Tenneco (TEN) Beats on Q3 Earnings & Sales, Cuts '21 Guidance

Tenneco TEN reported third-quarter 2021 adjusted earnings of 17 cents per share, which topped the Zacks Consensus Estimate of 15 cents. The outperformance stemmed from higher-than-expected EBITDA from the Clean Air, Performance Solutions, and Powertrain segments. The bottom line, however, compared unfavorably with the year-ago figure of 33 cents a share. Revenues of $4,332 million topped the Zacks Consensus Estimate of $3,995 million and improved around 2% year over year.

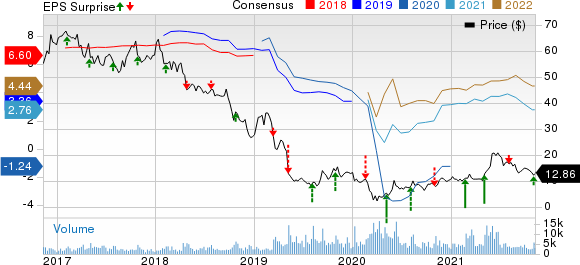

Tenneco Inc. Price, Consensus and EPS Surprise

Tenneco Inc. price-consensus-eps-surprise-chart | Tenneco Inc. Quote

Segmental Performance

In the reported quarter, the Clean Air division’s revenues summed $1,936 million, higher than the year-ago figure of $1,919 million. The figure also surpassed the Zacks Consensus Estimate of $1,759 million. Adjusted EBITDA totaled $137 million in the quarter, down from $149 million. The metric, however, topped the consensus estimate of $102 million.

Revenues in the Performance Solutions division amounted to $686 million, increasing from $679 million recorded in the year-earlier period and surpassing the consensus mark of $593 million. Adjusted EBITDA totaled $38 million in the September quarter, down from $55 million in the prior-year quarter. The reported EBITDA beat the consensus mark of $18.25 million.

The Powertrain division’s revenues amounted to $941 million in the third quarter, rising from $928 million in the year-earlier period and outpacing the consensus mark of $851 million. Adjusted EBITDA totaled $74 million, beating the consensus mark of $55 million but declining from of $101 million in the year-ago period.

The Motorparts division’s revenues were $769 million, up from the $730 million generated in third-quarter 2020. The figure, however, lagged the Zacks Consensus Estimate of $790 million. Adjusted EBITDA totaled $115 million in the quarter, down from $131 million. The metric, however, missed the consensus mark of $125 million.

Financials & Outlook

Tenneco had cash and cash equivalents of $589 million as of Sep 30, 2021, down from $798 million as of Dec 31, 2020. Long-term debt totaled $5,050 million, down from $5,171 million as of Dec 31, 2021. During the third quarter, the company’s net cash used by operating activities was $48 million compared with the year-earlier quarter’s $486 million.

The firm has trimmed 2021 outlook. Full-year revenues are now envisioned within $17.75-$17.85 billion, down from the prior outlook of $18.3-$18.6 billion. The company expects 2021 adjusted EBITDA in the band of $1.25-$1.28 billion, lower than the previous guidance of 1.36-$1.44 billion. Management anticipates net debt to be around $4.3 billion at the end of 2021, a little higher than the previous forecast of debt less than $4.2 billion.

Tenneco — which shares space with Magna International MGA, Meritor MTOR, and American Axle & Manufacturing AXL, currently carries a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Axle & Manufacturing Holdings, Inc. (AXL) : Free Stock Analysis Report

Tenneco Inc. (TEN) : Free Stock Analysis Report

Magna International Inc. (MGA) : Free Stock Analysis Report

Meritor, Inc. (MTOR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance