SI Research: SIA Engineering Company – A Once-In-Ten-Year Opportunity

SIA Engineering Company’s (SIAEC) share price hit its 10-year low closing at $2.28 on 21 December 2018, last seen only during the sub-prime crisis period in May 2009. Within a span of more than five years, the group had shed more than 55.9 percent of its market capitalisation as its share price plunged from a high of $5.17 in May 2013 to current level.

SIAEC used to garner strong interest among investors for its business moat providing maintenance, repair and overhaul (MRO) services to airlines and aerospace equipment manufacturers. Aircrafts are required to undergo scheduled and stringent checks to maintain their airworthiness certifications before they are allowed to take off. Furthermore with Singapore Airlines as its parent company, SIAEC got to receive exclusive works from SIA planes that typically account for around half of its consolidated revenues. What then could have caused the shift in sentiment towards this company that was reflected in its recent price weakness?

Industry Headwinds

The aviation MRO sector has been undergoing some structural changes in the last few years. Firstly, the newer generation of aircrafts now requires lower maintenance frequency due to various advanced technologies being employed and the use of composite materials for the airframe and aircraft interiors.

Furthermore, current fleet growth is mainly driven by low-cost carriers and due to their business strategies, minimal maintenance downtime is required at the hangars as a greater proportion of heavier checks are already being performed while the aircraft is still in service.

In addition, a number of airlines are already expanding their MRO capacity. This coupled with original equipment manufacturers (OEM) seeking to capture a larger share of the aftermarket, intensify the competition within the MRO industry. As such, existing players continue to face mounting cost pressure and narrowing margins.

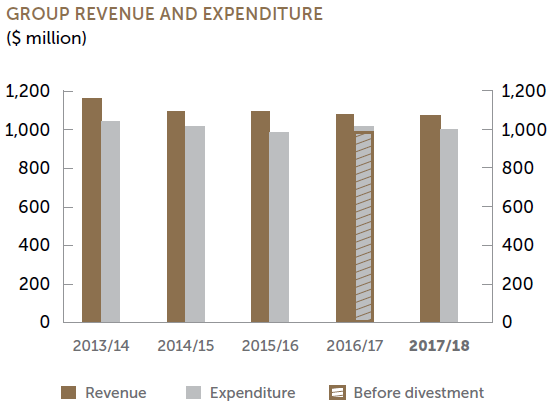

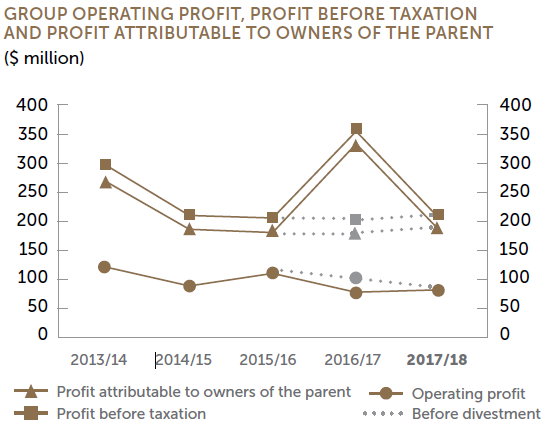

Apparently SIAEC was not spared from the challenges arising from these industry trends. Over the last five years, the group’s revenue shrank at a compounded annual growth rate (CAGR) of negative 1.8 percent to $1.1 billion in FY18. Correspondingly, net profit also declined by 8.8 percent annually over the same period to $184.1 million.

Source: Company’s Annual Reports

Financials And Fundamentals

SIAEC’s latest 1H19 results demonstrated that the group’s operations continued to be under pressure with its top line sliding 7 percent to $509 million, attributable to lower airframe and fleet management revenue. Nonetheless, net profit managed to grow 4.2 percent to $78.5 million with increased contributions from joint ventures and associates.

We noticed weaker cash flows from operations affected by unfavourable working capital movements. Fortunately, SIAEC’s balance sheet remained healthy in a net cash position. With its cash balance standing at $455 million and $20.9 million of borrowings as at 30 September 2018, the group held an aggregate $434.1 million of net cash.

Possibly Brighter Outlook Ahead

Medium-term growth challenges aside, not all industry factors are pointing against SIAEC’s favour. For instance according to forecast by the International Air Transport Association (IATA), commercial aircraft fleet growth is expected to be sustained at three to four percent over the next 10 years, underpinned by a surge in air passengers to 7.8 billion in the next 20 years because of the emerging middle-class and airport infrastructure development in the Asia-Pacific region.

Singapore’s Changi Airport was ranked the 18th busiest airports in the world by passenger traffic handling 62.2 million passengers in 2017. Following the opening of the new Terminal Four in October 2017 which added a capacity of 16 million passengers per annum, Changi Airport’s total handling capacity was raised to 85 million last year. The figure looked set to be boosted further to 135 million in the late 2020s with the construction of Terminal Five underway.

As a leading aviation MRO service provider with a dominant presence in Singapore, SIAEC stood to benefit from this trend. In fact along with the growth of flights at Changi Airport, the group serviced a total of 146,687 flights in FY18 increasing 3.7 percent over the previous year.

Valuation

SIAEC closed at $2.28 on 21 December 2018. Based on 1H19 earnings-per-share of $0.0702 and net asset value of $1.327 as at 30 September 2018, price-to-earnings ratio and price-to-book ratio stood at 16.2 times and 1.7 times respectively.

We particularly like SIAEC’s increased yield as a result of the depressed price. Although the group cut its FY19 interim dividend to $0.03 from $0.04 a year ago, assuming SIAEC maintained its final dividend at $0.09 a share, this would work out to be a very attractive dividend yield of 5.3 percent based on current price.

Related Article:

Yahoo Finance

Yahoo Finance