Singaporean investors were net buyers in August, favouring sectors like healthcare and consumer staples: TD Ameritrade

In August, TD Ameritrade’s Singapore clients and overall client population preferred tech giants such as Google, Meta and Amazon.

During a “volatile” August, TD Ameritrade found that its clients in Singapore had little change in exposure during the month.

To be sure, the brokerage found that its Singapore clients were slight net buyers in August, favouring defensive sectors such as healthcare and consumer staples along with the consumer discretionary sector.

In the same month, TD Ameritrade’s clients in both Singapore and the larger population favoured tech giants such as Google and Metaverse (Meta). Amazon, Intel, AT&T Inc and Tesla were other names that were bought.

Like the overall TD Ameritrade client population, its Singapore clients were net sellers of Chinese electric vehicle (EV) maker Nio.

Both populations also used the recent strength in Alibaba as an opportunity to reduce their exposures in the Chinese consumer discretionary company. In August, TD Ameritrade’s overall client population, including its clients in Singapore, were net sellers of Apple, Netflix, Twitter and Roblox. Uber and Moderna were other stocks that were sold during the month.

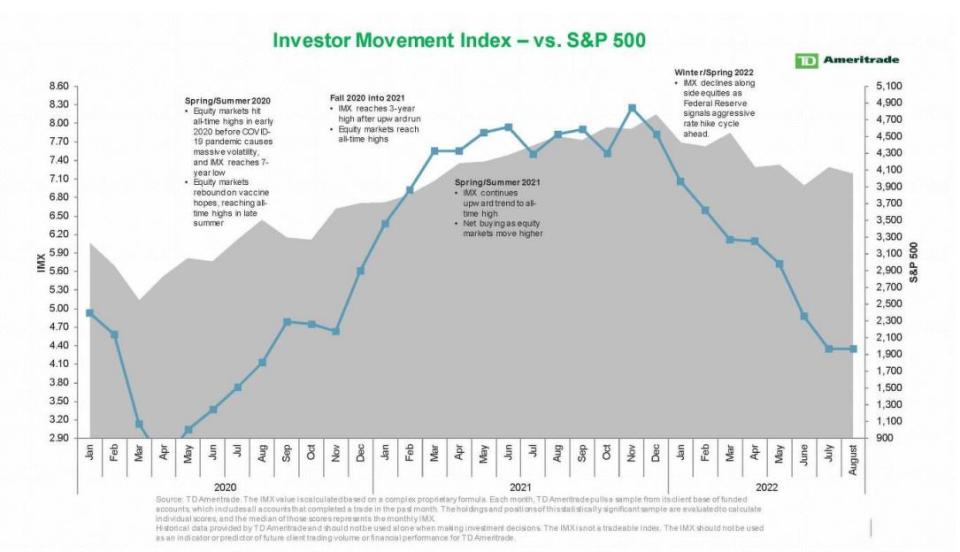

In August, TD Ameritrade's Investor Movement Index (IMX) measured 4.35, unchanged from its score in July.

The IMX is TD Ameritrade’s proprietary, behaviour-based index that aggregates Main Street investor positions and activities to see what investors were actually doing and how they were positioned in the market.

The total IMX for TD Ameritrade’s overall client population measured 4.82 in August, up from 4.68 in July.

“In the face of mixed signals ranging from positive macroeconomic catalysts to noteworthy earnings to a reckoning with the short-term pain required to tame inflation, optimism among retail investors across the globe waxed and waned in August,” says Greg Baker, CEO of TD Ameritrade Singapore.

“Despite how the period ended, TD Ameritrade clients globally increased exposure during the period. In Singapore, however, clients demonstrated a bit more reserve and kept their exposure virtually unchanged from the month prior,” he adds.

The August IMX period was another one that saw elevated volatility for US markets. However, unlike in July, the volatility was not constrained to a tight range, with the month starting off with a strong move higher — at one point trading up nearly +5% — before turning lower in the latter half of the month.

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Amazon favoured, EV makers spurned as Singaporeans cut US exposure: TD Ameritrade

Singapore-based investors sold more than bought in June: TD Ameritrade

Stay vested to counter inflationary pressures: Brankin of TD Ameritrade

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance