Swedish Growth Leaders With High Insider Ownership For May 2024

As of May 2024, the Swedish market is responding to a broader global economic context where various regions are showing mixed signals, with Sweden's central bank recently cutting rates amid inflation forecasts. This backdrop sets a crucial stage for evaluating growth companies in Sweden, particularly those with high insider ownership which can indicate strong confidence from those closest to the company's operations and future. In assessing such stocks, it’s beneficial to consider how well-positioned these companies are within the current economic environment. High insider ownership might suggest resilience and an intrinsic motivation among key stakeholders to navigate through economic uncertainties effectively.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Yubico (OM:YUBICO) | 37.5% | 42% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 91.9% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Here we highlight a subset of our preferred stocks from the screener.

Bilia

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium, with a market capitalization of approximately SEK 13.50 billion.

Operations: The company generates revenue primarily through car sales and services in Sweden (SEK 19.28 billion and SEK 6.16 billion, respectively), Norway (SEK 7.16 billion and SEK 2.16 billion), and Western Europe (SEK 3.61 billion and SEK 654 million), along with fuel sales amounting to SEK 1.08 billion.

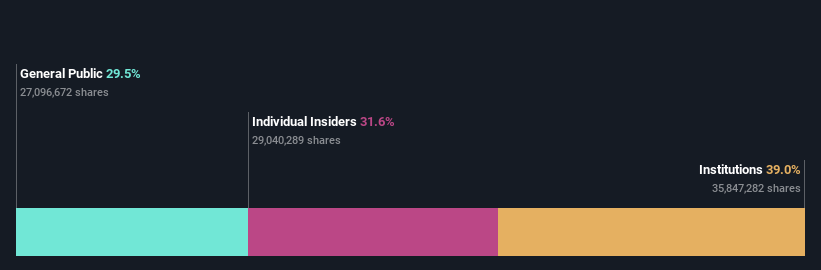

Insider Ownership: 31.6%

Earnings Growth Forecast: 15.4% p.a.

Bilia, a Swedish automotive retailer, has shown resilience with its strategic expansion and partnership with XPENG, enhancing its footprint in electric vehicles across Sweden and Norway. Despite a recent dip in quarterly earnings and net income, the company maintains a steady dividend payout. Bilia's insider transactions reflect stability with more buying than selling activities over the past three months. However, it faces challenges like high debt levels and lower profit margins compared to last year.

Dive into the specifics of Bilia here with our thorough growth forecast report.

The valuation report we've compiled suggests that Bilia's current price could be quite moderate.

Surgical Science Sweden

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Surgical Science Sweden AB, with a market cap of SEK 7.85 billion, specializes in developing and marketing virtual reality simulators for evidence-based medical training across Europe, North and South America, Asia, and other international markets.

Operations: The company generates its revenue primarily from two segments: Industry/OEM at SEK 364.42 million and Educational Products at SEK 518.43 million.

Insider Ownership: 26.6%

Earnings Growth Forecast: 22.1% p.a.

Surgical Science Sweden, a key entity in medical simulation, is trading at 55.9% below its estimated fair value, presenting a potential opportunity for growth-focused investors. The company's earnings have expanded by 66.3% annually over the past five years and are projected to grow by 22.06% yearly moving forward. Despite this robust growth, its forecasted return on equity remains low at 8.5%. Recent executive changes and active conference participation highlight ongoing strategic endeavors despite some financial fluctuations in quarterly reports.

Vestum

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vestum AB (publ) operates in the infrastructure, water, and service sectors both in Sweden and internationally, with a market capitalization of approximately SEK 3.56 billion.

Operations: The company generates revenue from its operations in infrastructure, water, and services across both domestic and international markets.

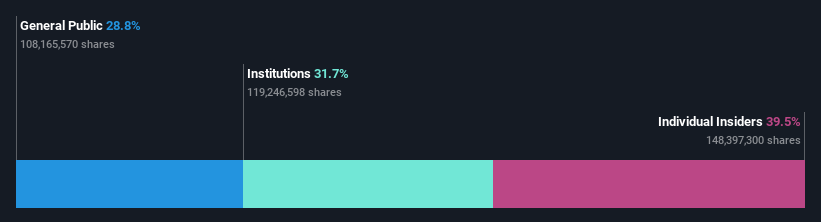

Insider Ownership: 39.5%

Earnings Growth Forecast: 73.2% p.a.

Vestum, a Swedish company with high insider ownership, is navigating a challenging financial landscape. Despite a recent net loss of SEK 161 million in Q1 2024 and an annual net loss increase from the previous year, the firm's earnings are expected to grow significantly at 73.2% per year over the next three years. The company's revenue growth forecast stands at 2.8% annually, slightly above Sweden's market average of 1.8%. Moreover, Vestum has not seen substantial insider selling in the past three months and has actively engaged in strategic refinancing to reduce interest costs by approximately SEK 30 million annually while ensuring no credit facilities or bonds mature until after 2025.

Take a closer look at Vestum's potential here in our earnings growth report.

Our valuation report here indicates Vestum may be overvalued.

Key Takeaways

Unlock more gems! Our Fast Growing Swedish Companies With High Insider Ownership screener has unearthed 78 more companies for you to explore.Click here to unveil our expertly curated list of 81 Fast Growing Swedish Companies With High Insider Ownership.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BILI AOM:SUSOM:VESTUM and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance