Stag Industrial Inc (STAG) Q1 2024 Earnings: Mixed Results Amid Market Volatility

Net Income: Reported $36.6 million for Q1 2024, a decrease of 26% from $49.4 million in Q1 2023, falling short of the estimated $34.55 million.

Earnings Per Share: Achieved $0.20 per share, surpassing the estimated $0.19 and down from $0.28 year-over-year.

Revenue: Total revenue reached $187.54 million, exceeding the estimate of $183.84 million and up from $173.55 million in the previous year.

Core FFO Per Share: Increased to $0.59, up 7.3% from $0.55 in Q1 2023.

Same Store Cash NOI: Grew by 7.1% to $139.1 million from $129.8 million in the prior year.

Cash Available for Distribution: Rose to $98.13 million, marking an 8.9% increase from $90.1 million in Q1 2023.

Acquisition Activity: Acquired one building with 697,500 square feet for $50.1 million, featuring a Cash Capitalization Rate of 6.1%.

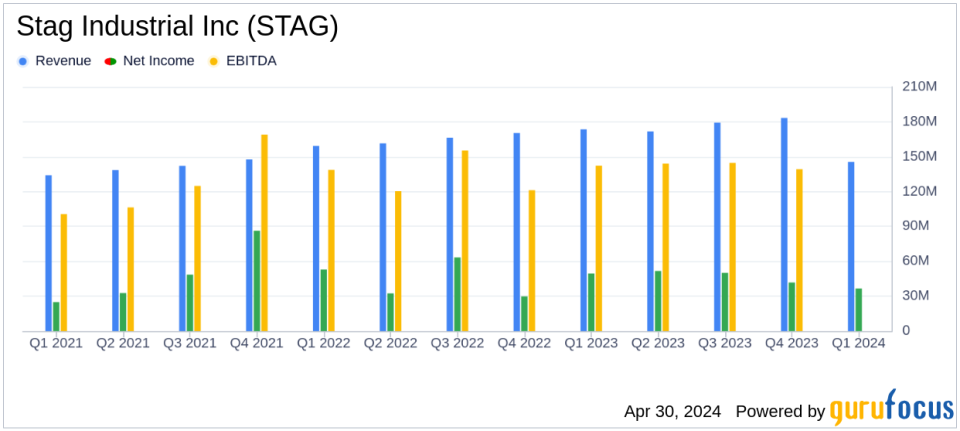

On April 30, 2024, Stag Industrial Inc (NYSE:STAG), a prominent real estate investment trust specializing in industrial properties, disclosed its financial outcomes for the first quarter ended March 31, 2024. The company's detailed performance was revealed in its 8-K filing. Despite a challenging economic environment marked by continued market volatility, Stag Industrial reported a mix of declining net income alongside growth in Core Funds From Operations (FFO) and Cash Net Operating Income (NOI).

Financial Performance Overview

Stag Industrial reported a net income of $36.6 million for Q1 2024, down 26% from $49.4 million in the same period last year. This decline was reflected in the earnings per share, which decreased from $0.28 in Q1 2023 to $0.20 in Q1 2024. Despite the dip in net income, the company experienced growth in several key areas. Core FFO increased by 7.3% to $0.59 per diluted share, and Cash NOI saw a 9.7% rise to $145.5 million. Additionally, Same Store Cash NOI grew by 7.1% to $139.1 million.

The company's strategic acquisitions and leasing activities contributed positively to its financial metrics. Stag Industrial acquired one building during the quarter, adding 697,500 square feet to its portfolio for $50.1 million. The occupancy rate as of March 31, 2024, stood strong at 97.7% for the total portfolio and 97.9% for the Operating Portfolio.

Capital Market and Leasing Activities

Stag Industrial continued to actively manage its capital structure. The company issued $450 million of fixed rate senior unsecured notes and refinanced a $200 million term loan, extending its maturity and securing favorable interest rates. In terms of leasing, the company commenced leases totaling 4.3 million square feet, achieving significant cash and straight-line rent changes of 30.5% and 43.6%, respectively.

Challenges and Market Position

Despite its financial growth in certain areas, Stag Industrial faces challenges due to market volatility which has impacted its net income. However, the company's president and CEO, Bill Crooker, remains optimistic about leveraging the firm's operational momentum from 2023 to navigate the current economic landscape effectively. Crooker emphasized the company's readiness to capitalize on transactions as markets stabilize, highlighting a strategic patience in the face of ongoing fluctuations.

Conclusion and Forward Outlook

While Stag Industrial's decrease in net income highlights the impacts of a volatile market environment, its growth in Core FFO and Cash NOI underscores the company's robust operational foundation and effective management strategy. As Stag Industrial continues to expand its portfolio and optimize its capital structure, it remains well-positioned to navigate future market conditions and enhance shareholder value.

Investors and stakeholders are invited to join Stag Industrial's conference call on May 1, 2024, to discuss these results in detail and gain further insights into the company's strategic initiatives and market outlook.

Explore the complete 8-K earnings release (here) from Stag Industrial Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance