Supercharged QE Boosting Japan ETFs

Japan’s central bank decision to increase asset purchases puts Japan ETFs back in the limelight.

Japan is expanding its quantitative easing program for the first time in about 18 months, offering a boost to Japan-linked equities ETFs, particularly currency-hedged funds that benefit from a weakening yen.

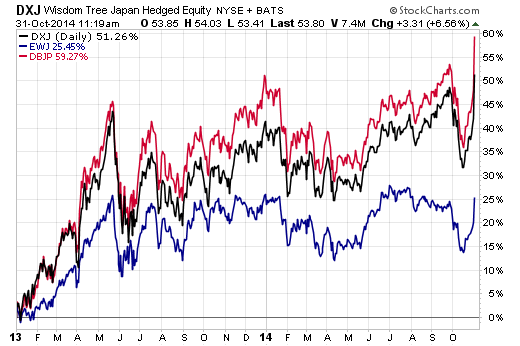

The $10 billion WisdomTree Japan Hedged Equity ETF (DXJ | B-64)—the most popular fund in 2013—and the Deutsche X-trackers MSCI Japan Hedged Equity ETF (DBJP | B-73) have had a tough time finding upside this year as Japan’s momentum waned. But today these two ETFs were up some 7 percent in early trade following the news.

Remember that back in early 2013, when the Bank of Japan first embarked on its mission to stave off deflation and spark economic growth through easy money policies, DXJ emerged as the ETF-du-jour, quickly growing to $8 billion in a matter of weeks as it shot sharply higher.

Chart courtesy of StockCharts.com

The BOJ Loosens As Fed Tightens

The BOJ said that its asset purchases are now going to total 80 trillion yen annually—or about $60 billion a month—a far bigger amount than the previously projected 60-plus trillion, according to the Wall Street Journal. Japan’s largest pension fund also said it is going to increase its bond and international stock purchases—another shot in the arm for global markets.

The decision comes just two days after the U.S. Federal Reserve announced the end of its QE after six years of bond purchases. The yen dropped to a seven-year low, while the U.S. dollar is now sitting at a four-year high.

There’s no question that Japan’s decision is helping improve investor sentiment around the globe. Markets like easy money policies, and the message out of the BOJ is that Japan still has a lot of money-pumping to do before it’s done, even as the Fed begins to tighten up.

Nouriel Roubini, one of the world’s most respected macroeconomists, recently told ETF.com that within developed markets, U.S. equity valuations are looking stretched, but Japan may actually be able to “slightly outperform” the U.S. market next year.

There’s no question that the latest BOJ move is beneficial to Japanese equities, and particularly to currency-hedged Japan ETFs.

DXJ, for instance, is essentially an Abenomics-targeted, dividend-focused portfolio, according to ETF.com Analytics. The fund selects export-oriented, dividend-paying Japanese firms—the very names that benefit the most from a weak yen, as it makes them more competitive in the global market.

The Currency-Hedged Difference

Similarly, competing DBJP also hedges its currency exposure, but the fund is broader in its coverage as it tracks a market-cap-weighted MSCI index, which itself is a hedged version of the popular MSCI benchmark anchoring the iShares MSCI Japan ETF (EWJ | B-97).

EWJ benefits from Japan’s QE expansion, but the strength of the dollar dampens its total returns. In fact, EWJ is up only 4 percent today following the news and, year-to-date, the fund actually remains in negative territory, as the chart above shows.

Yahoo Finance

Yahoo Finance