Straits Times Index moves above key moving averages as yield on 10-year treasuries dips

STI rebounds and moves above key moving averages as yields on 10-year treasuries continue to abate.

The Straits Times Index ended the week of Aug 1-5 on a firm note, up 71 points week-on-week, to 3,282. This takes the STI above a resistance area at 3,260, and above the confluence of its 100- and 200-day moving averages at 3,230 to 3,240 range. With quarterly momentum moving above its own resistance at its equilibrium line, the STI may have the impetus to test the area around 3,350.

The index was buoyed by the local banks which rallied following the positive impact that inflation and rising interest rates have had on their net interest income in 1HFY2022. These gains more than offset declines elsewhere in their businesses. Seemingly, net interest income in the second half of the year is likely to be even better with the full impact of rising rates as more of the banks’ portfolios re-price.

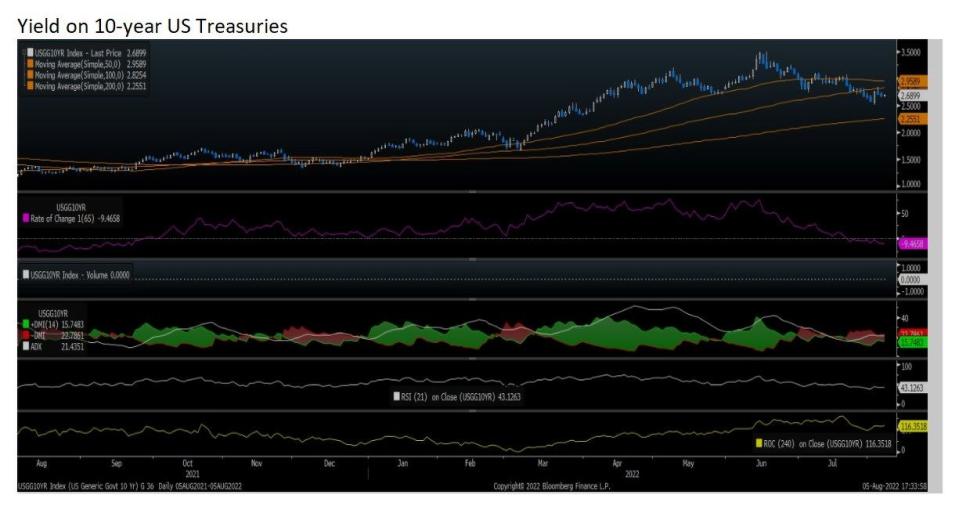

Yields on the 10-year US treasuries continued to ease, getting to a low of 2.65% during the week of Aug 1-5. Technically, the 10-year treasury yield has broken down from a top formation, at around 2.82%. The US bond market is a lot deeper than the investor pool of the STI. As such, technical indicators should work better because they are an indication of crowd sentiment. These yields may rebound during the week of Aug 8-12, but if a clear downtrend develops, equity markets will continue to cheer.

The worrisome trend - which has been evident for several weeks now - is that yields on the 2-year US treasuries remain higher than yields on 10-year treasuries. The 2-year treasury yield is above 3%, and as at Aug 5 stands at 3.052%. Hence longer bond yields are lower than yields on shorter tenors, an indication of recessionary trends.

Policy rates continue to rise. Whether further indications of a recession will stay the hand of the Federal Reserve remains to be seen, but market players appear to be thinking so.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Market outlook in August to follow historical pattern of post-July slump: DBS

Straits Times Index rebounds sharply but temporarily as risk-free rates decline

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance