SI Research: Venture Corporation – Recent Sell-Off Offers A Buying Opportunity?

On 13 September 2018, the share price of Venture Corporation (Venture) slumped 5.7 percent or $1.03 to $15.90 on a turnover of 2.7 million shares. The sudden sell-off occurred after the US Food and Drug Administration (FDA) proposed restrictions related to the sales and marketing of e-cigarettes to teenagers.

Venture is widely believed to be the manufacturer of “I Quit Ordinary Smoking (IQOS)” by Philip Morris, a smokeless tobacco device that uses a heat-not-burn technology to release a nicotine-containing vapor. Philip Morris has been seeking the FDA’s approval to launch IQOS in the US. The recent FDA news created a knee-jerk reaction to Venture’s shares, as investors are concerned about the potential loss of a business opportunity if Philip Morris could not sell IQOS in the US. Meanwhile, with the FDA busy clamping down e-cigarettes, the IQOS approval is very likely to be delayed.

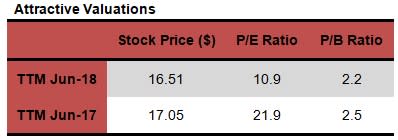

At the time of writing, Venture’s stock is trading at $16.51. Is the beaten down share price an opportune entry point for investors?

Another Strong Quarter

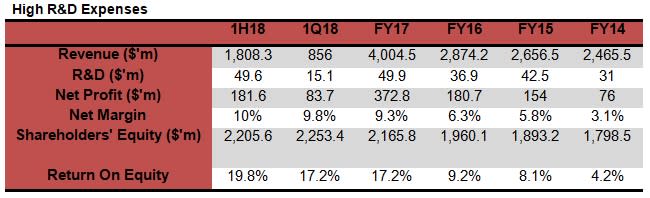

In the latest 1H18 results, Venture registered a 2.6 percent decrease in revenue to $1.8 billion but 3.4 percent revenue growth in US dollar terms. Venture executed well in improving cost efficiencies with cost of materials used in production falling 9.1 percent to $1.3 billion while employee costs also reduced 4.5 percent to $167.2 million. Bottom line was further propped up by $4 million in investment revenue and $2.6 million in exchange gains.

Despite lower revenue, net profit surged 53.3 percent to $181.6 million as net margins improved from 6.4 percent to 10 percent.

In 1H18, Venture spent a total of $50 million in research and development (R&D) expenses, which was the highest in Venture’s history. We believe the previous R&D expenses went into improving productivity and reducing material costs to boost up the net margin.

Through strong delivery on factors within management control, Venture has achieved more than nine percent net margin since FY17. With the strong improvement in profitability, Venture is on track to achieve a second year of 17 to 18 percent return on equity (ROE) in FY18. We view that the high R&D spending could enhance profitability over the long run and the substantial revenue impact could be either be seen during the current or the next quarter.

Strong Balance Sheet and Dividend Surprise

The balance sheet and cash flow of Venture have always been strong. As at 30 June 2018, the group’s cash and bank balances stood at $688.6 million and only has bank loans of $72.5 million. This translates to a net cash position of $616.1 million. Moreover, Venture has been able to generate positive cash flows from its operations for the last five years. The more money Venture produces from its operations means it is less reliant on external funding and able to fund future projects.

Meanwhile, management declared the first ever interim dividend of $0.20 for 1H18 and hinted that the full year dividend should be at least on par with previous year. Judging by the consistent dividend record and strong cash position, we believe Venture has the capability to continue to do so in the foreseeable future. At the closing price of $16.51 and an expected total dividend of $0.60 in FY18, this translates to a decent dividend yield 3.6 percent making it one of the established blue chips on the Singapore Exchange offering a reasonable and stable dividend income.

Venture closed at $16.51 on 17 September 2018, falling 22.9 percent year to date. On a trailing 12-months earning basis, Venture is now trading at 10.9 times price-to-earnings (P/E) compared to 21.9 times a year ago. Also, the price-to-book (P/B) ratio is lower at 2.2 times compared to 2.5 times.

Management expressed concerns over heightened volatility that may arise in the near future from customers’ merger and acquisitions, new product or platform transitions, possibility of escalating trade war as well as component shortages. At the same time, investors need not worry excessively about the trade tariffs that may affect Venture’s profitability as management indicated that less than two percent of the revenue may be affected. In all, despite the gloomy global economy outlook, we remain optimistic on Venture for long term as the company continues to report strong results. Venture is also a fundamentally good company and the shares remain attractive.

Yahoo Finance

Yahoo Finance