SI Research: Singapore Airlines – Ready To Take Flight?

Singapore Airlines’ (SIA) share price plunged 7.2 percent to $9.98 in a single day on 17 May 2017, following the release of its 4Q17 results which reported a shocking quarter net loss of $138.3 million attributable to SIA Cargo’s provision of competition-related fines and settlement. This led to a 55.2 percent decline in net profit for FY17 to $360.4 million.

Cathay Pacific Airways, SIA’s counterpart in Hong Kong, is not far better off. Last month, the group announced that it is set to cut around 600 staffs in a bid to reduce costs and streamline its operations, hoping to turnaround its business which has been bleeding cash, losing around HK$3 billion in last year alone.

Value investors tend to shun the airlines industry commonly referred to as a “deathtrap for investors” owing to its capital intensive business nature and airline companies are often at the mercy of oil price volatility which constitute a large part of their expenditure.

However, Oracle of Omaha, Warrant Buffett’s investment into the US airline industry in recent years has surprised many. As at February 2017, Berkshire Hathaway’s total stakes in the US’s four major airlines – namely American Airlines, United Continental Holdings, Delta Air Lines and Southwest Airlines – stood at close to nearly US$10 billion. With Buffett taking the lead, is now a good time for us to reconsider our options?

This issue, we shall take a second look at SIA – the only airline company listed on the Singapore Exchange since the privatisation of Tiger Airways (TigerAir) in 2016.

What The Bears Say

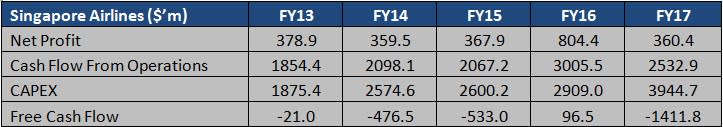

SIA has a high capital expenditure (CAPEX). Over the last five years, the group’s CAPEX has grown from $1.9 billion in FY13 to $3.9 billion in FY17 at a compounded annual growth rate (CAGR) of 20.4 percent, which is also consistently higher than its cash flow from operations in four out of the five years (except FY16). Looking at FY17 alone, the CAPEX of $3.9 billion is more than 10 times the net profit of $360.4 million, and 1.6 times the operating cash flow of $2.5 billion respectively.

SIA has revealed an ambitious capital expenditure plan of $30.1 billion for the next five years during a briefing on 19 May, mostly on aircraft purchase to take advantage of new growth opportunities. We deemed these huge commitments unlikely to be financed by cash flow from operations alone, and the group will probably have to raise funds through additional debts. In fact, given SIA’s net cash position standing at only $1.8 billion as at 31 March 2017, it is very possible that SIA might actually fall into a net-debt position in the subsequent years to come, as early as FY18 for the first time in the past 13 years.

Source: Company’s Annual Reports

While the aviation industry as a whole had benefitted from the low fuel cost environment in the past two years, the same cannot be said for the near future as OPEC and Russia have agreed to extend oil production cuts until 1Q18 or possibly for the rest of FY18.

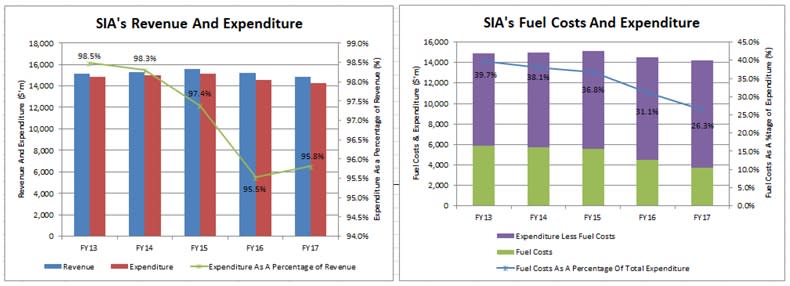

Expenditure took out a large chunk of SIA’s revenue historically, generally above 95 percent as seen in the last five years, and fuel costs remained a significant portion of the expenditure. Although the figure has somewhat declined from 39.7 percent in FY13 to 26.3 percent in FY17 in line with the lower oil price, the impact on SIA’s bottom line will not be encouraging if oil price begins to rally.

Already we are seeing the average Singapore Jet Kerosene (MOPS) price rising from its low of US$37.90 per barrel in January 2016 to US$61.90 per barrel in March 2017. Likewise, Brent crude oil price has also recovered from its low of around US$27.80 per barrel in January 2016 to current price of US$50.30 per barrel as at June 2017.

We like it that in view of the price volatility in the short term, management has taken measures to hedge its fuel requirements prudently. For FY18, the group has hedged 20.6 percent of its fuel requirement in MOPS and 20 percent in Brent at weighted average prices of US$66 and US$53 per barrel respectively.

Source: Company’s Annual Reports

What The Bulls Say

According to the ASEAN Aviation Industry Focus Report issued by DBS Bank in February 2017, the proportion of low cost carriers (LCC) seats out of total available seats for to/from ASEAN flights has expanded from 17 percent in 2007 to 23.7 percent in 2016, while the market share of LCC in intra-ASEAN flights has grown from 32 percent to 54.2 percent over the same period. This represents LCC’ market share in to/from ASEAN and intra-ASEAN flights to be climbing at a CAGR of 3.8 percent and six percent per annum respectively. On hindsight, SIA’s acquisition of Tiger Airways as well as its approach to provide both full-service and budget airline segments of the market seems like a strategic move in the right direction after all.

From SIA’s FY17 report, the group’s budget aviation segment (comprising Scoot and TigerAir) accounted for 9.1 percent of FY17 total revenue, inching up from the 7.8 percent proportion in FY16 revenue. In absolute terms, revenue contributed by the budget aviation division in FY17 jumped 13 percent year-on-year to $1.3 billion. With SIA’s strategic initiatives starting to show positive results, we are optimistic that there could be room for further growth as the group continues to extract synergies from its acquisitions and achieve higher level of efficiency.

Air traffic statistics published by the Changi Airport Group painted a similarly rosy picture. From the data released, total number of passengers passing through the airport rose from 51.2 million in 2012 to 58.7 million in 2016, growing at a CAGR of 3.5 percent per annum. On that note, about 360,500 commercial aircrafts land or depart from Changi in 2016, as compared to 324,700 aircrafts five years ago. With Changi’s Terminal 4 set to open in the second half of this year and Terminal 5 to be operationally ready within the next 10 years, the local aviation scene could potentially see a surge in air traffic as well as a boost to SIA’s top line.

What Do We Say

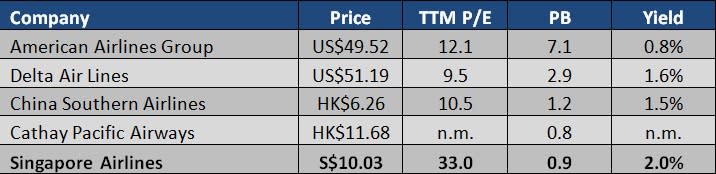

SIA’s share price surged to a high of $12.91 in January 2015 triggered by unusually low oil price, but tumbled down to around $9.60 over the next eight months as its results continued to disappoint. Technically, it is well supported by a relatively strong support at $9.60 which has been tested thrice – in October 2014, August 2015 and November 2016 – and looks likely to hold barring any unforeseen circumstances. Currently trading at a market price of $10.03 as at 5 June 2017, it has rebounded 4.6 percent from its 52-week low and is now valued at a price-to-earnings ratio of 33 times and a price-to-book ratio of 0.9 times.

We reckon that being the only airline company that is trading below its book value while remaining profitable at the same time in comparison with the other international players, our local premium carrier could well be a worthy candidate worth considering for longer term investments.

Source: As at 5 June 2017

Yahoo Finance

Yahoo Finance