Syndax (SNDX) to Report Q4 Earnings: What's in the Cards?

We expect investors to focus on the updates related to Syndax Pharmaceuticals’ SNDX pipeline candidates when it reports fourth-quarter 2022 results.

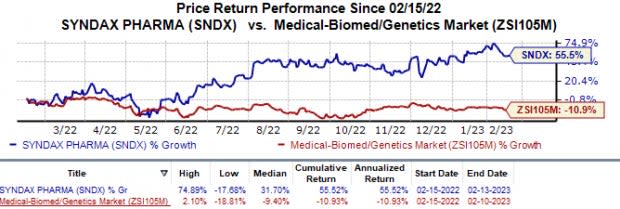

In the trailing 12 months period, shares of Syndax Pharmaceuticals have surged 55.5% against the industry’s 10.9% fall.

Image Source: Zacks Investment Research

Syndax Pharmaceuticals’ earnings surpassed expectations in three of the trailing four quarters, while meeting the mark on one occasion, witnessing an average surprise of 95.39%. In the last reported quarter, SNDX witnessed a negative earnings surprise of 10.77%.

Syndax Pharmaceuticals, Inc. Price and EPS Surprise

Syndax Pharmaceuticals, Inc. price-eps-surprise | Syndax Pharmaceuticals, Inc. Quote

Let’s see how things have shaped up for the quarter to be reported.

Factors to Consider

In the absence of an approved/marketed product in its portfolio, the focus of the fourth quarter earnings call will be on updates related to Syndax Pharmaceuticals’ pipeline candidates.

Syndax’s pipeline currently consists of two candidates – revumenib and axatilimab – being evaluated in clinical studies targeting cancer indications.

Syndax is evaluating revumenib in the pivotal phase I/II AUGMENT-101 study for the treatment of relapsed/refractory (R/R) acute leukemias. Last November, management announced positive data from the phase I portion of the AUGMENT-101 study evaluating revumenib in R/R acute leukemia patients with nucleophosmin (NPM1) or mixed lineage leukemia rearranged (MLLr) mutations. Data showed that 30% of study participants achieved complete remission (CR/CRh) at a median duration of CR/CRh response of 9.1 months. The study achieved an overall response rate (ORR) of 53%.

Syndax is currently conducting the phase II portion of the AUGMENT-101 study and top-line data from this portion is expected to be announced in the third quarter. Based on discussions with the FDA, the AUGMENT-101 study will serve as the basis for a new drug application (NDA) filing seeking approval for revumenib in R/R acute leukemia patients. The NDA filing is expected by year-end.

We expect SNDX to provide an update on the ongoing phase I AUGMENT-102 study which is evaluating the combination of revumenib and chemotherapy in R/R acute leukemia patients with NPM1 or MLLr mutations.

Syndax Pharmaceuticals is evaluating axatilimab, its anti-CSF-1R antibody, for treating patients with R/R chronic graft-versus-host disease (cGVHD) in the phase II AGAVE-201 study. The study is evaluating evaluating the safety and efficacy of three dosing regimens of axatilimab. Data from this study, expected by mid-2023, is expected to support a regulatory filing for axatilimab expected before year-end. The candidate is being developed in partnership with Incyte INCY.

Syndax and Incyte entered into an exclusive worldwide co-development and co-commercialization license agreement for axatilimab in September 2021. Per the terms of agreement, Incyte will lead global commercial activities for axatilimab across all indications.

Investors will also expect an update on a phase IIb study on axatilimab in idiopathic pulmonary fibrosis (IPF), which is expected to start in first-half 2023. Partner Incyte is also expected to start an early-stage study evaluating the combination of ruxolitinib and axatilimab in first-line cGVHD before the end of first-quarter 2023.

Earnings Whispers

Our proven model predicts an earnings beat for Syndax Pharmaceuticals this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Fortunately, that is the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: Syndax Pharmaceuticals has an Earnings ESP of 4.39% as the Most Accurate Estimate of a loss of 61 cents per share is narrower than the Zacks Consensus Estimate of a loss of 64 cents.

Zacks Rank: Syndax Pharmaceuticals currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are a few other stocks worth considering, as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Alkermes ALKS has an Earnings ESP of +49.57% and a Zacks Rank #2.

Alkermes’ stock has risen 18.8% in the past year. Earnings of Alkermes beat estimates in three of the last four quarters while meeting the mark on another. On average, Alkermes witnessed a trailing four-quarter positive earnings surprise of 306.73%, on average. In the last reported quarter, Alkermes’ earnings met estimates. Alkermes is scheduled to release its fourth-quarter 2022 results on Feb 16, before market open.

Allogene ALLO has an Earnings ESP of +25.70% and a Zacks Rank #2.

Allogene’s stock has declined 30.1% in the past year. Earnings of Allogene beat estimates in each of the last four quarters, witnessing a trailing four-quarter positive earnings surprise of 9.44%, on average. In the last reported quarter, Allogene’s earnings beat estimates by 6.45%.

Stay on top ofupcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance