SI Research: TalkMed Group – An Overlooked Healthcare Growth Stock

Early last year, market research firm Frost and Sullivan predicted that the Asia-Pacific healthcare industry is going to grow at 11.1 percent in 2018 driven by an increasing adoption of technology, innovative healthcare access and delivery of care outside of traditional hospital settings. Concurrently, Singapore Exchange (SGX) also released a market update identifying the five largest healthcare companies listed on the local bourse in terms of market capitalisation.

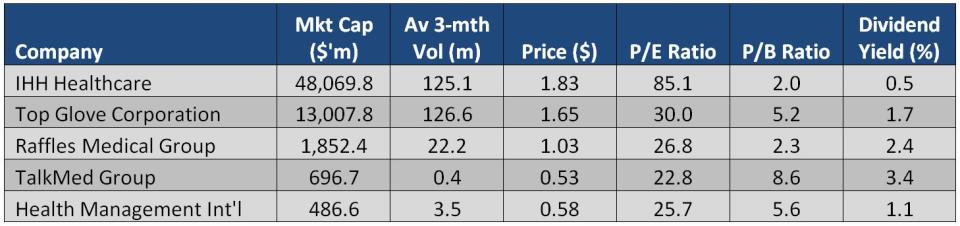

With a market capitalisation of $696.7 million, TalkMed Group (TalkMed) was ranked the fourth largest healthcare company right after IHH Healthcare, Top Glove Corporation and Raffles Medical Group (RafflesMed). Nevertheless TalkMed has not been given the reasonably sufficient market interest justifiable of its status. At an average 3-month volume of merely 0.4 million shares a month, TalkMed is not trading even close to one-tenth of RafflesMed’s volume. This issue, we take a closer look at this healthcare growth stock that has been largely overlooked by the market, analyzing deeper into what it has got to offer.

About TalkMed Group

Listed on the SGX in January 2014, TalkMed is a premier provider of oncology-related medical services, stem cell transplants and palliative care services, serving patients in Singapore and the Asian region. Being one of the market leaders in the niche market of cancer treatment and nursing care of the terminally ill patients, we see TalkMed as a price-setter having strong pricing powers. For instance if you were to be diagnosed with an end-stage disease, would you prefer to undergo treatment in a well-reputed institution or haggle over the expensive bills? I think the answer would be obvious. Given that one could not bring his money to the grave, I would think that most people would not hesitate to use whatever money he has left in exchange for just a couple more months to live if he could.

Over the past eight years, TalkMed has continued to enlarge its facilities and medical team. The group’s number of clinics has grown from 6 clinics in FY10 to 9 clinics in FY18 while the number of doctors in Singapore also increased to 16 correspondingly.

Financial Performances

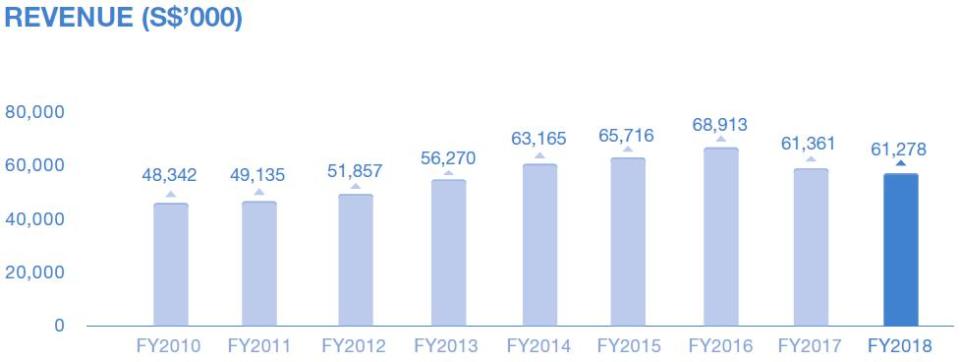

While TalkMed’s top-line grew at a compounded annual growth rate (CAGR) of 3 percent from $48.3 million in FY10 to $61.3 million in FY18, the group has not been performing well in the last two years. The group’s revenue slid 11 percent in FY17 year-on-year (y-o-y) followed by a further decline of 0.1 percent in FY18. Likewise, net profit shrank by 14.3 percent and 9.8 percent y-o-y in FY17 and FY18 respectively while CAGR of net profit over the last eight years registered a negative growth of 1.4 percent.

Source: Company’s Annual Reports

This was in large part due to Dr Ang Peng Piam, CEO of TalkMed who was also the key contributor to the group’s earnings, being embroiled in a lengthy inquiry conducted by the Singapore Medical Council’s disciplinary tribunal in relation to a complaint filed by the family of Ang’s ex-patient. To recap, the patient came to Ang in 2010 with lung cancer and was told that there was a high chance of the disease responding to chemotherapy and targeted therapy. Ang did not offer her the option of surgery as he did not believe it to be suitable for her case. The patient eventually passed away six months later. Consequently, Ang was given an eight-month suspension on the grounds of professional misconduct with effect from 25 July 2017.

TalkMed’s 1Q19 performances took a turn for the better with revenue climbing 40.7 percent to $17 million attributable to an improvement in the number of patient visits. Correspondingly, net profit rose 23.7 percent to $7 million in tandem with the higher revenue. We believe that TalkMed could be well on track for a recovery given that Dr Ang has since resumed practice in March last year. Coupled with the group’s plans to venture into the larger China market by signing of an agreement with the People’s Government of Yongchuan District in August 2018 to establish a Sino-Singapore International Cancer Hospital in Chongqing, we would expect to see TalkMed delivering stronger results in subsequent quarters.

Relatively Higher Yield

In terms of financial strength, TalkMed’s cash-generative business allows it to maintain a strong financial position with net cash of $82.6 million and zero borrowings as at 31 March 2019. This provides the group with the necessary resources and various available options for further growth.

Furthermore, TalkMed was not stingy in rewarding its shareholders. The group paid out $0.01065 of final dividend and $0.00761 of interim dividend in FY18, translating to a pay-out ratio of 83 percent in that year. Based on the group’s last market price of $0.53 as at 31 May 2019, TalkMed’s total dividend of $0.01826 a share represents a decent yield of 3.4 percent, relatively higher in comparison to most of its healthcare counterparts. The periodic returns could serve as additional sweeteners while investors await for TalkMed’s value to be realised.

Source: Singapore Exchange, updated 31 May 2019

Yahoo Finance

Yahoo Finance