Taylor Morrison Home Corp (TMHC) Surpasses Analyst Expectations in Q1 2024

Net Income: $190 million, slightly below the prior year's $191 million, falling short of estimates of $172.97 million.

Revenue: $1.70 billion, up 2.3% year-over-year, exceeding estimates of $1.64 billion.

Earnings Per Share (EPS): $1.75 per diluted share, surpassing the estimated $1.60.

Home Closings Revenue: Increased to $1.64 billion from $1.61 billion in the prior year, indicating a growth of 1.5%.

Home Closings Gross Margin: Improved to 24.0% from 23.9% year-over-year, reflecting a 10 basis points increase.

Net Sales Orders: Rose by 29% year-over-year, with a corresponding sales value increase of 25.4% to $2.24 billion.

Geographic Expansion: Entered the Indianapolis market with the acquisition of approximately 1,500 homebuilding lots, enhancing geographic diversification.

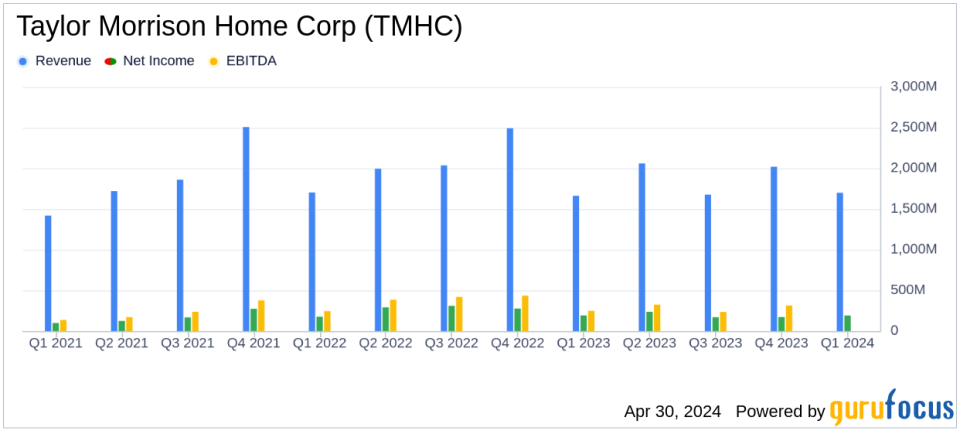

Taylor Morrison Home Corp (NYSE:TMHC) released its 8-K filing on April 30, 2024, revealing a robust performance for the first quarter ended March 31, 2024. The company reported a net income of $190 million, or $1.75 per diluted share, slightly under the previous year's $191 million, yet surpassing the current quarterly analyst estimate of $1.60 per share. Revenue also exceeded expectations, totaling $1,699.75 million against the forecasted $1,644.51 million.

Headquartered in Scottsdale, Arizona, Taylor Morrison is a top national developer and homebuilder. The company operates across four segments: East, Central, West, and Financial Services, with the majority of its revenue derived from the East segment. Taylor Morrison caters to a diverse consumer base, including entry-level, move-up, and resort lifestyle buyers, through a variety of brands such as Taylor Morrison, Esplanade, and Darling Homes Collection.

Operational Highlights and Future Outlook

The first quarter saw Taylor Morrison deliver 2,731 homes, achieving a home closings gross margin of 24.0%. This performance was bolstered by a 29% year-over-year increase in net sales orders and a monthly sales pace of 3.7 per community. CEO Sheryl Palmer highlighted the company's diversified strategy and efficient construction as key drivers behind these results. Looking ahead, Taylor Morrison has raised its full-year guidance, now expecting to deliver approximately 12,500 homes with a home closings gross margin between 23.5% to 24.0%.

Strategically, the company expanded its geographic footprint by acquiring approximately 1,500 homebuilding lots in Indianapolis, a move expected to contribute around 175 closings over the remaining year. This expansion is supported by Indianapolis's strong employment growth and affordability, aligning with Taylor Morrison's risk mitigation and growth strategy.

Financial Performance Analysis

For Q1 2024, the company reported total revenue of $1.7 billion, a 2.3% increase from the previous year, driven by a 1.5% rise in home closings revenue which amounted to $1.64 billion. The home closings gross margin saw a slight improvement, up 10 basis points to 24.0%. However, selling, general, and administrative expenses (SG&A) as a percentage of home closings revenue increased by 50 basis points to 10.4%, reflecting higher operational costs.

The balance sheet remains solid with cash and cash equivalents of $554.29 million. The company's total assets stood at $8.91 billion as of March 31, 2024, demonstrating a strong financial position to support ongoing operations and strategic initiatives.

Market and Industry Implications

Taylor Morrison's performance in Q1 2024 not only reflects its operational efficiency and strategic market positioning but also indicates a resilient housing market despite broader economic uncertainties. The company's focus on diversified consumer and geographic strategies, combined with its operational capabilities, positions it well for sustained growth and profitability. This performance is particularly noteworthy for investors considering the volatile economic environment and the competitive nature of the homebuilding industry.

The company's proactive management strategies and robust financial health are likely to continue to attract investor interest, particularly among those looking for stable returns in the real estate sector.

For further details, Taylor Morrison will host an earnings conference call, and stakeholders can access the webcast on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Taylor Morrison Home Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance