

Cheap energy fuels higher US growth, says Chancellor

Cheap energy in America is fuelling faster economic growth, Jeremy Hunt has said, as he spoke up the importance of new nuclear power stations.

“From a purely economic point of view,” green energy was important. “I do agree that we need to have a plan for plentiful green energy”.

He said that one of the reasons the US has experience higher growth is the cheapness of their energy, and that the country needed more nuclear.

04:02 PM GMT

Chancellor says ‘triple lock’ state pension depends on public services report

Lord Bridges asked the Chancellor about whether the “triple lock” state pension and the current age of retirement are plausible long term.

Jeremy Hunt said: “Both those things are kept under review.”

He added that if the Government is able to run public services more efficiently and increase long-term growth rate, retaining the triple lock and current age of retirement would be sustainable.

03:54 PM GMT

Being on benefits can be bad for mental health, says Chancellor

Welfare recipients with mental health conditions should be helped to get back to work where it is appropriate, the Chancellor has said.

Jeremy Hunt told the Lords Economic Affairs committee that there will be cases where not being in work is detrimental to mental health conditions. Helping them back into work “is a very big change”, he said.

03:50 PM GMT

Jeremy Hunt declines to commit to an immigration target

Lord Bridges asked Jeremy Hunt about whether he should commit to cut immigration to 100,000-200,000 a year. Mr Hunt said:

I just don’t think it’s possible to land on a single number.

03:48 PM GMT

Britain’s economy has experienced ‘very impressive performance’ since 2010

The British economy has done better than many European countries since 2010, despite the economic shock from the pandemic, the Chancellor has said.

“I think we’ve had a very impressive performance”, he told the Lords Economuic Affairs committee.

03:44 PM GMT

Unlimited immigration undermines living standards, warns Hunt

Immigration has contributed significantly to economic growth, Jeremy Hunt has said, but warned that the arguement for it is “much harder” if you look at GDP per head - effect on individual citizens’ living standards.

He told peers that “some controlled migration that addresses skills gaps” was beneficial but “the risk you have is that if you end up with a model reliant on unlimited immigration you undermine GDP per head” and risk “civil unrest”.

We need a “high skill high wage model” that does not rely on high migration, he said.

03:40 PM GMT

NHS managers will be assessed on productivity, says Hunt

NHS leaders and their hospitals will be measured in new quarterly productivity figures, the Chancellor has said.

In comments to the Lords Economuic Affairs Committee, he said he had won a commitment from NHS England to drive productivity higher in return for new investment.

03:32 PM GMT

Hunt rejects European levels of growth

Jeremy Hunt has said that he wants US levels of economic growth, in a grilling before the Lords Economic Affairs committee.

The Chancellor said that the time is right to focus on the use of IT in improving public sector performance. He said: “If you look in the public sector, things that we weren’t able to think about in 2010 such as the IT transformation” should now receive focus.

Mr Hunt pointed to the Passport Office, which he said was now “one of the most efficient passport service in the world”. He said that it had cut waiting times from 10 weeks to three, as a result of IT improvements.

03:29 PM GMT

Hunt hints general election could be held in October

Jeremy Hunt has hinted the general election could be held in October, writes our politics live blog editor Jack Maidment.

The Chancellor told the Economic Affairs Committee this afternoon:

No governments decide a spending review this far ahead of when that spending review is happening.

This particular spending review has to be complete before next April when the next financial year starts.

And of course if the general election is in October that will mean it is very, very tight and that is why we are thinking in advance about the most important element of that spending review which is the productivity element…

03:29 PM GMT

Hunt says more defence spending should increase as ‘world getting more dangerous’

The Government will need to spend more money on defence, the Chancellor has said, because “the world getting more dangerous”.

Jeremy Hunt told a Lords committee:

I think we will need to increase defence spending. We’ve committed to increasing it to 2.5pc [of GDP] as soon as its affordable.

03:15 PM GMT

Harvey Nichols plans head office cull

Harvey Nichols has launched a major shake-up of its operations, with plans to cut around 60 head office jobs.

The group, which is owned by Hong-Kong based Sir Dickson Poon, said it will seek to offer affected workers roles in other parts of the business.

Pearson Poon, Harvey Nichols’ vice chairman, said:

We are taking action to simplify and strengthen our business by optimising our cost structure to operate more efficiently across our support team.

Coming out of Covid has been very difficult for the wider retail industry in the UK, which faced increased inflation, cost pressures, and the loss of tax-free shopping.

On Tuesday, the luxury firm also confirmed it saw higher sales over the previous financial year and cut its losses.

Accounts for the year to April 1 2023, which are due to be published soon, are set to show revenues grew by 13pc to £216.6 million as it continues its recovery following the impact of the pandemic and cost-of-living pressures.

It also recorded a pre-tax loss of £21.3m for the year, down from £30.4m a year earlier.

03:07 PM GMT

Jeremy Hunt says tax cuts require ‘productivity revolution’ in public sector

Tax cuts require a “productivity revolution in the way public services are delivered”, the Chancellor has said.

Jeremy Hunt told peers at the House of Lords Economic Affairs committee that he doesn’t believe “the increases in the tax burden should become irreversable”.

Mr Hunt pointed out that the Government “did reduce spending in real terms in 2010 by 2.1pc a year [and in 2014] by 0.7pc a year.” But he said that the Government can only do that sustainably and meet public expectations of services “if you have a productivity revolution in the way public services are delivered”.

He added that “countries that grow the fastest tend to have lower tax burdens”.

02:51 PM GMT

Shrinkflation happens because of an ‘obsession’ with low prices, says food industry

Shrinkflation is a “natural” part of keeping prices low because “we have an obsession with low prices”, the head of a food trade body has said.

Rod Addy, director general of the Provision Trade Federation, told the Commons Environment, Food and Rural Affairs committee today that “at times” it could border on “misleading” and that it would be better to focus on the proper “value of food”.

Meanwhile, Peter Dawson of Dairy UK told MPs that shrinkflation “may have helped cushion” shoppers from high prices and that it may have “protect long term demand”.

02:35 PM GMT

Lidl also loses at Court of Appeal

Lidl had also brought an appeal against the High Court judge’s findings, after Mrs Justice Smith ruled that Lidl’s trademark registrations in 2002, 2005 and 2007 were applied for in bad faith.

Tesco had previously alleged that “some of the Lidl trademarks” were liable to be declared invalid on the grounds that they were “registered in bad faith”, or “should be revoked for non-use and/or that they have no distinctive character”.

Lidl’s appeal against this decision was dismissed in today’s judgment.

A Lidl spokesman said:

Last year, the High Court ruled that Tesco’s Clubcard logo was copied from ours and infringed our trademark rights, allowing them to unfairly benefit from our longstanding reputation for value while misleading its customers.

Despite this, Tesco prolonged the dispute by appealing, deceiving customers for another year.

Therefore, we are delighted to see that the Court of Appeal has now agreed with the High Court that Tesco’s use of its Clubcard logo is unlawful.

We expect Tesco now to respect the Court’s decision and change its Clubcard logo to one that is not designed to look like ours.

02:13 PM GMT

Tesco ‘disappointed’ with Court of Appeal ruling

After losing its case at the Court of Appeal, a Tesco spokesman said:

Our customers always tell us just how important Clubcard Prices are to giving them great value – and it’s been a key reason why we’re consistently the cheapest full-line grocer.

We are disappointed with the judgment relating to the colour and shape of the Clubcard Prices logo but would like to reassure customers that it will in no way impact our Clubcard Prices program.

Clubcard Prices, irrespective of its logo, will continue to play a central role in rewarding our Clubcard members with thousands of deals every week.

02:01 PM GMT

Ted Baker owner plunges into administration

The US owner of Ted Baker said it plans to appoint administrators for the fashion retailer, putting hundreds of jobs at risk.

Authentic Brands Group (ABG), which bought retailer Ted Baker in 2022, blamed “damage done” to the fashion brand during the time Dutch company AARC had been running its stores and e-commerce business in Europe - a tie-up that ended in January.

Authentic Brands said Ted Baker stores and the retailer’s website would continue to trade.

John McNamara, chief strategy and transition officer for Authentic Brands Group, said: “We wish that there could have been a better outcome for the Ted Baker employees and stakeholders.

“We remain focused on securing a new partner to uphold and grow the Ted Baker brand in the UK and Europe where it began.”

01:53 PM GMT

I avoid flying Boeing because I value my life, says French finance minister

France’s finance minister has said he hesitates to fly with Boeing because he values his life, months after the mid-air blowout on an Alaska Airlines flight which rocked the plane manufacturer.

Bruno Le Maire drew laughter and applause from a conference audience as he said he preferred “the situation of Airbus to Boeing’s”.

The French government is the biggest single shareholder in Airbus, the arch rival of the troubled US plane maker, with a .

Mr Le Maire told the Europe 2024 conference in Berlin: “I now prefer flying in Airbus over Boeing — my family too, they care about me.”

Boeing has been in crisis since after a refrigerator-sized hole opened up in a plane mid-flight in January.

The blowout was linked to loose bolts and led the Federal Aviation Administration (FAA) to ground all Boeing 737 Max 9 planes with a door plug.

01:41 PM GMT

Wall Street slumps ahead of interest rate decision

The benchmark S&P 500 and the tech-heavy Nasdaq opened lower as investors shifted their attention to the Federal Reserve’s two-day meeting with focus on economic and interest rate projections by the US central bankers.

The S&P 500 opened lower by 10.33 points, or 0.2pc, at 5,139.09, while the Nasdaq Composite dropped 71.52 points, or 0.4pc, to 16,031.93 at the opening bell.

The Dow Jones Industrial Average rose 29.18 points, or 0.1pc, at the open to 38,819.61.

01:08 PM GMT

UAE-backed Telegraph takeover potentially against public interest, Ofcom warns Culture Secretary

A UAE-backed takeover of the Telegraph would potentially be against the public interest, Ofcom has warned the Culture Secretary.

Our deputy political editor Daniel Martin has the latest:

Lucy Frazer told MPs that she is “minded to” refer the deal for an in-depth investigation by the Competition and Markets Authority (CMA) over its potential threat to press freedom.

She said in a written ministerial statement that the parties, including the UAE-backed bidder RedBird IMI, would have 10 working days to respond to her proposal.

The process is running in parallel to plans for new laws to ban foreign state ownership of British newspapers which could effectively short-circuit the CMA’s investigation.

Ms Frazer’s latest intervention nevertheless represents a further sign of official opposition to RedBird IMI’s bid, which media analysts already believed was effectively dead.

12:48 PM GMT

Andrew Bailey ‘already too late’ on rate cuts, says Citi

The Bank of England has already “left it too late” to start cutting interest rates, a leading US investment bank has warned.

Our deputy economics editor Tim Wallace has the details:

Economists at Citi said they expect Governor Andrew Bailey to make a “screeching reversal” as it becomes clear to officials that they have kept rates too high for too long.

“The Monetary Policy Committee has in all likelihood already left it too late,” said Benjamin Nabarro, chief UK economist at Citi. “Evidence for a tough ‘last mile’ on inflation feels limited.”

Estimates from Citi indicate that interest rates are as much as two percentage points too high for current economic conditions, particularly given the impact of falling inflation.

Read why Mr Nabarro said thinks holding rates risks doing more harm than good.

12:18 PM GMT

Majestic Wines in talks to buy Vagabond

Majestic Wine is in talks to buy to troubled bar chain Vagabond and could announce a deal within days.

The specialist wine retailer would add about a dozen wine bars to its business if it confirms a takeover, first reported by Sky News.

Vagabond was launched in Fulham, southwest London, by Stephen Finch in 2010 but filed a notice of its intention to appoint administrators earlier this month.

A Majestic spokesman said:

Majestic can confirm that it is exploring a deal to purchase all or part of the Vagabond Wines business. Majestic cannot comment further on ongoing discussions but we are hopeful of securing a deal.

Since our acquisition by Fortress Investment Group in 2019, we have invested heavily in our growth plan, opening 16 new shops; hiring many new colleagues; supplying thousands of premium hospitality businesses through our B2B division; and training thousands of colleagues as one of the biggest wine educators in Europe.

11:58 AM GMT

Tesco loses appeal over Clubcard logo

Tesco has lost an appeal at the High Court against a ruling that its Clubcard logo infringed on the trademark of rival supermarket Lidl.

Lidl sued Tesco in 2020 shortly after Tesco adopted a yellow circle against a blue background to promote its “Clubcard Prices” discount scheme.

The two retailers traded allegations of copying brands and deceiving customers at a trial last year.

A judge at London’s High Court ruled Tesco took “unfair advantage” of the reputation for low prices held by Lidl’s trademarks.

The Court of Appeal today dismissed Tesco’s appeal against the ruling that it infringed Lidl’s trademark.

11:45 AM GMT

US markets poised to open lower as AI excitement cools

Wall Street’s main stock indexes were lower in premarket trading as investors refrained from making big bets ahead of the start of the Federal Reserve’s March policy meeting.

All three major stock indexes finished higher in the previous session, with the Nasdaq bouncing back from two successive small weekly losses as growth stocks such as Alphabet and Tesla boosted the tech-heavy index.

However, investor darling Nvidia weakened 1.2pc after the company unveiled the Blackwell B200, an AI chip it says is up to 30 times faster than its previous chip. Some investors suggested the news was priced into the high-flying stock.

Fellow chipmaker AMD dipped 2.5pc, while semiconductor firms such as Marvell Technology, Intel and Broadcom also fell between 0.3pc and 2.8pc.

In premarket trading, the Dow Jones Industrial Average was down 0.3pc, the S&P 500 fell 0.5pc and the Nasdaq 100 dropped 0.6pc.

11:13 AM GMT

Pound falls ahead of interest rate decision

The pound has slipped against the dollar and the euro but jumped against the yen after the Bank of Japan’s decision to ditch negative interest rates after eight years.

Sterling was last down 0.4pc against the greenback at $1.26, while the euro rose 0.1pc against sterling to 85p.

Against the yen, sterling rose 0.6pc towards 191, just shy of late February’s eight and a half year high of 191.32.

The Bank of Japan delivered its first rate rise in 17 years today in a decision which was widely expected and still leaves interest rates around zero, meaning other higher-yielding currencies such as the pound retain their allure.

The pound has risen by nearly 18pc against the yen in the last year, well ahead of the 15pc gain in the euro against the Japanese currency, or even the 10pc rise in the New Zealand dollar, which has the highest interest rates within the G10 group of major currencies.

The Bank of England will deliver its next decision on interest rates on Thursday. It is not expected to make any change to borrowing costs, but investors will scour the statement from policymakers for any indication of when monetary policy might change.

11:00 AM GMT

Bentley delays launch of first electric car

Bentley has pushed back the launch of its first electric car as it anticipates greater demand for hybrid models from consumers.

The luxury car maker said it would introduce its first battery-electric vehicle towards the end of 2026 rather than next year, as previously planned.

The company also delayed by another year the launch of its full range of fully electric models, which originally was expected to roll out by 2030.

Instead, Bentley will refresh its Continental GT and Flying Spur ranges in the second half of this year, launching four plug-in hybrid models.

Bentley chairman and chief executive Adrian Hallmark said: “There’s no question that BEVs are the way that we’ll all head in the midterm.

“But also, what we’re seeing is an uptick in the acceptance and the demand for hybrids.”

It comes as Bentley delivered 13,560 cars in 2023, its third highest retail figure in history.

Revenues hit €2.9bn (£2.5bn) as operating profits reached €589m (£504m) with return on sales of 20.1pc.

10:46 AM GMT

Staveley arrives for bankruptcy case at High Court

Newcaster United co-owner Amanda Staveley has arrived at the High Court for a bankruptcy hearing over an alleged unpaid debt of over £36m.

Ms Staveley, who headed the Saudi-backed consortium that took over the football club in 2021, has asked the Insolvency and Companies Court to set aside a demand served by Greek businessman Victor Restis in May last year.

10:31 AM GMT

Crest Nicholson expects to build fewer homes

Crest Nicholson has warned it may build 11pc fewer houses this financial year and revealed a hit of up to £15m from defects on past developments.

The building giant said it expects to deliver 1,800 to 2,000 house completions in the year to the end of October, down from 2,020 in 2022 to 2023.

It said this reflected the “opening order book and the low level of reservations in the first two months of the financial year”.

The group said its weekly sales rate per outlet had improved in the eight weeks to March 15, having been under pressure in the run-up to Christmas.

It said build activity across the sector had remained at a lower level, but that this was seeing labour costs ease back.

“Overall build cost inflation has largely stabilised and at a level lower than prior year,” it added.

Crest also flagged a hit of up to £15m after discovering “certain build defects” largely on four sites that were completed before 2019, when the group closed its regeneration and London divisions.

Shares have slumped 8.2pc to make the company the worst performer on the FTSE 250 today.

10:07 AM GMT

Robinhood takes aim at the Bank of England

Robin Hood stole from the rich to give to the poor and the bosses at the trading platform named after the legendary outlaw wasted no time in capitalising on their opportunity for some imagery as they launched in the UK.

A nine-foot statue has been placed outside the Bank of England in London’s financial district to mark investing app Robinhood becoming available in Britain.

The app captured the imagination of investors as a driving force in the so-called memestock craze, in which groups on social media coordinated buying to boost share prices of stocks targeted by short sellers.

It adds competition to domestic rivals such as Freetrade and Lightyear, as well as traditional retail stock broking companies, such as Hargreaves Lansdown.

09:51 AM GMT

Close Brothers to raise as much as £400m ahead of car loan investigation

Close Brothers has said it plans to bolster its balance sheet in a “prudent” step amid a review into into potentially mis-sold car loans.

The FTSE 250 merchant bank said it had identified ways to improve its capital position by as much as £400m by the end of the 2025 financial year.

The lender had already announced it was scrapping its dividend payment this year after the Financial Conduct Authority launched an investigation into whether banks knowingly ripped off customers through mis-sold motor finance.

Last month, Lloyds Banking Group has set aside £450m to cover potential compensation claims from the mis-selling of car finance, in a brewing scandal which has drawn comparisons with the PPI crisis.

Close Brothers shares jumped as much as 17pc in their biggest intraday gain since 2009.

09:31 AM GMT

UAE ownership of Man City totally different to Telegraph, says minister

Culture Secretary Lucy Frazer rejected suggestions of a “double standard” in the Government accepting the ownership of Manchester City Football Club by an Emirati royal but opposing the Gulf state-backed Telegraph takeover.

She said it is important to “draw a distinction” between investment in sport and a government-linked acquisition of a newspaper, saying the latter is “inappropriate”.

Appearing on the morning broadcast round, Ms Frazer was asked whether there is a “double standard” in the UK Government giving a “tick” to Sheikh Mansour bin Zayed bin Sultan Al Nahyan, an Emirati royal, owning Manchester City, but attempting to block the UAE-backed Telegraph sale.

She told ITV’s Good Morning Britain:

I don’t think there is... We believe in this country in the free press. The media’s job is to hold power to account and it’s therefore inappropriate for the UK Government to own a newspaper, and it’s therefore also inappropriate for a foreign state to own a newspaper.

But we are very much open for business in terms of foreign investment in other spheres, like football.

She added: “They’re totally different.”

09:25 AM GMT

AstraZeneca pushes further into cancer treatments with £1.9bn takeover

AstraZeneca has agreed to buy US biopharma company Fusion for up to $2.4bn (£1.9bn), in the group’s latest expansion into cancer treatments.

The company said the deal would help it deliver “on its ambition to transform cancer treatment and outcomes for patients by replacing traditional regimens like chemotherapy and radiotherapy with more targeted treatments”.

Fusion Pharmaceuticals is a clinical stage company developing next-generation radioconjugates.

The medicines help deliver radioactive isotopes directly to cancer cells in a targeted way that minimises damage to healthy cells.

AstraZeneca shares fell as much as 1.1pc after announcing the $21 a share deal, which represents a 126pc premium on Fusion’s closing price on Monday.

09:00 AM GMT

Unilever props up FTSE 100 ahead of interest rate decision

The FTSE 100 was propped up by Unilever after it announced plans to spin out its ice cream business.

The blue-chip index was flat amid caution ahead of inflation figures and Federal Reserve’s interest rate decision on Wednesday.

The FTSE 100 was cushioned from a fall by a 5.3pc gain in Unilever as the consumer goods group plans to spin off its ice cream unit into a standalone business and announced a new cost-savings programme that would impact 7,500 jobs.

Personal care stocks rose by as much as 2.9pc.

The Bank of England is expected on Thursday to keep interest rates at 16-year highs of 5.25pc, although the focus will be on the timing of the first rate cut.

The mid cap FTSE 250 was down 0.1pc, led by a 5.6pc fall in Crest Nicholson after the homebuilder said it could build up to 11pc fewer homes in this financial year amid persistent tough conditions in the housing market.

08:45 AM GMT

Gas prices surge 20pc as cold snap hits Europe

Wholesale gas prices have surged higher as colder temperatures hit Europe and amid the ongoing risks to supply in the Middle East.

Europe’s benchmark contract has powered higher by 20pc over the last five days in its longest rally since September. The UK equivalent has risen about 16pc over the same period.

Before then, prices had dropped by about a fifth since the start of the year after a mild winter meant the Continent ended the season with stockpiles still high.

Storage sites had already been filled to record levels in an effort to avoid the kind of supply shock caused after Russia’s invasion of Ukraine.

However, prices have moved higher in recent days amid the ongoing war in the Middle East, disruption to shipping in the Red Sea and amid outages at some suppliers.

Meanwhile, Europe has been hit by a cold spell which has also boosted demand.

Temperatures dropped as low as minus 1C in Berlin and Copenhagen on Monday.

08:27 AM GMT

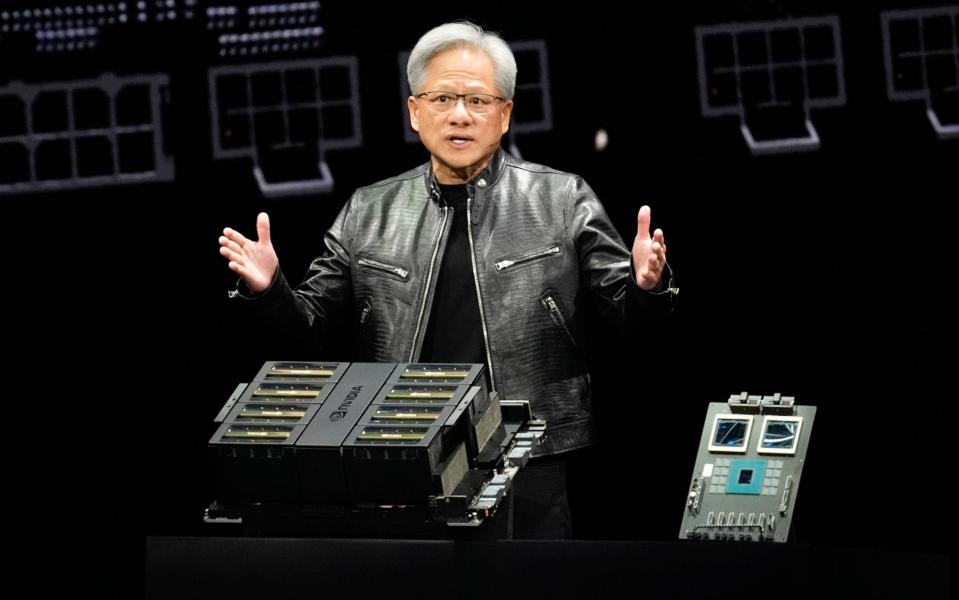

Nvidia launches superchip to extend AI market dominance

Semiconductor powerhouse Nvidia has unveiled a flagship new AI chip saying it is up to 30 times speedier than its previous chip.

Chief executive Jensen Huang kicked off the company’s annual developer conference by also launching a new set of software tools designed to help developers sell their artificial-intelligence models more easily to any company that uses Nvidia.

Its new chip, named the Blackwell B200, takes two chips the size of Nvidia’s previous offering and binds them together into a single chip.

Nvidia’s chip and software announcements at GTC 2024 will help determine whether the company can maintain its leadership position as the dominant seller of AI equipment.

Nvidia had a roughly 80pc share of the data centre AI chip market last year.

08:20 AM GMT

Independent artists generate record £3.5bn on Spotify

Independent artists and labels have experienced a record year on Spotify as streaming puts the “power back into the hands of fans and listeners”, according to a report.

DIY artists and artists signed to independent record labels generated nearly $4.5bn (£3.5bn) on the music streaming platform in 2023, figures in Spotify’s annual report, Loud And Clear, have shown.

The streamer said this marks the first year independents accounted for around half of what the entire industry generated on Spotify, which totalled $9bn (£7.1bn) last year.

International artists have also benefited from music from further afield being more easily available to listeners across the world.

Spotify has said that of the 66,000 artists who generated at least $10,000 (£7,855) on the platform in 2023, more than half were from countries where English is not the first language.

It comes as there has been a surge in popularity for K-pop bands such as Blackpink and BTS as well as Latin music continuing to establish itself as a major player with Puerto Rican rapper Bad Bunny’s album Un Verano Sin Ti being the most streamed album globally on Spotify in 2023, knocking pop superstar Taylor Swift’s Midnights down to second place.

08:07 AM GMT

Unilever spinning out ice cream ‘not a huge shock,’ say analysts

Unilever’s ice cream business had “always looked like the odd one out” compared to its other consumer brands, according to analysts, who said the FTSE 100 company’s plan would be welcomed by shareholders.

Matt Britzman, equity analyst at Hargreaves Lansdown, said:

Action is what shareholders wanted to see from the new team at the top, and that’s what’s been delivered today.

Ice cream always looked like the odd one out when you compare it to other product lines, and performance has struggled of late.

It’s not a huge shock to see this move, but it’s something prior management wasn’t able to deliver.

Unilever’s not an overly expensive name at the minute so expect markets to react positively to the news, perhaps more due to the decisive action than anything else.

Unilever’s shares have risen 5.8pc at the start of trading.

08:06 AM GMT

UK markets mixed as Japan ends negative rates

Stock markets in London lacked direction after the Bank of Japan took the historic step of ending its long-running policy of negative interest rates.

The FTSE 100 has opened 0.1pc higher at 7,728.50 while the midcap FTSE 250 fell 0.1pc to 19,470.01.

07:59 AM GMT

Unilever plans to list ice cream business

Unilever said it plans to list its ice cream business by the end of next year under its overhaul which has put 7,500 jobs at risk.

It said:

A demerger of ice cream is the most likely separation route, and in that case we expect the company to operate with a capital structure in line with comparable listed companies.

Other options for separation will be considered to maximise returns for shareholders.

It added: “Separation activity will begin immediately, with full separation expected by the end of 2025.”

07:56 AM GMT

DFS issues profit warning as consumers cut back on big purchases

Furniture retailer DFS warned that its profits will be £10m lower than expected this year as cost-conscious consumers held back.

The group cautioned that continued disruption from shipment delays through the Red Sea could mean a further £4m in profit is pushed back until the next financial year.

The company said sales this financial year will be up to £65m below previous expectations after demand “weakened significantly” over the past two months.

The sofa specialist said order volumes dropped 16pc year-on-year across January and February as a result.

Tim Stacey, group chief executive, said:

I want to thank our colleagues for their dedication toward providing a first class service to our customers.

Whilst the current macroeconomic situation has presented many challenges, we are pleased to have extended our market leadership while reporting a resilient profit performance through the first half.

07:44 AM GMT

Unilever job cuts expected over next two years

Unilever, which has 128,000 employees globally, including 6,000 in the UK, said the job cuts will predominantly affect office-based roles around the world.

Bosses said staff will be consulted about the cuts, which are expected to happen over the next two years.

Chief executive Hein Schumacher said:

Under the growth action plan we have committed to do fewer things, better, and with greater impact.

The changes we are announcing today will help us accelerate that plan, focusing our business and our resources on global or scalable brands where we can apply our leading innovation, technology and go-to-market capabilities across complementary operating models.

Simplifying our portfolio and driving greater productivity will allow us to further unlock the potential of this business, supporting our ambition to position Unilever as a world-leading consumer goods company delivering strong, sustainable growth and enhanced profitability.

We are committed to carrying out our productivity programme in consultation with employee representatives, and with respect and care for those of our people who are impacted.

07:27 AM GMT

Magnum maker warns of up to 7,500 job cuts

Unilever has warned that up to 7,500 jobs are at risk as the Magnum maker outlined plans to split off its ice cream unit as a separate business.

The sprawling FTSE 100 consumer goods giant makes dozens of household brands from Ben & Jerry’s and Magnum ice cream to Dove soap.

It said it was accelerating its “Growth Action Plan” which will make it a “simpler, more focused company”.

Under the overhaul, which is expected to save €800m (£684m) over the next three years, it will separate its ice cream businesses and divide the rest of Unilever into four divisions: Beauty & Wellbeing, Personal Care, Home Care and Nutrition.

07:10 AM GMT

Japan ends world’s last negative interest rate policy

The Bank of Japan has ended the world’s last negative interest rate policy as it raised borrowing costs for the first time in 17 years.

The short-term rate was raised to a range of zero to 0.1pc from minus 0.1pc in a widely-expected move.

It is the first rate increase since February 2007 after the Bank said that the negative interest rate policy, combined with other measures to inject money into the economy and keep borrowing costs low, “have fulfilled their roles”.

The shift makes Japan the last central bank to exit negative rates and ends an era in which policymakers around the world sought to prop up growth using cheap money and unconventional monetary tools.

Negative interest rates effectively charged banks to keep their money at the Bank of Japan and the hope was banks would loan out their capital instead, boosting economic activity.

The rate rise comes as inflation headed towards the Bank of Japan’s 2pc target in recent months.

The shift was also influenced by Japanese companies announcing relatively robust wage increases for this year’s round of negotiations with trade unions.

Wages and profits at companies were improving, the Bank of Japan said, in releasing its latest decision, referring to “anecdotal” accounts as well as data it had gathered lately.

“Japan’s economy has recovered moderately,” it said.

Following the decision, Tokyo’s benchmark Nikkei 225 index gained 0.7pc, while the Japanese yen fell 0.3pc to 149.66 per dollar.

The last time the BoJ raised interest rates was in 2007, but its war against deflation began in earnest in 2013 under then-prime minister Shinzo Abe.

“Abenomics” combined generous government spending and central bank monetary easing.

The BoJ spent vast amounts on bonds and other assets to pump liquidity into the system, targeting inflation of two percent that policymakers hoped would fuel growth.

It was “an extremely ambitious goal” and it did not work right away, said Kazuo Momma, an economist at Mizuho Research and Technologies.

He told AFP: “Having failed to achieve the target within a committed two-year period, the BoJ had no other choice than to pursue further stimulative measures including the negative interest rate.”

Frederic Neumann, chief Asia economist at HSBC, said:

The BOJ took its first, tentative step towards policy normalization. The big question is what happens next.

Likely, the BOJ will find that it is getting ‘stuck at zero’, being unable to lift short-term interest rates meaningfully further in the coming quarters.

06:54 AM GMT

Good morning

Thanks for joining me. The Bank of Japan has ended eight years of negative interest rates, making a historic shift away from a focus of reflating growth with decades of massive monetary stimulus.

The move was Japan’s first interest rate hike in 17 years but still keeps rates stuck around zero.

5 things to start your day

1) Britain’s energy system will not hit net zero until 2035, National Grid tells Labour | Accelerated timeline for a carbon neutral grid would weigh more heavily on bill payers

2) Mike Lynch masterminded ‘multiyear, multilayered fraud’, court hears | Tech entrepreneur accused of spinning ‘fabulous tale’ to lure HP into $11bn Autonomy deal

3) Heathrow has lost its status as a global transport hub, says Dubai Airports boss | Former Gatwick chief says the West places too much emphasis on environmental concerns

4) Electric lorry maker backed by David Beckham collapses into administration | Troubled Lunaz Group blames Sunak’s decision to delay ban on petrol car sales

5) Encyclopedia Britannica plots $1bn stock market listing | Move to go public would mark a watershed moment for the 250-year-old publisher

What happened overnight

Shares were mixed in Asia after the Bank of Japan hiked its benchmark interest rate for the first time in 17 years, ending a longstanding negative rate policy.

In a widely anticipated move, the Bank raised its overnight call rate to a range of 0 to 0.1pc, up from minus 0.1pc.

It said that wage increases and other indicators suggested that inflation had stabilized above the Bank of Japan’s 2pc target, but noted “extremely high uncertainties,” including weakness in industrial production, exports, housing investment and government spending.

Market reaction was muted.

Tokyo’s benchmark Nikkei 225 index closed higher by 0.7pc, or 263.16 points, to end at 40,003.60, while the broader Topix index climbed 1.1pc, or 28.98 points, to 2,750.97.

Chinese markets declined. Hong Kong’s Hang Seng index lost 1.2pc to 16,543.08 while the Shanghai Composite index dropped 0.4pc to 3,073.93.

In Seoul, the Kospi fell 1.1pc to 2,656.26.

Australia’s S&P/ASX 200 added 0.4pc to 7,706.80 after Australia’s central bank kept its benchmark interest rate steady at 4.4pc for a third consecutive meeting. The widely expected decision reflected the fact that inflation is cooling but still above the Reserve Bank of Australia’s target.

US stocks rose on Monday, with the S&P 500 adding 0.6pc, to 5,149.42. The Dow Jones Industrial Average rose 0.2pc to 38,790.43 and the Nasdaq Composite index rose 0.8pc to 16,103.45.

In the bond market, the yield on benchmark 10-year US Treasury bonds rose to 4.33pc from 4.31pc late on Friday.

Yahoo Finance

Yahoo Finance