Target Hikes Dividend: 3 More Things That May Arouse Interest

Target Corporation TGT gave investors a reason to cheer by hiking its dividend payout. The board of directors raised the quarterly dividend by 3.2% to 64 cents a share to be paid on Sep 10, 2018. The dividend yield based on the new payout and the last closing market price is approximately 3.3%. Last year in June, Target increased regular quarterly dividend by 3.3% to 62 cents.

We believe that such hikes not only enhance shareholders’ value but raise the market value of the stock as well. In fact, through these dividend increases companies persuade investors to either buy or hold the scrip instead of selling it. People looking for regular income from stocks are most likely to choose companies that have a track record of consistent and incremental dividend payouts.

3 Other Things That May Raise Interest

Stock Ascends 25% in Six Months

Target’s growth strategies and sound fundamentals reinforce its position. Notably, shares of this Zacks Rank #3 (Hold) company have advanced 24.7% in the past six months compared with the industry’s growth of 12%. The stock has also comfortably outperformed the Retail-Wholesale sector and the S&P 500 index that advanced 13.4% and 3.7%, respectively. Further, the stock is hovering close to its 52-week high of $79.59.

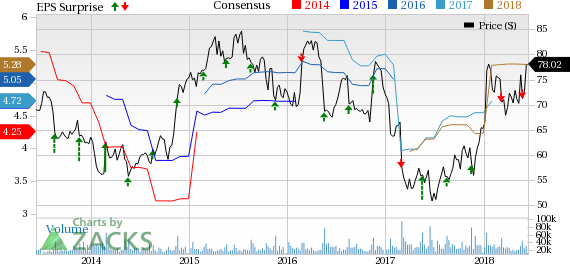

Target Corporation Price, Consensus and EPS Surprise

Target Corporation Price, Consensus and EPS Surprise | Target Corporation Quote

We see no reason why Target with a VGM Score of A and long-term earnings growth rate of 6% cannot breach that mark in the near term. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Same-Day Delivery

Retailers are ensuring a speedy delivery to customers. They are either acquiring or partnering with delivery service companies for same-day delivery to stay ahead in the race. In this respect, Target has chalked out strategies to take on Amazon AMZN and Walmart WMT in the fast-changing retail landscape. The company acquired Shipt to expand same-day delivery.

The company commenced same-day delivery service in the Chicago metro area through Shipt. This is in line with the company’s efforts to expand in the Midwest states of Illinois, Indiana, Michigan, Missouri, Ohio and Wisconsin for more than 55,000 groceries, essentials, home, electronics, toys and other products.

Target has for long been coming up with offers to drive customer count For those signing up for the same-day service prior to the launch, the company has announced an annual membership fee offer of $49 instead of the usual $99. Further, with the annual membership, customers can avail free delivery on orders above $35. Apart from this, customers will be credited $15 on a Target order of at least $100.

Restock Program & Other Initiatives

The company has rolled out Target Restock program that allows customers to restock their shipping box with essential items online and get them delivered at door steps by the next business day for a nominal charge. Drive Up, an app-based service, is another initiative to expedite the shopping process. The service allows customers to place orders using the Target app and have them delivered to their cars.

Target in the recently concluded first-quarter fiscal 2018 informed that it has introduced Drive-Up service in more than 250 stores and expanded Target Restock nationwide. Courtesy to Shipt, it also rolled out same-day delivery from more than 700 outlets. The company expect to add Drive-Up service in another 300 stores during the second quarter.

Wrapping Up

Target, which shares space with Costco COST, is deploying resources to enhance omni-channel capacities, coming up with new brands, remodeling or refurbishing stores, and expanding same-day delivery options. The company has undertaken rationalization of supply chain with same-day delivery of in-store purchases for a flat fee along with technology and process improvements.

The company remains on track to inject $7 billion of capital to merge digital and physical shopping, open small format stores and fulfillment centers, revamp stores and bring in new merchandise. The company continues to expect capital investments of roughly $3.5 billion during fiscal 2018. Analysts pointed that incremental investments may weigh on margins. However, it is better to face short-term impediments in order to attain the long-term goals. Target is trying all means to fast adapt to the altering retail environment.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Costco Wholesale Corporation (COST) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance