Singapore Property Auctions – Are They a Good Source of Deals?

By KK Tong (guest contributor)

Thinking of buying a property? You can try buying one at an auction. Most property buyers purchase their residences or investment properties via the traditional way, through a real estate agent.

Recently, however, it appears that people are turning to an alternative way of buying and selling property, that is, through property auctions. According to a local auction house, sellers need to be aware that each property submitted for an auction will incur an administrative cost of about S$800 + 7% GST, plus a sale commission is payable as well if the property is successfully sold. In today’s tepid market, keen sellers may not mind incurring additional costs if the auction houses are able to execute a successful sale for them.

Attending a property auction

The major auction houses in Singapore are Colliers International, DTZ, Jones Lang LaSalle, and Knight Frank, and these auctioneers hold regular monthly auctions.

After reading numerous articles about the growing popularity of auctions, I decided to attend a couple of auctions to learn how these work.I found out that all the auctions are conducted at the Amara Hotel at TanjongPagar. The ones I attended were conducted by two different auction houses.

Prior to the auction, I went through the respective websites to see what properties were on offer, and how many were mortgagee sales. I thought that mortgagee sales would probably be more interesting (read: have more attractive pricing) than owner sales.

As I was only going to look-see-look-see, I did not arrange to view any of the listed properties. However, serious buyers can make arrangements to view the properties they are interested in.

At the venue of the property auction

Upon arrival 15 minutes before the auction start, I could see a group of people milling around the venue. Some of these were actual buyers, usually with their agents, some were mortgage bankers touting for business, others were just like me, there out of curiosity.

The auction room was pretty small, with seats for about 70 persons. Information on the listed properties were displayed on the walls for reference. These included the floor plans, location maps of the property sites, as well as photographs of the properties’ interiors and exteriors.

When the auction started, all the seats were taken up, and the back of the room was filled with people. My guesstimate was that about 120 to 130 people attended the auction.

Before the auction started, the attendees were informed of the rules, one of which was that once the property goes under the hammer, you would need to sign the contract immediately and pay a deposit (usually 5% or 10%) of the bid price. Never bid unless you are a hundred percent sure that you want that property!

A monotonous auction

Expecting the auction to be exciting, I was in for disappointment. The actual auction was rather boring, tedious at times. Starting with residential properties, the auctioneer went through the list of submitted properties, and started bidding with an opening price. Calls were made for bids, and the auctioneer tried to drum up interest by talking upthe good points of the property, and used previous transactions to attract buyers that these properties are being offered as ‘the real deal’. Despite these efforts, the atmosphere was muted, and excitement was noticeably absent.

In the two auctions I attended, of which 23 properties were put up, only one property found a buyer, a 3,821 sf ramp-up factory at Woodlands, which went for $820,000, $60,000 lower that the opening bid of $880,000.After a period of no bids at the opening bid, a call for bids was made and a bid of $820,000 was made. As this bid was above the reserve price and there were no counter bids, the bid was accepted and it was sold.

Properties without any bids are withdrawn from sale.

Halfway through, I saw people leaving, probably because the property they were keen on was not offered at the price they were willing to pay. The crowd got even thinner when the auction for commercial properties started. By the time the auction ended, only a very small group remained. In all honesty, I expected more liveliness, more excitement, some action perhaps, but unfortunately, I had no luck in witnessing any bidding war. Looks like I may have to attend yet another auction and keep my fingers crossed.

Is it worthwhile to buy a property from an auction?

To see if it is worthwhile to buy a property from an auction, I tried to compare some of these auction properties with previous transacted data. The properties chosen for comparison are mortgagee sales.

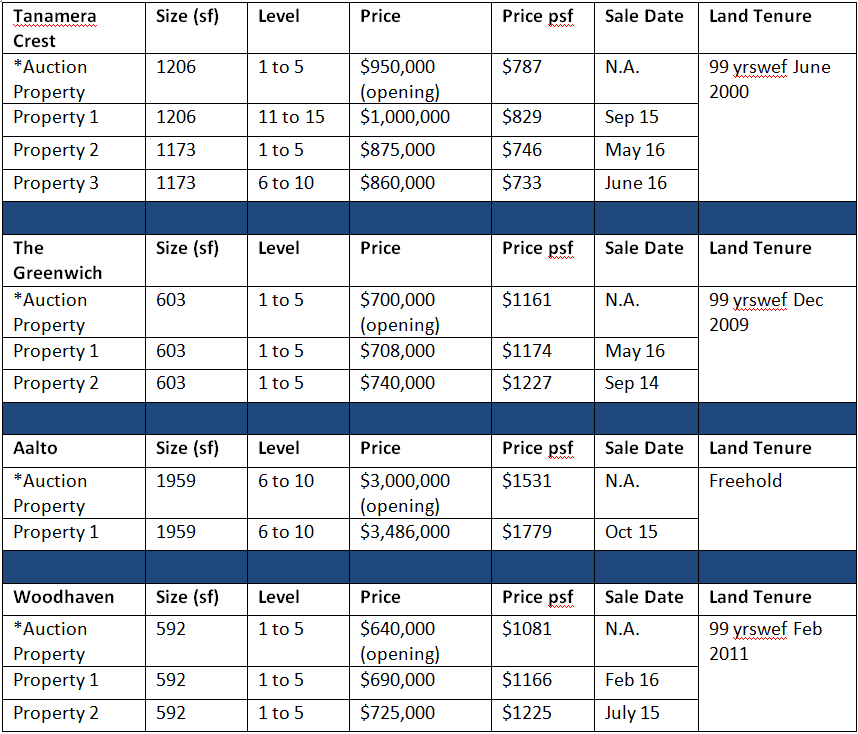

Table 1: Comparison of Auction Properties with Previous Transacted Units

From the figures, it looks like mortgagee sales are not necessarily much better deals as compared to properties bought via the usual channels. The opening prices of auction properties look comparable to previous transacted prices. In the case of Aalto, although the opening price of the unit seemed attractive, the lack of recent transactions makes it difficult for serious buyers to do meaningful comparisons. As for the unit at Woodhaven, although the opening price did look attractive in terms of quantum, the discount compared to a similar previous transacted unit was less than 10%. Real bargain hunters may not bite at such small discounts.

Thus, buyers who are hoping to get real value buys at ‘generous discounts’ will probably not get any deals at these auctions. I guess this is why so few units attracted any bidding, resulting in a low number of successful sales. Moreover, successful buyers are expected to pay the deposit and sign the contract immediately, so effectively, there is no turning back. Caveat Emptor!

Posted courtesy of www.Propwise.sg, a Singapore property blog dedicated to helping you understand the real estate market and make better decisions. Click here to get your free Property Beginner’s and Buyer’s Guide.

Related Articles

How to Tell Good Property Agents from Bad Ones (at Propwise.sg)

[Reader Story] From HDB Flat to Landed Property on an Average Salary (at Propwise.sg)

4 Burning Property Investment Questions Answered (at Propwise.sg)

Yahoo Finance

Yahoo Finance