Star Bulk (SBLK) to Report Q1 Earnings: Is a Beat Likely?

Star Bulk Carriers SBLK is scheduled to release first-quarter 2022 results on May 24, after market close.

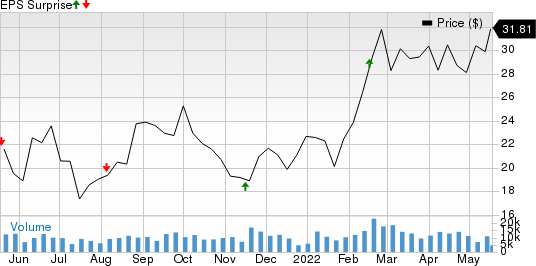

Star Bulk’s earnings surpassed the Zacks Consensus Estimate in two of the last four quarters (missing the consensus mark on the other two occasions), the average miss being 1.99%.

Star Bulk Carriers Corp. Price and EPS Surprise

Star Bulk Carriers Corp. price-eps-surprise | Star Bulk Carriers Corp. Quote

The Zacks Consensus Estimate for SBLK’s first-quarter earnings has been revised 2.9% upward in the past 60 days.

Against this backdrop, let’s look at the factors that are expected to have impacted Star Bulk’s March-quarter performance.

We expect high travel demand to have boosted voyage revenues in the March quarter. Continued fleet expansion initiatives are also likely to have driven Star Bulk’s performance in the to-be-reported quarter. Bullish sentiments surrounding the dry bulk market are also likely to have boosted results.

However, higher vessel operating expenses, mainly due to increased crew expenses, are likely to have hurt the bottom line. Moreover, COVID-induced supply-chain disruptions are likely to dent this shipping company’s results.

Earnings Whispers

Our proven model hints at an earnings beat for Star Bulk this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive surprise, as is the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Star Bulk has an Earnings ESP of +1.77% as the Most Accurate Estimate is 3 cents above the Zacks Consensus Estimate of $1.41. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Star Bulk sports a Zacks Rank of 1, currently.

Highlights of Q4 Earnings

In the last reported quarter, Star Bulk delivered an earnings surprise of 17.46%. Total revenues of $499.9 million beat the Zacks Consensus Estimate of $476.1 million and surged more than 100% year over year.

Sectorial Snapshots

Let’s look at the earnings results of a few companies in the broader Transportation sector, which already reported first-quarter 2022 results.

J.B. Hunt Transportation Services JBHT reported better-than-expected first-quarter 2022 earnings. Quarterly earnings of $2.29 per share surpassed the Zacks Consensus Estimate of $1.91. The bottom line surged 67.2% year over year on the back of higher revenues across all segments.

Total operating revenues of $3,488.6 million also outperformed the Zacks Consensus Estimate of $3,260.5 million. The top line jumped 33.3% year over year. JBHT currently carries a Zacks Rank #3.

CSX Corp’s CSX first-quarter 2022 earnings of 39 cents per share beat the Zacks Consensus Estimate by a penny despite the decrease in overall volumes as supply-chain issues continue to dent results. The bottom line improved 25.81% year over year owing to higher revenues, aided by increased shipping rates.

Total revenues of $3,413 million outperformed the Zacks Consensus Estimate of $3291.2 million. The top line increased 21.33% year over year. CSX carries a Zacks Rank of 3 at present.

United Airlines UAL incurred a loss of $4.24 per share in the first quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $4.19. This is the ninth consecutive quarterly loss incurred by UAL as coronavirus concerns continue to weigh on air-travel demand.

Operating revenues of $7,566 million also fell short of the Zacks Consensus Estimate of $7,657.2 million. UAL is presently Zacks #3 Ranked.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Star Bulk Carriers Corp. (SBLK) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance