Singapore private home prices rose by 7.9% in 2018: URA

Prices of private residential properties in Singapore rose by 7.9 per cent in 2018, compared with the 1.1 per cent gain in 2017, according to a flash estimate of the price index by the Urban Redevelopment Authority (URA) released on Wednesday (2 January).

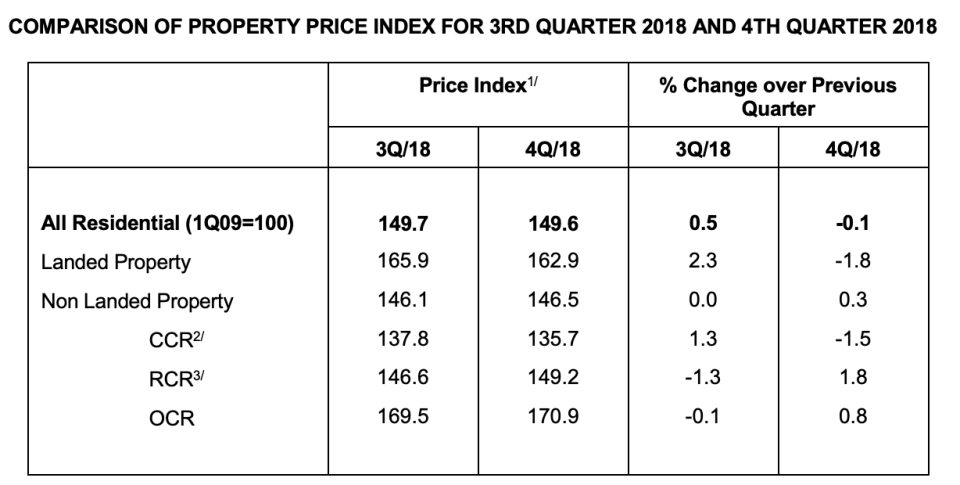

The effects of the property cooling measures introduced by the Singapore government in July is seen to take effect as property prices fell by 0.1 per cent in the fourth quarter after slowing to a 0.5 per cent gain in the third quarter.

In the fourth quarter, prices of landed homes also fell 1.8 per cent compared with the 2.3 per cent gain in the third quarter. Prices of non-landed properties gained 0.3 per cent after remaining flat in the third quarter.

According to the URA, prices of private residential properties fell by 1.5 per cent in the core central region (CCR), or prime areas, compared with a 1.3 per cent rise in the previous quarter.

Prices in rest of the central region (RCR), or city fringes, increased by 1.8 per cent after a decline of 1.3 per cent in the previous quarter. Prices in areas outside the central region (OCR), or suburbs, gained 0.8 per cent after a 0.1 per cent drop in the previous quarter.

For the whole of 2018, prices in CCR, RCR and OCR increased by 6.2 per cent, 7.4 per cent and 9.5 per cent respectively.

Outlook

Colliers International estimates overall private home prices could potentially climb by 3 per cent in 2019, in line with the economic growth, barring any foreseen events.

For the end-buyers, it is conceivable that the market sentiment will likely maintain status quo in the first half of 2019 as the property curbs continue to moderate investment demand for private homes, said Tricia Song, head of research for Singapore at Colliers International.

For the developers, given the sizeable supply pipeline from public land tenders and private collective sale sites accumulated before the curbs, they are likely to be more cautious and may pace out their launches to ensure the market remains sustainable in 2019, Song said.

The flash estimates are compiled based on transaction prices given in contracts submitted for stamp duty payment and data on units sold by developers up till mid-December. The statistics will be updated on 25 January when URA releases its full set of real estate statistics for the fourth quarter.

Related stories:

Singapore moves to cool down resurgent property market

Singapore cuts private housing supply under H1 2019 land sales programme

Yahoo Finance

Yahoo Finance