SI Technical Analysis: ComfortDelgro At 3.5-Year Low

We have received an overwhelming number of requests for technical analysis on a few companies, but the bulk of the recent requests pertained to our taxi operator – ComfortDelgro (CDG).

Since you asked for it, we oblige.

The share price tanked. Is it Grab and Uber? Is it the Hungry Ghost Festival that has the tendency to cause corrections? The share price of CDG has plunged to a three-and-a-half year low – a level not seen since the beginning of 2014.

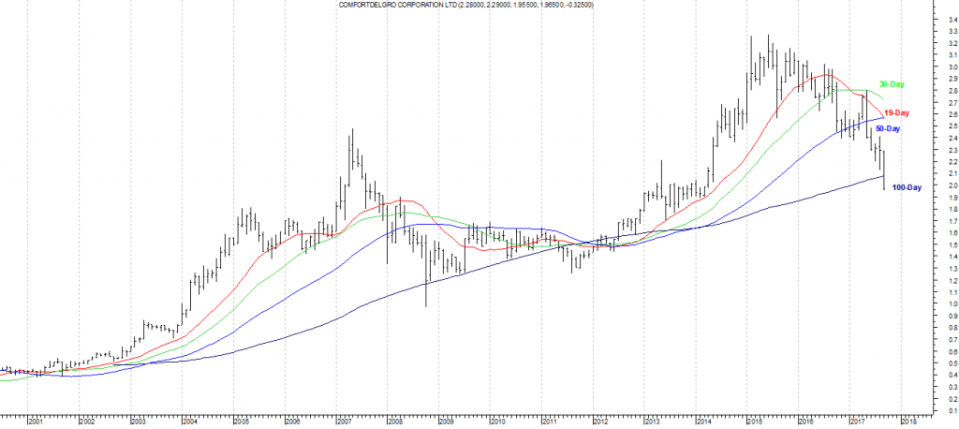

This completes a multi-year rounding top pattern while some say head-and-shoulder. But whatever it is, we are not comfortable with what we are seeing on the charts.

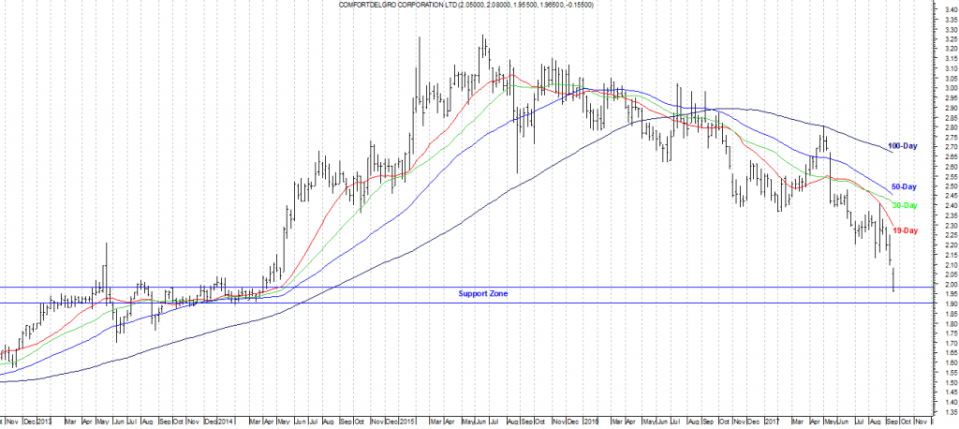

“Unchartered Territory”

On a one-year chart, the share price of CDG is in “unchartered territory” as it is now trading at a 3.5-year low. It is extremely bearish, but the share price is trying to find a point of equilibrium at around $1.95. A full Fibonacci Retracement from its high of $3.27 on 19 June 2015 plotted with a low of $1.905 reached on 21 March 2014 yielded several key supports – $2.94, $2.74, $2.58 and $2.43 – that were broken with ease.

Coincidentally, the closing price of $1.975 on 22 September falls within the support zone of $1.90-$2.00. This support zone is formed during the rather tight trading range from 2013 to 2014. So to say, we are now at the support zone.

However, a rounding top formation has been completed and it is a bearish signal! We would not be interested in this stock as it looks even worse on a monthly chart unless you are hoping to catch a rebound, but you might end up catching a falling knife instead of a rebound!

Weekly Chart

On the weekly chart, we can see the Moving Averages colluding to trigger sell signals one after another whereby the shorter-period MAs took turns to cut the longer-period MAs from the top, forming death crosses.

While we can see this stock languishing in an oversold region (RSI < 30), we have also mentioned that stocks can “wallow in depression” for a prolonged period of time meaning that oversold stocks can remain oversold for quite long unless a spectacular piece of news can overcome this bearishness.

On current trend, the charts, as mentioned above, tell us that the share price is trying to find a point of equilibrium with key support zone at $1.90-$2.00. Due to its oversold nature, there is likely to be a brief rebound but such a price action is more akin to a dead cat bounce than anything meaningful.

Monthly Chart

The bearishness had just started from this view on monthly charts! The first death cross between the 19-day and the 30-day MA took place at the beginning of this year. This is followed by yet another death cross formed between the 19-day MA and the 50-day MA last week. Further bearishness will be confirmed once the 30-day and the 50-day MA form a death cross.

This bearishness can only be negated when prices rebound above $2.04, followed by forming a trading range between $2.04-$2.28. On the other hand, we may also see some support at $1.81 – the high created 12 years ago in 2005.

Conclusion

Expect to see resistance at $2.09, $2.20 and $2.25 (technical analysis); expect to see resistance from Uber and Grab! The war has begun and CDG must react quickly or it will face more and more defections to the private hire group. Ultimately, this is not just a problem that technical analysis can solve because the fundamentals of the past that CDG had boasted of is now under severe attack!

Yahoo Finance

Yahoo Finance