Singapore startup gets series B funding to do mobile payments in Africa and more emerging markets

Nearex, a mobile payments startup based in Singapore, yesterday announced it raised funds in a series B round led by Tata Capital Growth Fund. After it has gained traction across Africa, the startup is aiming to expand to other emerging markets.

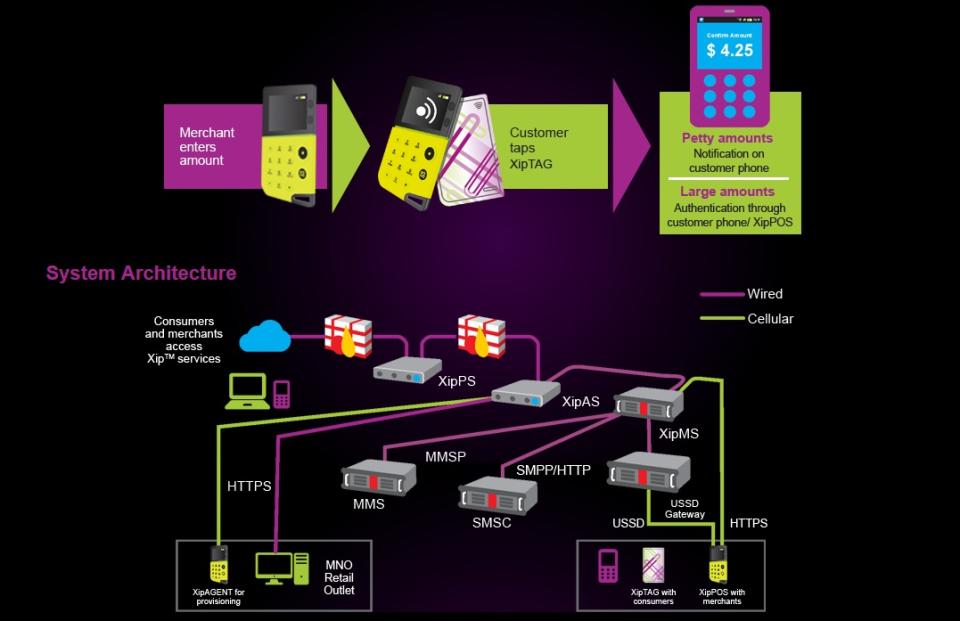

Nearex specializes in mobile payments and mobile points of sale (mPOS) systems for developing markets. Its product, called Xip, is designed to work with mobile money service providers (MMSPs) to enable cashless transactions between consumers and merchants. The system consists of a contactless card for consumers (XipTAG), an mPOS system for businesses (XipPOS), and a mediation and web server (XipMS) that handles connection to the mobile money system, security, and administration.

Mobile wallets are already taking off in parts of Africa, such as Kenya’s M-Pesa and Uganda’s Payway.

Out of Africa

The startup has been pilot testing its product extensively in Tanzania and Zimbabwe for the past year, according to Nearex CEO Mayank Sharma. “All the pilots have been converted to commercial orders and launches are expected in these and adjoining markets in the next couple of months. The product has been accepted very well by the user groups who have repeatedly responded that using Xip is easier than cash. The technology has also been found affordable by most users, paving the way for widespread adoption,” he told Tech in Asia.

Tata Capital’s involvement gives Nearex access to the Indian company’s understanding of emerging markets, Sharma explained. “Besides their mammoth presence in India, Tata group also has a very well established distribution network across Africa,” he said.

“Our product has no clear references in the developed world, so the investment team had to value our potential based on the unproven business model and growth prospects in the emerging market. The efforts they have made to understand our business space makes them a very valuable partner, and their emerging market footprint as well as professional management practices will permit Nearex to scale as a well-structured and robust organisation.”

Financial inclusion

Nearex aims at expanding to emerging markets beyond Africa that have little or no access to traditional cashless payments systems such as credit and debit cards, from Southeast Asia to Latin America. Its system is based on mobile money, which on the surface resembles the mobile wallets used in developed markets, such as Google Wallet or PayPal.

The difference is, mobile money doesn’t need to be connected to an existing bank account or credit card – both rather hard to come by in many emerging markets. Rather, mobile money exists as a value stored in an online account linked to the user’s mobile number. As such, it can be accessed even through low-cost feature phones.

With their phone, people can make payments for goods and services, settle bills, and even send money to other users. This eliminates the need for traditional banking systems and cash, which is the primary transaction method in most emerging markets.

See: Fintech can be the unbanked’s best hope for financial inclusionThe funding will allow Nearex to meet the growing demand for its product, Sharma said. It will enable the startup to enhance the support structure for its services and customize its product for use in different sectors such as retail and transportation. Nearex will also continue development of its product’s hardware and software components. “While the device is the visible part of the product, the core technology is locked in the extensive suite of software developed by Nearex that manages the devices and integrates with various payment wallets and services,” he exlained.

Mobilizing money

According to GSMA’s Mobile Money for the Unbanked state of the industry report for 2014, there were 255 mobile money services operating in 89 countries in 2014. 21 of those services have more than one million active accounts.

At the end of the year, there were 103 million active mobile money accounts, up from 73 million in 2013. And as different services become available, interoperability between them is becoming a priority, allowing users from different services to transact with each other. It also presents an attractive opportunity for companies looking to get into that space with payments products. Systems like Xip can benefit from this to expand and encourage adoption across markets.

“Nearex’s solution leverages the omnipresent mobile connectivity to create an extremely affordable payment network that may be a closed loop and local, but can be universally affordable, much like the feature phone,” Sharma explained. “Mobile money has fueled the growth of financial inclusion – Xip payments leverages such digital wallets and delivers instant tap and pay transactions that are really easy to use.”

Existing investors Beenos Asia and Xinvesco also participated in the Nearex round. The details of the deal are undisclosed, although Nearex claims it plans to reveal those details in the future. The company did confirm that Tata Capital will be on its board.

This post Singapore startup gets series B funding to do mobile payments in Africa and more emerging markets appeared first on Tech in Asia.

Yahoo Finance

Yahoo Finance