Singapore SMEs: financing through debt crowdfunding platforms

Small and medium enterprises often find it difficult to access the formal lending system.

Banks have stringent credit norms and require a business to meet certain basic eligibility criteria before they are willing to consider its request for finance.

Traditional financial institutions also find it uneconomical to make small value business loans as the resources needed to expend for this type of lending since it does not commensurate with the profits they make.

Fortunately, a number of debt crowdfunding platforms have been launched in Singapore in the last few years.

These fintechs platforms provide small business borrowers with an alternative financing option.

How do debt crowdfunding platforms work?

It is an accepted fact that lending to small and medium enterprises (SMEs) can be risky. While many firms in this category are financially sound there are others that may default on the loans they take.

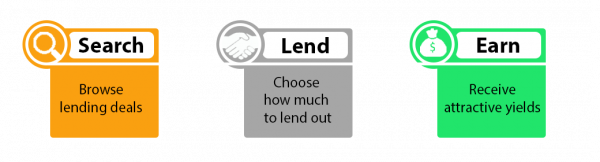

Debt crowdfunding platforms work as an intermediary between investors and SME borrowers. There are distinct advantages for both parties.

An investor has the option of splitting the amount that is being lent instead of advancing funds only to a single borrower. This serves to reduce the risk and limit the possible losses.

Source: CapitalMatch

For example, CapitalMatch, has a minimum investment size of S$1,000 on each loan. If an investor wishes to allocate S$10,000 to borrowers in the SME category, it is possible to spread out the risk between 10 loans.

Investors can earn an annual return ranging from 15% to 25%, a rate that is much higher than what is available through other investment options. The CapitalMatch platform has seen great success and has been the intermediary for over S$21mil in loans since its launch in 2014.

Regulation by the Monetary Authority of Singapore

In June this year, MAS decided to bring securities-based crowdfunding platforms under its ambit.

This move, which was under consideration for some months and for which the regulator had invited public comments, will serve to lay down clear rules for crowdfunding transactions.

It will also reassure investors that the crowdfunding organisation they are dealing with has met the requirements laid down by MAS.

One reason the government is keen to promote crowdfunding platforms is that it gives SME borrowers an additional option from which to source funds.

Partnership with DBS Bank

In an innovative arrangement, two of Singapore’s leading crowdfunding platforms, MoolahSense and Funding Societies, have tied up with DBS Bank to provide SMEs with the most appropriate financing options.

Source: MoolahSense

Under the terms of the collaboration that has been entered into, DBS will send those small customers, which it is not in a position to finance, to the crowdfunding platforms. MoolahSense and Funding Societies, in turn, will refer SMEs who have completed two rounds of borrowing to DBS.

Source: MoolahSense

This association between Singapore’s largest bank and the two crowdfunding platforms serves to benefit borrowers in two ways. Smaller companies get the opportunity to raise money even if they do not meet the minimum norms laid down by traditional lenders.

Source: Funding Societies

Additionally, those firms that have established a record of prompt payment on loans sourced through a crowdfunding platform can progress to borrowing at lower rates of interest from a bank.

Lending money through a crowdfunding website can be risky for the investor

There is no guarantee that funds advanced to an SME borrower will be repaid. After all, many of the companies that seek a loan on a crowdfunding platform would not meet the eligibility norms of a bank.

Source: New Union

Despite this constraint, the number of crowdfunding websites is growing. Take the example of New Union, a business financing platform established three years ago.

The company has already arranged over $39 million in funding for Singapore businesses. Its volume of funding across Asia exceeds $1.3 billion. The platform has operations in China, Taiwan, and Cambodia in addition to Singapore.

What explains the willingness of investors lend their funds through a debt crowdfunding platform?

For one, most borrowers are sound credit risks. The fact that a bank is not willing to finance an SME could be because the business has very low revenues or that its loan requirement is below the minimum stipulated by the bank.

New Union carries out a comprehensive credit assessment of each firm that seeks funds on its platform. Business owners may be required to furnish personal guarantees in addition to providing collateral.

Despite these safeguards, it makes sense for investors to lend to multiple borrowers instead of putting all their eggs in one basket. In fact, this is exactly the advice that the crowdfunding platforms give those who want to lend using their websites.

(By Ravinder Kapur)

Related Articles

- Singapore as a debt restructuring hub: insolvency laws and bankruptcy protection

- Crowdfunding in Singapore – new concept, but same old risks?

- Breaking down the budgeting process for SMEs

Yahoo Finance

Yahoo Finance