Southern Copper (SCCO) Q1 Earnings & Revenues Beat Estimates

Southern Copper Corporation SCCO reported first-quarter 2023 earnings of $1.05 per share, which beat the Zacks Consensus Estimate of $1.04. The bottom line improved 3% from the prior-year quarter. Higher sales volumes for copper, silver and zinc were offset by lower prices for metals (except molybdenum) and inflated production costs.

Net sales were $2,794 million, up 1% year over year. The top line surpassed the Zacks Consensus Estimate of $2,724 million. Revenues were primarily driven by higher sales volumes for copper (10%), silver (15.5%) and zinc (6.4%) which was somewhat offset by a 7.9% drop in molybdenum sales volumes. Prices for molybdenum soared 69% during the quarter while copper, silver and zinc prices declined 10.6%, 6.3% and 16.5% respectively.

Operating cash cost per pound of copper (net of by-product revenue credits) was 76 cents in the quarter under review, up 31% from the year-ago quarter mainly due to higher production costs. Total operating costs moved up 11% year over year to $1,440 million.

Operating profit declined 8% to $1,354 million. The operating margin in the reported quarter was 48.5%, compared with 53.2% in the prior-year quarter.

Adjusted EBITDA declined 7% year over year to $1,568 million in first-quarter 2023. Adjusted EBITDA margin was 56.1%, compared with the year-ago quarter figure of 60.7%.

Southern Copper Corporation Price, Consensus and EPS Surprise

Southern Copper Corporation price-consensus-eps-surprise-chart | Southern Copper Corporation Quote

Production Details

Copper: SCCO mined 223,272 tons of copper in the reported quarter, up 4% year over year. Production at the Cuajone mine was up 48.5% year over year, aided by higher ore grades and the resumption of full operating capacity this year. Production at Toquepala mine and IMMSA operations improved 0.6% and 7.5% respectively, year over year. Lower production at La Caridad (-10.8%) and Buenavista operations (0.3%) due to lower ore grades somewhat offset these gains.

Molybdenum: The company mined 6,462 tons of molybdenum in the reported quarter, reflecting a year-over-year decline of 9%. The decline was attributed to lower production at Toquepala due to lower grades. Higher output at the Cuajone and La Caridad operations offset the decline somewhat.

Zinc: The company’s zinc production rose 2.4% year over year to 15,075 tons in the quarter under review, owing to improved production numbers at the San Martin and Santa Barbara units, which was partially offset by lower production at the Charcas mine.

Silver: Southern Copper’s silver production improved 3% year over year to 4,412,000 ounces due to higher production at Peruvian operations.

Financials

Southern Copper generated net cash from operating activities of $1.19 billion in the first quarter of 2023, up from $0.8 billion in the prior-year quarter due to higher sales and cost-control efficiencies..

Cash and cash equivalents were $2.3 billion at the end of the first quarter of 2023, compared with $2.07 billion as of 2022 end. Long-term debt was $6.25 billion at the end of the quarter under review, flat with 2022 end. SCCO made capital investments worth $238 million during the quarter, higher than the prior year’s quarter spending of $205 million.

Price Performance

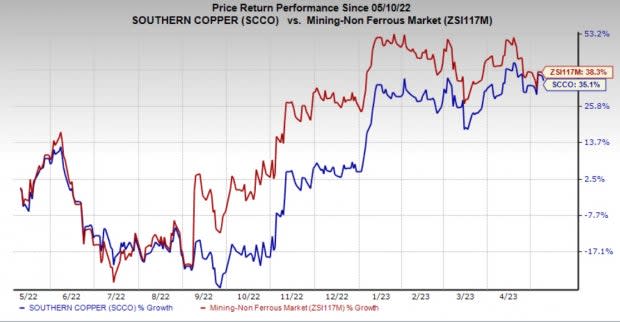

Shares of Southern Copper have gained 35.1% in the past year against the industry’s 38.3% growth.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Southern Copper currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Steel Dynamics, Inc. STLD, PPG Industries, Inc. PPG and Linde plc LIN. All these stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for STLD's current-year earnings has been revised 24% upward in the past 60 days. Steel Dynamics’ earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 10.7%, on average. STLD has gained around 26% in a year.

The Zacks Consensus Estimate for PPG's current-year earnings has been revised 11.7% upward in the past 60 days.

PPG Industries’ earnings beat the consensus estimate in three of the last four quarters while missing in one quarter. It has a trailing four-quarter earnings surprise of roughly 6.8%, on average. PPG has gained around 8% in a year.

The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 3.8% upward in the past 60 days.

Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 5.9%, on average. LIN’s shares have gained roughly 21% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Steel Dynamics, Inc. (STLD) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Southern Copper Corporation (SCCO) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance