CEO optimism drops for fifth straight quarter: survey

A new survey shows optimism among CEOs has dropped for the fifth quarter in a row, likely due to trade worries and uncertainty about global growth.

On Wednesday the Business Roundtable released its CEO Economic Outlook survey for the second quarter. The group’s economic outlook index dipped by 5.7 points to 89.5 – the lowest level since the fourth quarter of 2016.

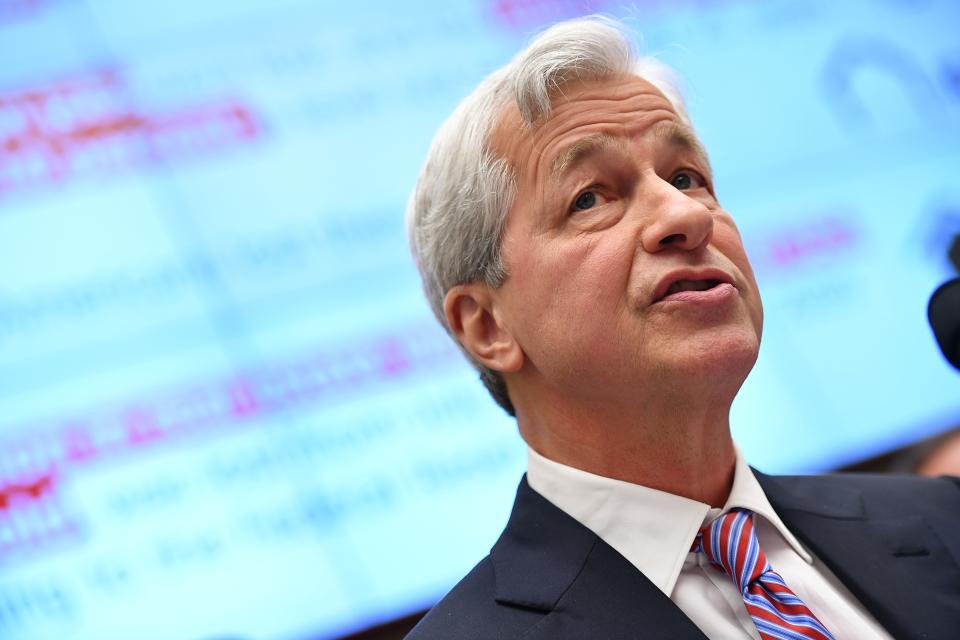

In a roundtable discussion with reporters, Jamie Dimon, JPMorgan Chase CEO and Business Roundtable Chairman, said “bad policy” is holding the United States economy back.

“It’s a disgrace and it needs to be fixed,” said Dimon.

Still, the index is higher than the historical average of 82.6 and above the 50-point threshold the group says historically has indicated the onset of recession.

“The second quarter CEO survey was in the field during a turbulent few weeks for U.S. trade relations with China and Mexico. Business leaders are ready and eager to invest and hire in the United States. Yet, the uncertainty over trade policy is making it more difficult for companies to invest and operate confidently,” said Joshua Bolten, president and CEO of the Business Roundtable.

The CEOs’ GDP projections improved slightly. They estimate 2.6% growth for 2019, up from their 2.5% estimate in the first quarter.

“The elements are in place for continued, good growth in the US and global economy — and to the extent that there’s hesitation about that, it’s very substantially driven by uncertainty about policy,” said Bolten. “My guess is that every CEO in our organization needs, this far along in a recovery, to be thinking about and planning for what might happen with a downturn — the survey is not reflecting an expectation that it’s around the corner.”

The chief executives’ plans for hiring and capital investment decreased in the second quarter, as did their expectations for sales. The group notes plans for hiring and capital investment remain higher than the historical average.

Of the 127 executives surveyed, 65% expect their company’s sales to increase over the next six months — down from 73% last quarter. Forty-one percent of CEOs expect to increase hiring over the next six months, down from 46% in the first quarter survey.

“CEO plans for hiring and capital investment remain healthy, but uncertainty about U.S. trade policy, softening global growth conditions and inaction on other pressing public policy issues are a concern,” said Dimon. “It is crucial for Congress and the administration to work together to enact policies that will encourage inclusive growth, innovation and opportunity in the United States.”

Dimon urged Congress and the Trump administration to take action on healthcare, workforce training, immigration, trade, regulation (though he noted he wasn’t talking about banking regulation) and infrastructure.

“This country is most prosperous still, it has created the most opportunity. We’re going to have to fix these policy issues to get back to where we were,” said Dimon.

Cummins CEO Tom Linebarger, who leads the Business Roundtable’s trade efforts, said there would be opportunity for “significant increases” in economic growth if trade uncertainty were eliminated.

“What you have now is a situation where U.S. companies are paying significant tax burden now from tariffs — it’s a large number. Because we’re the ones paying Chinese import tariffs now. If those tariffs are removed, it’s another tax cut essentially,” said Linebarger. “If the USMCA passes and confidence builds that we have our North American supply chains are now good for investment, again — a bit growth burst can occur. Cycles are what they are, but I think there’s opportunity for significant improvement and maybe lengthening of this cycle if some of those tariff burdens were removed.”

The Business Roundtable conducted the survey between May 16 and June 3, 2019.

Jessica Smith is a reporter for Yahoo Finance based in Washington, D.C. Follow her on Twitter at @JessicaASmith8.

Uber CEO blames Trump’s ‘tariff wars’ for disappointing IPO

Senator warns of 'irreparable' consumer harm after data breach

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance