SI Research: Too Much Pessimism On Valuetronics?

Integrated electronic manufacturing services (EMS) provider Valuetronics Holdings’ (Valuetronics) share price fell roughly 37.2 percent from its peak of $1.09, which it touched in late-March this year. Its share price has been battered in recent months as investors are cautious about the impact of the on-going US-China trade war. For the EMS provider, all of its manufacturing plants are located in China and it derived a significant 41.9 percent of revenue from the US in FY18.

On top of that, Valuetronics delivered a mixed earnings performance in the latest quarter. Is the beaten-down share price an opportune entry point for investors? We dive deeper to see if Valuetronics could rekindle better performances in coming quarters.

Latest Earnings

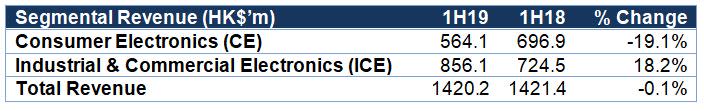

In 1H19, revenue remained flat at HK$1.4 billion, with an 18.2 percent increase in the Industrial and Commercial Electronics (ICE) segment offsetting a 19.1 decline in Consumer Electronics (CE) segment. The strong growth in ICE segment was due to increased demand from printing and automotive businesses. On the other hand, softness in the CE segment was attributed to weak demand for smart lighting and temporary production disruptions in Danshui Factory caused by the flash flooding from Super Typhoon Mangkhut. On a slightly positive note, this was partially offset by the increased sales of printed circuit board assembly (PCBA) for shavers and electric toothbrushes.

Gross profit edged up 0.3 percent to HK$209.8 million as gross profit margin improved 10 basis points to 14.8 percent on the back of a favourable product sales mix. Meanwhile, other income and gains increased by HK$7.9 million to HK$12.6 million thanks to higher interest income and reversal of net exchange losses of HK$1.6 million to net exchange gain of HK$2.8 million helped to cushion the bottom line.

Valuetronics made an insurance claim for the damages suffered in the Danshui flooding incident and booked a provision of HK$13.6 million. As a result, net profit fell 5.6 percent to HK$94 million. Excluding the one-off provision, net profit would have grown 8.1 percent to HK$107.6 million.

Industrial Headwinds

Though being a manufacturer with global sales, management updated that only around 20 percent of revenues are potentially impacted by tariffs, a revised figure from initial 10 percent, after more customers have come forward to update Valuetronics that they are impacted.

Despite that, Valuetronics has not observed a slowdown in momentum and remains confident that the impact of a US-China trade war will be limited. In order to mitigate impact of tariffs on goods exported to US market, Valuetronics has been working with customers in evaluating various measures which includes the option of shifting product assembly outside of China.

In addition, management started to see some relief with the normalisation of lead times and stabilisation of prices in passive electronic components.

Meanwhile, as the consumer demand for in-car technology has grown significantly over the past few years in tandem with growing car population. Management also expects ICE segment to grow at a high double-digit with margins maintaining due to increased volumes and operational efficiencies. This will lend strength to offset CE segment’s temporal weakness.

Zero Debt Business With Good Dividend Yield

As at 30 September 2018, Valuetronics held zero debt and had increased its cash hoard from HK$671.1 million in 1Q19 to HK$798.2 million ($140.1 million). The net cash position is equivalent to 47.2 percent of its market capitalization as per its closing price of $0.685 on 26 November 2018. Its massive cash position highlights its prudent balance sheet and financial flexibility to provide a good war chest for expansion and also a reserve in times of need.

Moreover, Valuetronics saw strong cash generation in 1H19 with operating cash flow coming in at HK$221.8 million and a 66.4 percent decrease in capital expenditure to HK$20.5 million. This translates to a free cash flow of HK$201.3 million, compared to a negative free cash flow of HK$52.8 million considering it spent HK$61 million in capital expenditure in 1H18.

Valuetronics paid a total dividend of HK$0.27 (including special dividend of HK$0.05) in FY18 and an interim dividend of HK$0.05 in 1H19. Given its large net cash position and strong cash flow, we believe Valuetronics will maintain a dividend of HK$0.27 per share for FY19, implying a yield of 6.9 percent. Not only that, we also could expect management to continue rewarding shareholders with higher dividends, in view of better financial performance.

Valuation

Valuetronics is now trading at a rather undemanding trailing 12-month price-to-earnings (P/E) of 8.4 times, compared to 12.3 times a year ago. Excluding the one-off provision, the adjusted P/E would be 7.9 times. Also, the price-to-book (P/B) ratio is lower at 1.6 times compared to 2.2 times a year ago.

We believe the recent share price correction presents a good buying opportunity. The low valuation is further supported by its attractive dividend yield of 6.4 percent. On top of that, an average target price of $0.895 from four brokerage firms still implies a further potential upside of another 30.7 percent.

Yahoo Finance

Yahoo Finance