Singapore prime home rents down 3.3% in Q3

Prime residential rents continue to weaken in Singapore.

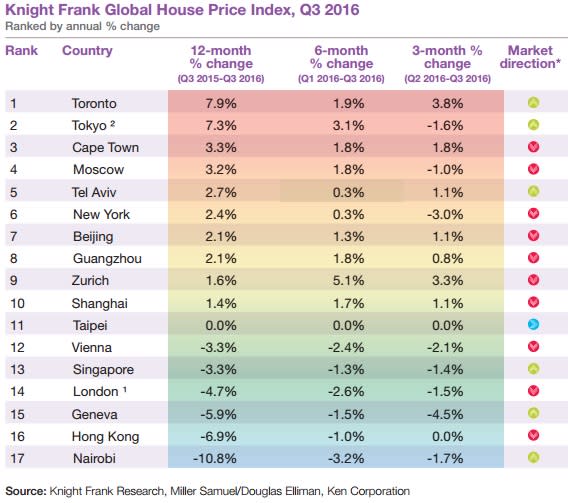

Prime residential rents in Singapore fell by 3.3 percent during the third quarter of 2016, while prime rental performance across the 17 global cities tracked by Knight Frank registered zero percent growth in the year to September.

“Despite this slowdown in aggregate performance, the number of cities where annual rental growth is positive remains the same as last quarter (10); however, the rate of growth has slowed in 10 of the 17 cities,” said Knight Frank.

Toronto topped the rankings, with prime rents increasing by 7.9 percent year-on-year. The consultancy noted that last year’s annual population growth of nine percent and stable rate of unemployment at 6.6 percent contributed to higher demand for rental properties there.

Tokyo came in second with a 7.3 percent increase in rent, while Cape Town settled in third spot with a 3.3 percent gain.

Completing the top five cities are Moscow and Tel Aviv, with rent increases of 3.2 percent and 2.7 percent, respectively.

“Whilst uncertainty remains over the form of Brexit and the stance on global trade which President-elect Trump is likely to take, we can be more confident that a US rate hike is imminent,” said Taimur Khan, Senior Research Analyst at Knight Frank.

“However, any rise may have significant knock on effects, particularly for emerging markets. Record levels of sovereign debt in some emerging markets means that even a small increase in interest rates may suppress corporate activity, which in turn could hinder economic growth and prime rental market performance.”

Romesh Navaratnarajah, Senior Editor at PropertyGuru, edited this story. To contact him about this or other stories, email romesh@propertyguru.com.sg

Yahoo Finance

Yahoo Finance