Tech Stocks' Q3 Earnings Lineup for Nov 13: SINA, SVMK, WIX

The technology sector continues to benefit from strong demand environment for digital transformation. Notably, cloud computing, predictive analysis, artificial intelligence (AI), self-driving vehicles, digital personal assistants and Internet of Things (IoT) have been key drivers in this regard.

Increasing use of the Internet, courtesy of the ubiquitous social media, has been a key driver for technology stocks. Naturally, focus on video streaming has been driving user engagement that is, in turn, attracting advertising dollars.

However, weakness in semiconductors primarily due to intensifying trade tensions, slowing demand from the automotive market and component supply shortage doesn’t bode well for the sector. Moreover, increasing regulations for social media companies like the implementation of EU’s General Data Protection Regulation is an overhang.

Let’s take a sneak peek into three tech companies that are set to report quarterly earnings on Nov 13:

Shanghai, China-based SINA Corporation SINA is expected to get negatively impacted by stricter regulations faced by its micro-blogging platform, Weibo in the domestic market. Moreover, intensifying competition within the online advertising business doesn’t bode well for this Zacks Rank #4 (Sell) stock.

The company is unlikely to deliver a positive earnings surprise in third-quarter 2018 as according to the Zacks model, only a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates, if it also has a positive Earnings ESP. Meanwhile, Sell-rated stocks (Zacks Rank #4 or 5) are best avoided.

The Zacks Consensus Estimate for third-quarter revenues is currently pegged at $561.5 million, reflecting year-over-year growth of 26.7%. However, the consensus mark for earnings has been steady at 76 cents over the past seven days and reflects 1.3% decline.

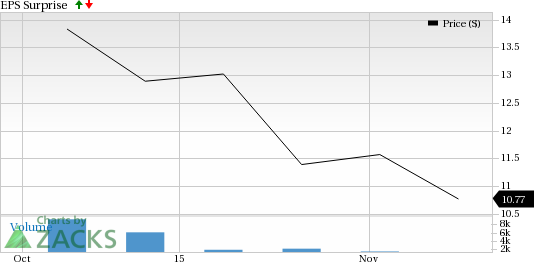

Sina Corporation Price and EPS Surprise

Sina Corporation Price and EPS Surprise | Sina Corporation Quote

Meanwhile, SVMK’s SVMK third-quarter 2018 results are expected to benefit from its growing registered user base and dominating position in the survey software products market.

However, the San Mateo-based company has an unfavorable combination of a Zacks Rank #3 and an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for third-quarter revenues is currently pegged at $62.7 million. The consensus mark has been steady at a loss of 5 cents over the past seven days.

SVMK Inc. Price and EPS Surprise

SVMK Inc. Price and EPS Surprise | SVMK Inc. Quote

Tel Aviv, Israel-based Wix.com WIX is expected to benefit from portfolio strength. Also, sturdy conversion and retention in its user cohorts are positives. Further, the company is benefiting from retail’s rapid transition to mobile and social sales channels.

However, Wix also has an unfavorable combination of an Earnings ESP of 0.00% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for third-quarter revenues is currently pegged at $69.4 million, reflecting year-over-year growth of 10.8%. Moreover, the consensus mark for earnings has been steady at 3 cents over the past seven days.

Wix.com Ltd. Price and EPS Surprise

Wix.com Ltd. Price and EPS Surprise | Wix.com Ltd. Quote

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sina Corporation (SINA) : Free Stock Analysis Report

Wix.com Ltd. (WIX) : Free Stock Analysis Report

SVMK Inc. (SVMK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance