Singapore’s Fintech Push

Investments in financial technology companies, or fintechs, are growing at a rapid pace across the world. One reason for this development is that in the aftermath of the 2007/08 financial crisis, regulators clamped down on traditional financial institutions. Consequently, fintechs emerged to take advantage of the market opportunity created by this development.

According to a report by global consultancy Accenture, investments in fintechs in 2015 amounted to US$22 billion (S$30.64 billion), a 75% increase over the previous year. In the first quarter of 2016, US$5.3 billion (S$7.38 billion) had been pumped into fintech companies. This is a 67% increase over the same period last year.

Singapore has recognised the immense potential that fintechs hold. A number of initiatives have been launched in the country to give new companies an opportunity to make their ideas a reality.

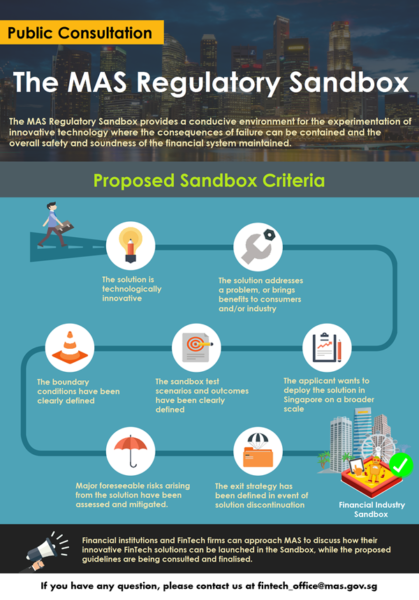

Monetary Authority of Singapore’s “regulatory sandbox” — The country’s financial regulator has taken a liberal approach and announced the creation of a “regulatory sandbox.” This will allow start-ups and existing companies in the financial sector or even those operating in non-financial areas to launch new products in a relaxed regulatory environment.

How will the “regulatory sandbox” work? According to the procedure proposed by MAS, a fintech could initially offer a solution to a targeted group of customers and monitor the progress over a period of, say, six months. Of course, MAS concurrence would be required before the new service can be launched.

If there are no glitches during the sandbox period, and both the fintech and MAS are satisfied with the performance of the product or service, then the company would be allowed to scale up.

This infographic from MAS illustrates how the regulatory sandbox will work.

Source: Monetary Authority of Singapore

FinTech & Innovation Group

In another initiative, MAS has set up the FinTech & Innovation Group, which has been tasked with providing fintechs with regulatory policies and strategies to help them succeed in their chosen areas. The unit has identified three distinct sectors in which it will focus.

Payments and technology solutions — to facilitate the development of simple and secure payment solutions for financial services.

Technology infrastructure — to provide a boost to cloud computing, big data and distributed ledgers.

Technology innovation lab — to identify and nurture new technologies in the financial sector.

The Singapore government and MAS have also committed to investing a sum of S$225 million in fintech projects over the next five years.

Hong Kong’s experience

Source: Thinkstock/Getty Images

Fintechs in Hong Kong have not had a very successful start. A recent report by Reuters says that start-ups find it difficult to meet the stringent regulatory requirements imposed by Hong Kong.

Approvals for starting operations are hard to come by. Take the example of Jimubox, a Chinese peer-to-peer lender. The company spent almost a year in setting itself up in Hong Kong, but finally withdrew from the market when it realised that it would be difficult to sign up customers because of the strict rules in force for account-opening.

Because of the relatively inflexible approach of the regulatory authorities, Hong Kong has fewer than 100 fintechs. Contrast this with the situation in Singapore, where over 200 fintechs have set up shop in the last two years.

Successful fintechs in Singapore

Source: Thinkstock/Getty Images

A tech-savvy population, the availability of highly skilled manpower and conducive government policies have resulted in the launch of several fintechs that have gained a foothold in the market.

Fastacash — This start-up has developed a social payment platform that enables the transfer of money across any social or messaging channel. Its business model is built on the question: “If I can send you a photo through WhatsApp, why can’t I share money with you too?”.

The company’s products already serve markets in India, Indonesia, Russia, Singapore and Vietnam.

Mesitis — The company has developed several products aimed at the private wealth market. Its specialised platforms provide account aggregation facilities, access to global equity and fixed income markets, and robo-advisory services.

Open Trade Docs — Utilising blockchain technology, Open Trade Docs provides users with the ability to create digital trade finance documents. This allows clients to control their data themselves instead of having to rely on a third-party service provider.

Fintechs can be Singapore’s next growth engine

The exponential increase in the number of fintechs in Singapore in the recent past indicates that this sector could help to boost the nation’s economy in the years ahead.

Southeast Asia has a population of 600 million, a majority of whom are not served by the formal banking system. Singapore is ideally positioned to take advantage of this massive business opportunity by becoming the regional hub for the financial technology companies that will be formed to address this market.

(By Ravinder Kapur)

Related Articles

- Fintech investment in Asia: China leads Europe and the US 50% of global fintech investment is in China

- Citibank Warning – 30% of jobs at US and European banks at risk from the FinTech Boom

- FinTech: Disruption in Banking –The Asia Story

Yahoo Finance

Yahoo Finance