Taylor Morrison Reports Record June Sales as Low Mortgage Rates Encourage Buying

Shrugging off the headwinds caused by the Covid-19 pandemic, Taylor Morrison Home Corp. (NYSE:TMHC) recorded its best month of sales in the company's history in June.

The combination of ultra-low mortgage rates, a shortage of existing homes for sale and high demand for new high-tech houses helped push the Scottsdale, Arizona-based homebuilder's net sales orders 94% higher year over year, setting a new record of 1,715. It also posted a record sales pace per community of 4.3.

In a statement, Chairman and CEO Sheryl Palmer praised the company's performance.

"To experience our best sales month in company history amid a pandemic, amid transitioning our business to a virtual environment seemingly overnight, and amid the economic and psychological impact on consumers speaks volumes to not only Taylor Morrison's resiliency, but our customers' resiliency, too," she said.

With the coronavirus shutting down most activity in April, buyer demand has been incredibly strong since mid-May. For the full quarter, Taylor Morrison said total closings came in at 3,212, an increase of 24% from the prior-year quarter. The sales pace for the three months ended June 30 was 2.8.

CNBC reported on July 8 that as home price gains continue to accelerate, low mortgage rates are giving buyers much-needed help. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of up to $510,400 fell to 3.26% from 3.29%. Points for loans with a 20% down payment, including the origination fee, decreased to 0.35 from 0.36.

Palmer partly attributed Taylor Morrison's success to new technology and online tools that allow customers to conduct self-guided tours.

"While nearly all of our sales offices are at some degree of open, we are still operating in a new, more virtual world," Palmer said. "Our customers and team members have adapted to more online options beautifully, and I believe that is fully reflected in our financial performance."

With a market cap of $2.81 billion, shares of Taylor Morrison were up over 14% on Wednesday morning at $21.65. GuruFocus data shows the stock is fairly flat year to date.

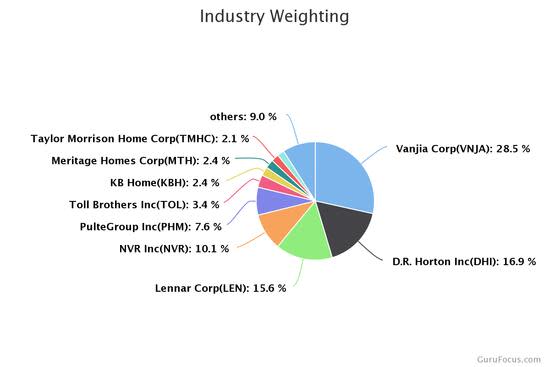

According to GuruFocus' Industry Overview, Taylor Morrison is the ninth-largest player in the homebuilding and construction sector. Other top players include Vanjia Corp. (VNJA), D.R. Horton Inc. (NYSE:DHI), Lennar Corp. (NYSE:LEN), NVR Inc. (NYSE:NVR) and PulteGroup Inc. (NYSE:PHM).

Disclosure: No positions.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance