Synchrony (SYF) to Post Q4 Earnings: What You Should Know

Synchrony Financial SYF is set to report its fourth-quarter 2022 results on Jan 23, before the opening bell.

The consumer financial services company reported adjusted earnings of $1.47 per share for the last quarter, beating the Zacks Consensus Estimate by 3.5% on the back of solid growth in purchase volume. It also gained significant contributions from all sales platforms. The results benefited from increased interest and fees on loans. However, the results were partially offset by steep expenses and decreased average active accounts.

Let’s see how things have shaped up before the fourth-quarter earnings announcement.

What Do the Estimates Say?

The Zacks Consensus Estimate for fourth-quarter earnings per share of $1.12 suggests a 24.3% decrease from the prior-year figure of $1.48. The consensus mark remained stable over the past week. The consensus estimate for fourth-quarter revenues of $4 billion indicates a 5.4% increase from the year-ago reported figure while our estimate suggests 2.6% year-over-year growth.

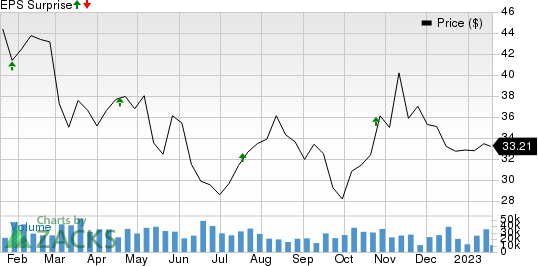

Synchrony beat the consensus estimate for earnings in all the prior four quarters, with the average being 7.3%. This is depicted in the graph below:

Synchrony Financial Price and EPS Surprise

Synchrony Financial price-eps-surprise | Synchrony Financial Quote

Factors to Note

Synchrony Financial is expected to have benefited from a better purchase volume in the fourth quarter as the economy is growing and people are spending more. Our estimate for total purchase volumes for the quarter under review indicates an improvement of 11.6% year over year.

SYF is expected to have consistently gained from digital sales volume in the to-be-reported quarter. Our estimate and the Zacks Consensus Estimate suggest that the average active accounts in the Home & Auto platform are expected to have risen 2.9% year over year in the fourth quarter.

The financial service provider is expected to have witnessed an increase in Average Interest-Earnings Assets. The consensus estimate indicates a 7.5% increase in the metric from the year-ago period while our estimate suggests a 6% jump. The Zacks Consensus Estimate for the efficiency ratio is pegged at 36.78%, suggesting a decline from the prior-year reported figure of 41.10%.

While the above-mentioned factors are likely to have benefited the company in the fourth quarter, some elements are likely to offset the positives, leading to an earnings miss and year-over-year decline. The company is expected to have incurred increased employee costs and information processing expenses in the fourth quarter.

Increased expenses are expected to have reduced the margins in the quarter under review. The Zacks Consensus Estimate for the net interest margin is pegged at 15.4%, down from 15.8% a year ago. The net charge-offs are also expected to have increased in the quarter in review.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Synchrony this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. That is not the case here, as you will see below.

Earnings ESP: The company’s Earnings ESP is -10.60%. This is because the Most Accurate Estimate currently stands at $1.00 per share, much lower than the Zacks Consensus Estimate of $1.12.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Synchrony currently carries a Zacks Rank #4 (Sell).

Stocks to Consider

While an earnings beat looks uncertain for Synchrony, here are some companies from the broader finance space that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this time around:

Axos Financial, Inc. AX has an Earnings ESP of +0.16% and is a Zacks #2 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Axos Financial’s bottom line for the to-be-reported quarter is pegged at $1.24 per share, implying a 19.2% improvement from the year-ago figure. AX beat earnings estimates in each of the past four quarters, with an average surprise of 6.6%.

Aon plc AON has an Earnings ESP of +1.52% and a Zacks Rank of 2.

The Zacks Consensus Estimate for AON’s bottom line for the to-be-reported quarter is pegged at $3.67 per share, which witnessed two upward estimate revisions in the past 30 days against one downward movement. AON beat earnings estimates in three of the past four quarters and missed once, with an average surprise of 2.8%.

The Hartford Financial Services Group, Inc. HIG has an Earnings ESP of +3.29% and a Zacks Rank of 3.

The Zacks Consensus Estimate for Hartford Financial’s bottom line for the to-be-reported quarter is pegged at $1.88 per share, which improved 2.2% in the past 60 days. AXP beat earnings estimates in each of the past four quarters, with an average surprise of 23.1%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Aon plc (AON) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

AXOS FINANCIAL, INC (AX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance