Swedish Exchange Highlights: 3 Growth Companies With Insider Ownership Reaching 35%

Amid a backdrop of global economic recalibrations, Sweden's market is showing signs of resilience, particularly in sectors where insider ownership aligns closely with company growth trajectories. As investors seek stable opportunities within fluctuating markets, companies with high insider ownership in Sweden may offer a compelling narrative of commitment and confidence in their long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Sweden

Name | Insider Ownership | Earnings Growth |

CTT Systems (OM:CTT) | 16.9% | 21.6% |

Sun4Energy Group (NGM:SUN4) | 12.6% | 49.6% |

BioArctic (OM:BIOA B) | 35.1% | 48.2% |

Spago Nanomedical (OM:SPAGO) | 16.1% | 52.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 49.9% |

InCoax Networks (OM:INCOAX) | 14.9% | 104.9% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Egetis Therapeutics (OM:EGTX) | 17.6% | 98.4% |

SaveLend Group (OM:YIELD) | 24.8% | 88.5% |

Yubico (OM:YUBICO) | 37.5% | 43% |

Below we spotlight a couple of our favorites from our exclusive screener.

BioArctic

Simply Wall St Growth Rating: ★★★★★★

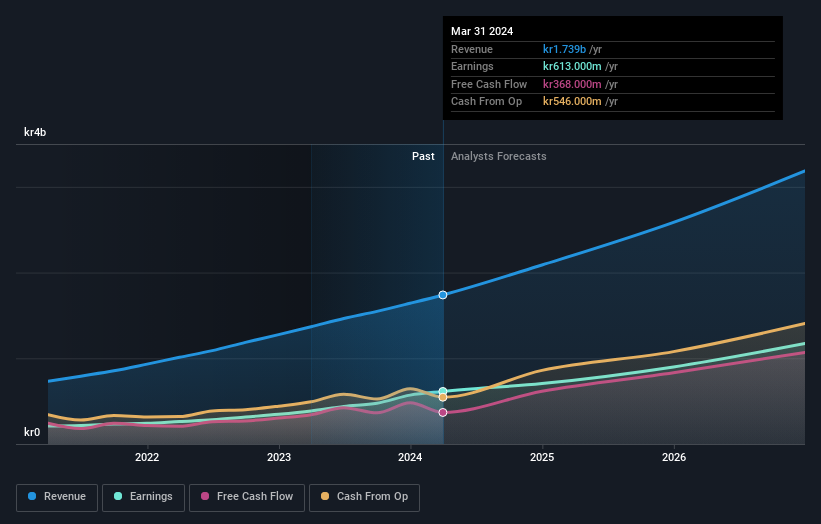

Overview: BioArctic AB (publ) focuses on developing biological drugs for central nervous system disorders in Sweden, with a market capitalization of SEK 20.49 billion.

Operations: The company generates SEK 615.99 million from its biotechnology segment, focusing on biological drugs for central nervous system disorders.

Insider Ownership: 35.1%

BioArctic, a Swedish biopharmaceutical firm, is trading at 68.2% below its estimated fair value, with analysts projecting a significant price increase of 57.8%. The company recently became profitable and expects robust annual earnings growth of 48.2%, outpacing the Swedish market's average. Despite limited recent insider buying, BioArctic's strategic collaboration with Eisai on Alzheimer’s treatment BAN2802 underscores its innovative edge and potential growth in a high-stakes market.

Fortnox

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fortnox AB operates in providing financial and administrative software solutions to small and medium-sized businesses, accounting firms, and organizations, with a market capitalization of approximately SEK 41.28 billion.

Operations: The company generates its revenue primarily through Core Products (SEK 698 million), Entrepreneurship (SEK 356 million), The Agency (SEK 327 million), and Marketplaces (SEK 150 million).

Insider Ownership: 21%

Fortnox, a Swedish software company, demonstrated strong financial performance with its first quarter revenue reaching SEK 473 million, up from SEK 378 million the previous year. Net income also rose to SEK 149 million. Fortnox is expected to maintain robust growth with earnings forecasted to increase by approximately 21.2% annually, outperforming the Swedish market's average growth rate. Insider activity has been balanced, featuring more buying than selling but not in significant volumes. The company's Return on Equity is projected to be high at around 33.2%, indicating efficient management and profitability potential.

AB Sagax

Simply Wall St Growth Rating: ★★★★☆☆

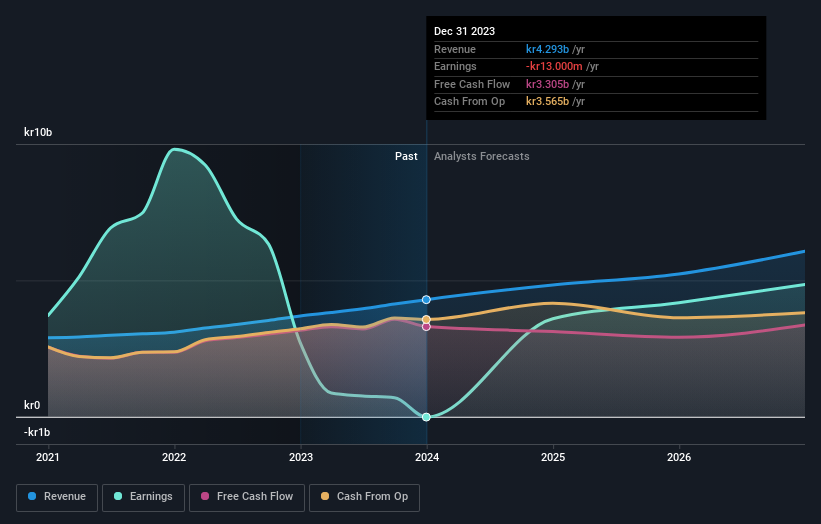

Overview: AB Sagax (publ) is a property company with operations across Sweden, Finland, France, Benelux, Spain, Germany, and other European countries, boasting a market capitalization of approximately SEK 105.50 billion.

Operations: The company generates revenue primarily through real estate rentals, totaling SEK 4.47 billion.

Insider Ownership: 28.3%

AB Sagax, a Swedish property investment firm, has shown significant financial recovery with first-quarter sales of SEK 1.19 billion, up from SEK 1.01 billion year-over-year. Net income for the same period surged to SEK 1.08 billion following a previous net loss, highlighting strong operational turnaround. Despite this growth, the company's debt is poorly covered by operating cash flow and large one-off items have skewed earnings figures. Annual earnings are expected to grow by 33.8%, outpacing the Swedish market forecast of 14.2%.

Navigate through the intricacies of AB Sagax with our comprehensive analyst estimates report here.

Our valuation report here indicates AB Sagax may be overvalued.

Make It Happen

Reveal the 81 hidden gems among our Fast Growing Swedish Companies With High Insider Ownership screener with a single click here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include OM:BIOA B OM:FNOX and OM:SAGA A.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance