Sunningdale Tech And Other Great Dividend Stocks

One of the best paying dividend stock on our list is Sunningdale Tech. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks Dividends play an important role in compounding returns in the long run and end up forming a sizeable part of investment returns. If you’re a buy and hold investor, these healthy dividend stocks can generously contribute to your monthly portfolio income.

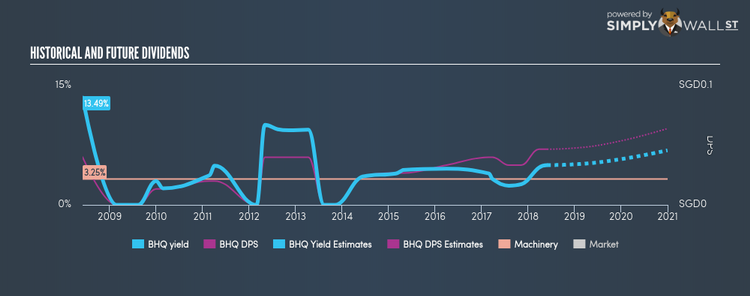

Sunningdale Tech Ltd (SGX:BHQ)

Sunningdale Tech Ltd. manufactures and sells dies, tools, jigs, fixtures, high precision steel moulds, and plastic products. Established in 1995, and run by CEO Boo Hor Khoo, the company now has 9,000 employees and with the market cap of SGD SGD264.89M, it falls under the small-cap group.

BHQ has an appealing dividend yield of 5.00% and is distributing 51.51% of earnings as dividends . Despite some volatility in the yield, DPS has risen in the last 10 years from S$0.06 to S$0.07. Analysts are enthusiastic about the company’s future growth, estimating a 57.00% earnings per share increase in the next three years. Dig deeper into Sunningdale Tech here.

UMS Holdings Limited (SGX:558)

UMS Holdings Limited, an investment holding company, provides high precision front-end semiconductor components, and electromechanical assembly and final testing services. Formed in 2001, and currently lead by Andy Luong, the company size now stands at 491 people and with the stock’s market cap sitting at SGD SGD490.83M, it comes under the small-cap category.

558 has a sumptuous dividend yield of 6.34% and distributes 49.26% of its earnings to shareholders as dividends , with analysts expecting a 60.55% payout in the next three years. Despite there being some hiccups, dividends per share have increased during the past 10 years. More on UMS Holdings here.

Chip Eng Seng Corporation Ltd (SGX:C29)

Chip Eng Seng Corporation Ltd, an investment holding company, engages in the construction, property development and investment, and hospitality businesses primarily in Singapore, Australia, Malaysia, and Maldives. Chip Eng Seng was established in 1998 and with the market cap of SGD SGD580.65M, it falls under the small-cap category.

C29 has a great dividend yield of 4.28% and is currently distributing 75.47% of profits to shareholders . The company’s DPS has increased from S$0.0075 to S$0.04 over the last 10 years. The company has been a dependable payer too, not missing a payment in this 10 year period. If analysts are correct, Chip Eng Seng has some strong future growth on the horizon with an expected increase in EPS of 94.14% over the next three years. Interested in Chip Eng Seng? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance