Tax Evasion: What Happens If You Don’t Report Your Taxes Accurately

As long as you earn an income from your business or employment in Singapore, you must file your income taxes, usually by 18 April.

While taxes are dreaded by businesses and individuals, they are one of the government’s key revenue sources. As an integral part of our fiscal policy, it helps with the financing of the government’s expenditures on nation-building.

Because of this, tax offences, especially tax evasion, are seen as serious crimes, akin to defrauding the state of revenue that was meant to pay for public services for society as a whole.

Here’s what businesses and self-employed persons need to know if you don’t report your business taxes accurately to the Inland Revenue Authority of Singapore (IRAS).

What Is Tax Evasion?

Tax evasion is when someone deliberately provides inaccurate or incomplete information about their activities to reduce their tax liability or obtain tax credits and refunds.

Some examples of tax evasion are failing to declare all assessable income, claiming deductions for expenses that were not incurred or are not legally deductible, claiming input tax on fictitious purchases, and omitting the output tax charged on local taxable supplies.

Tax Crimes Uncovered By IRAS Audit Programme

In the case of Khoo Chin Huat (“Khoo”) a sole proprietor of Sin Metal Industries (SMI), he was found guilty on 9 counts of making false entries in his Income Tax Returns and one count of failing to keep and retain tax invoices received by him for the business of SMI. He was charged with a total of 54 weeks’ imprisonment and fines and penalties totalling $1,784,451.

In another case, Tay Hai Choon (Roland Tay), founder of Direct Funeral Services, was charged with 3 counts of Personal Income Tax evasion totalling $427,427 and one count of failing to register for the Goods and Services Tax (GST), totalling $286,963 for his businesses.

Both cases were identified by IRAS’s regular audit programmes carried out across various industries to ensure tax compliance by individuals and businesses. IRAS is able to use data analytics and advanced statistical tools to verify tax reporting and detect anomalies.

Read Also: How Companies Can (Legally) Reduce Their Corporate Income Tax In Singapore

Consequences Of Tax Evasion Include Penalties, Fines, And Imprisonment

Any person found guilty of wilfully evading taxes or assisting any other person to evade taxes will face a penalty up to four times the amount of tax that has been undercharged or would have been undercharged as a result of the offence. It may also consist of a fine not exceeding $50,000 and/or imprisonment for a term not exceeding seven years.

Furthermore, the following tax offences are considered serious registrable crimes, such as cheating and robbery, and their details will be recorded in the criminal records:

Evading Income Tax, Goods & Services Tax and Stamp Duty;

Promoting abusive PIC arrangements

Improperly obtaining GST refunds from the Comptroller;

Not complying with notices to provide information to the Comptroller;

Providing false or misleading information to the Comptroller; and

Obstructing IRAS officers in carrying out their duties

Steps To Take When Filing Income Tax Returns

Here are some steps you can take to keep your business or yourself on the right side of the law.

#1 File Tax On Time And Make Voluntary Disclosures On Any Errors Made

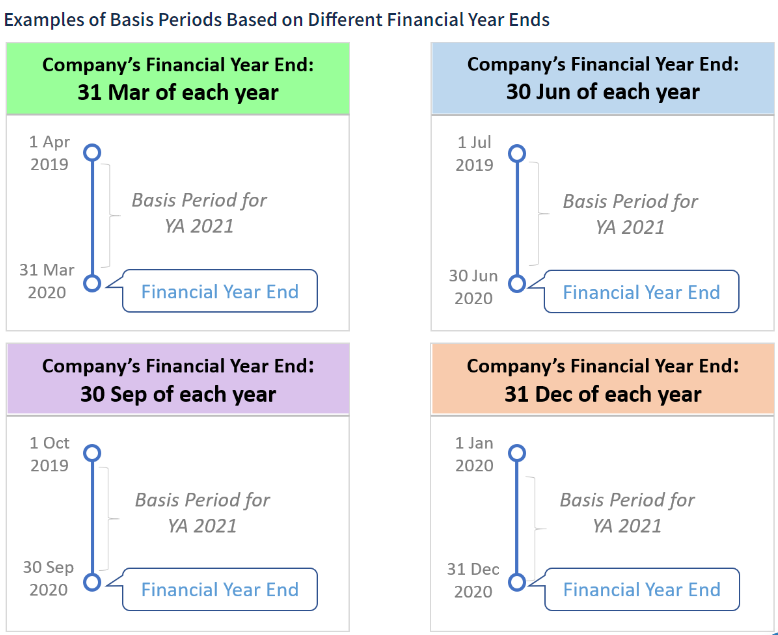

As a business owner or self-employed person, you need to decide on the accounting period when you start your company, as you will be taxed on the income earned in the preceding financial year. While your accounting period can end on any date, most businesses will choose December 31st each year.

Income tax returns must be filed on time, usually between the start of the year and 18 April. If you make any voluntary disclosure of errors within the 1-year grace period from the statutory filing deadline and if the qualifying conditions are met, no penalty will be imposed. Otherwise, you will face a reduced penalty of 5% of the undercharged income tax.

Read Also: Complete Guide To Filing Your Personal Income Tax In 2022

#2 Declare Income And Expenses Accurately

All businesses and self-employed persons must declare your taxable income such as gains from profits from your trade or business and income from investments that are accrued in or derived from Singapore.

You cannot claim for interest expense on non-income producing assets or investments that produce exempt dividends. Similarly, S-plated cars purchased for business use, including the associated running expenses, are also considered non-taxable expenses.

Also, for self-employed persons, you must report the income earned from your business operations as business income and not as a salary.

#3 Keep Proper Records

Businesses and self-employed persons need to have proper bookkeeping of all accounting and business records, source documents such as contracts, invoice payment vouchers, and receipts that substantiate your transactions, bank statements, and payment evidence from the start.

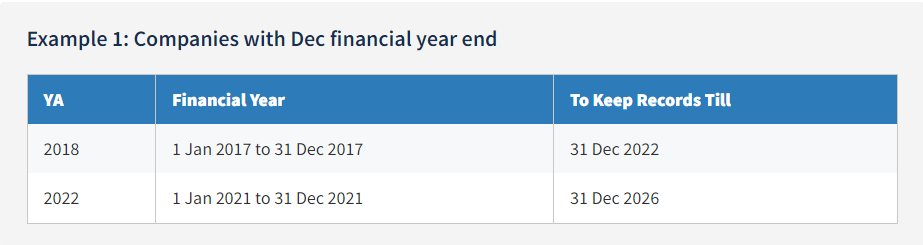

Under the Income Tax Act and the GST Act, you must maintain the records for at least five years from the relevant year of assessment (YA). You can refer to the record keeping guide by IRAS here: GST-registered businesses and non-GST-registered businesses.

Failure to maintain your business records may incur a fine of up to $5,000.

Cash Reward For Reporting Tax Evasion

If you are aware of or have information about someone who may have evaded tax in Singapore, you can report them to the IRAS using the reporting template.

If your information leads to the recovery of tax that would otherwise be lost, you may request a cash reward, which will be based on 15% of the tax recovered, capped at $100,000. You must state that you are requesting a reward and provide your full name, identity number, contact details, and relevant and specific information, along with supporting documents showing the tax evasion.

Read Also: Corporate Income Tax Filing YA2021: 6 Ways to Handle Your Company’s Tax Matters Effectively

The post Tax Evasion: What Happens If You Don’t Report Your Taxes Accurately appeared first on DollarsAndSense Business.

Yahoo Finance

Yahoo Finance