What is the outlook for Singapore property market in 2020?

SINGAPORE — Here is a close look at the forces in the local property market that will give a hint of what to expect in the new year.

1. More properties to be launched

Pipeline Supply of Private Residential Units

Strong growth in the private property development space is set to continue over the next three years, as an estimated 5,265 private residential units (including executive condominiums) will be completed by the end of 2020. This, coupled with the 35,538 unsold private residential units as of the end of 2019, points to the possibility of residential prices being moderated by the buoyant supply in the local property pipeline, especially amid an environment filled with sustained property cooling measures and possible higher interest rates

Pipeline Supply of Office Space

As prices and rental yields of office space in Singapore take on a positive trajectory, the huge jump expected in office space in 2020 comes just in time as island-wide vacancy rates declined to 11.5% by the second quarter of 2019. The next three years will see companies benefitting as strong competition between office space landlords persist due to the increased supply released into the markets.

Pipeline Supply of Retail Space

Over the past five years, prices and rental rates of retail spaces in Singapore have dropped significantly. Due to global trends such as burgeoning e-commerce markets and advancement in technologies, the corresponding dip in supply of projected retail space in 2020 reflects the shifting demands of customers and reduced demand for retail shops in Singapore. Hence, prices and rental yields of local retail spaces are likely to continue falling.

2. Increasing interest rates

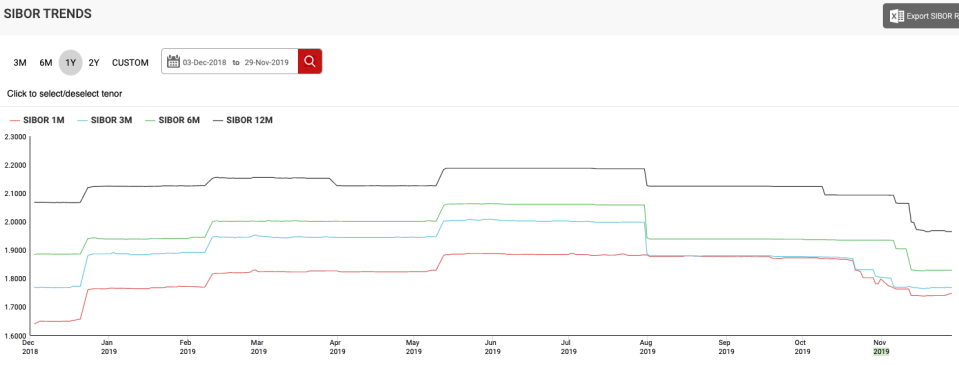

In Singapore, interest rates for residential and commercial property loans are typically benchmarked to the SIBOR (Singapore Interbank Offered Rate) or the SOR (Swap Offer Rate). As seen in the tables below, over the past year, both SIBOR and SOR rates have remained consistent and positive, despite the US Federal Reserve’s monetary policy to cut interest rates for the third time late 2019. This could be due to market uncertainty from tensions stemming from the potential US-China trade war and slowing economic growth in Singapore.

One-year SIBOR trend

One-year SOR trend

For several potential home buyers, strengthening interest rates could have a dampening effect on the consideration of new or resale properties, given the higher opportunity costs from having to service higher property loans from growing interest rates, amid other increasing costs imposed from the sustained property cooling measures in Singapore.

3. Property Cooling Measures to Stay

One can better understand the effects of continued property cooling measures by analysing a property heatmap depicting the range of average sale prices for private residential properties across the island’s 28 districts.

The price differentials between the prime Core Central Region (CCR) and less sought after Outside Central Region (OCR) districts are definitely vast, starting from S$681 psf and ending around S$3,248 psf on average. As can be observed from the red regions, indicating the highest psf prices, these have been limited to comparatively central districts such as City Hall and Tanglin. In contrast, the orange and yellow regions, indicating moderate psf prices, are slightly more and tend to cluster around the Rest of Central Region (RCR) districts. The green regions, indicating lowest psf priced properties, take up the most land and spaces in the heatmap.

As such, one can infer that the property cooling measures have been somewhat effective in controlling the range of property prices and preventing overwhelmingly high psf prices in majority of districts in Singapore. With the revised Additional Buyer’s Stamp Duty (ABSD), Sellers’ Stamp Duty (SSD) rates and lower Loan-To-Value (LTV) ratios effective from 2018, one can reasonably expect potential property investors to be cautiously optimistic and exceedingly careful in conducting due diligence and considering all grounds before making their next housing purchase in the near future.

*This story is contributed by EdgeProp.sg

Related stories:

Year in Review: Five best places to work in Singapore 2019

Year in Review 2019: CEOs who took the spotlight in Singapore

Year in Review 2019: Most searched beauty brands in Singapore

Yahoo Finance

Yahoo Finance